The focus today will be on the ECB's final decision on monetary policy. Investors will closely monitor the result and the rhetoric of Lagarde during the press conference.

The ECB is expected to leave all monetary policy parameters unchanged. The main thing that is expected from the outcome of the meeting is a speech with comments by the chairman of the bank, C. Lagarde. The regulator's broad opinion on the future course of monetary policy in the conditions of high inflation of 3.4% in the euro area and unsatisfactory economic growth by only 2.2% amid the coronavirus pandemic is expected here.

What will Lagarde say after the ECB meeting?

We believe that it will continue to address the impact of COVID-19 on the economies of the euro area countries. Undoubtedly, it will touch upon the topic of high inflation, which is currently 3.4% according to the latest data. As we can see, this is significantly higher than the target level of 2.0%. In addition to these standard topics, it is also necessary to discuss the issue of the prospects of monetary policy in conditions of high inflation. Earlier, Lagarde had already made it clear that the regulator could make changes in monetary policy, which locally supported the euro exchange rate, but then at a press conference on the results of the September meeting, this topic somehow faded into the background, and Mrs. Chairman talked more about the temporary phenomenon of high inflation. This has put pressure on the euro, which has declined markedly over the past month.

Despite the external independence of the European regulator, it still remains under the strong influence of the Fed's behavior like other world banks. Considering this, we believe that Lagarde will talk again about the likelihood of changes in monetary policy. She will not talk about the great influence of the Fed, but all of her and the bank's behavior indicates that they remain in the wake of the US Central Bank's policy. The latter is expected to announce the start of the process of reducing stimulus measures in November, and this should be taken into account by the ECB in order to remain in equilibrium with the Fed. Therefore, Lagarde can raise the topic of the negative impact of high inflation and the need for the bank to respond to this circumstance by adjusting the course of monetary policy next year.

How will the euro react to Lagarde's words?

If she really talks about the probability of a change in the monetary policy rate, then this will support the euro exchange rate against all currencies on the currency market. However, it should also be understood that this growth will only be a local reaction to her words, which means it will be limited. But if she decides not to mention this topic, then the euro will be under pressure and will temporarily decline.

To take any action, it is considered necessary to take a pause first before Lagarde's speech and only then react.

Forecast of the day:

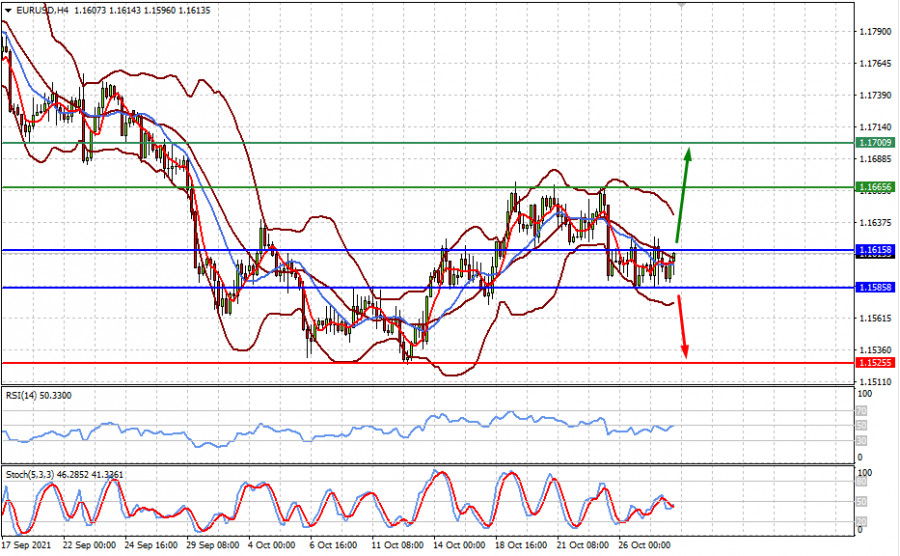

The EUR/USD pair is trading in a range in anticipation of C. Lagarde's speech. Positive news for the euro will push the pair up to the targets of 1.1665 and 1.1700, while negative news will put pressure on the pair, which will lead to a decline below the level of 1.1585 and then to 1.1525.

The USD/CAD pair slowed down in growth amid the beginning of a recovery in oil prices after falling on Wednesday and this morning. The continuation of this process on the wave of continued high demand for energy resources in the world, as well as the likely publication of positive Canadian GDP data for the third quarter, may put pressure on the pair, and it will continue to decline to 1.2250.