Here are the details of the economic calendar for December 1, 2021

According to the ADP report, the number of jobs in the US private sector rose by 534 thousand in November, compared with the forecast of an increase of 525 thousand. We are also dealing with a very high value despite the fact that the indicator is lower than the previous month

In this case, the growth of dollar positions is due to the good situation in the US labor market.

Analysis of trading charts from December 1:

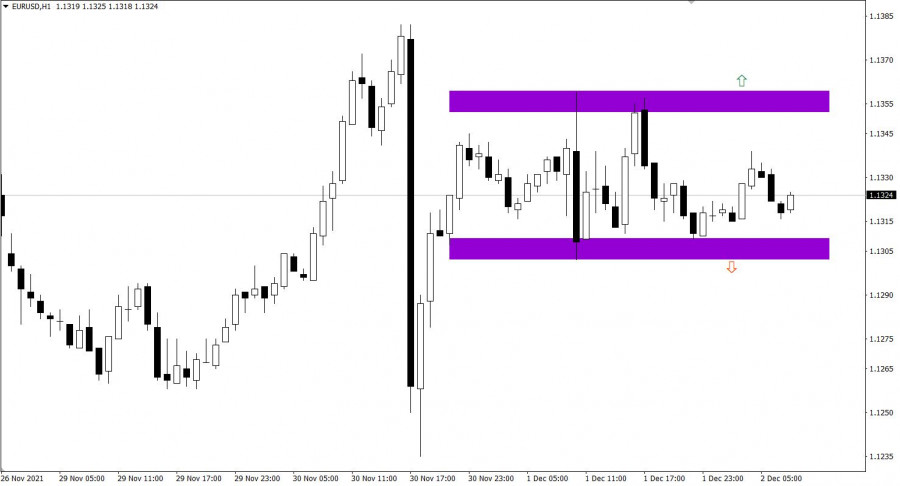

The EUR/USD pair showed insignificant speculative interest yesterday, which led only to a slight expansion of the existing side channel to the borders of 1.1300/1.1355.

A downward trend remains on the daily chart, in the structure of which a correction cycle has arisen.

The GBP/USD currency pair rebounded from the resistance level of 1.3350, which led to an increase in the volume of short positions. As a result, the quote was consolidated below the level of 1.3290, which indicates the prevailing downward interest among market participants.

The daily chart shows a gradual decline in the pound sterling, which has already led to large-scale price changes within 6 months.

December 2 economic calendar:

America's weekly data on applications for unemployment benefits will be published today at 13:30 Universal time, where a slight decrease in the overall indicator is predicted.

Details of statistics:

The volume of initial applications for benefits may rise from 199 thousand to 240 thousand.

The volume of repeated applications for benefits may decline from 2,049 thousand to 2,000 thousand.

If the data is confirmed at these levels, the US dollar will take a neutral position. But if the indicators come out better than the forecast, then speculation in favor of the US dollar will resume.

Trading plan for EUR/USD on December 2:

The side channel in the range of 1.1300/1.1355 is still relevant in the market, so traders continue to consider the outgoing momentum strategy. The signal for action will arise only after the price is kept outside the established limits in a four-hour period.

Trading plan for GBP/USD on December 2:

Stable price retention below the level of 1.3290 in a four-hour period increases sellers' chances of a subsequent decline. This may lead to an update of this year's local low in the future.

Traders will consider an alternative scenario for the development of the market in the event of a resumption of the lateral amplitude of 1.3290 /1.3350.

What is reflected in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.