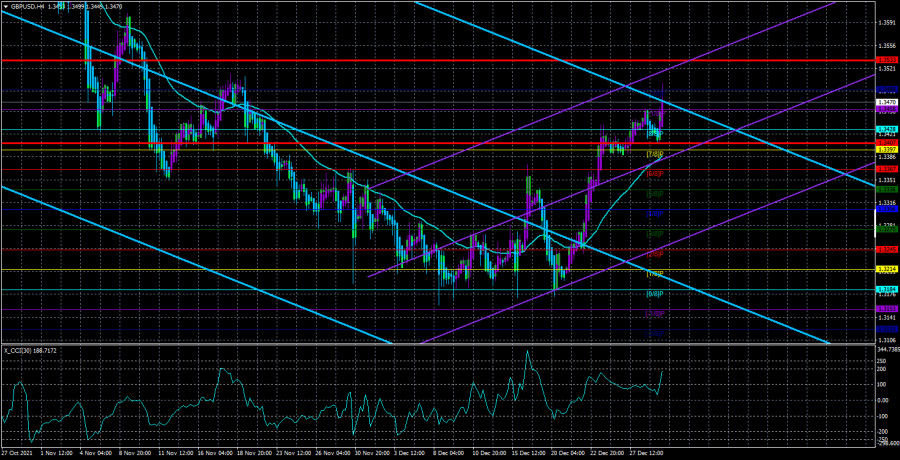

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

The GBP/USD currency pair seems to have started a downward correction on Wednesday, but it abruptly resumed its upward movement during the American trading session. Thus, the technical picture does not change for the pound/dollar pair either. It's just not the same as the euro/dollar pair. Namely, the upward trend in the pound is now continuing. Of course, it looks much more impressive on the hourly timeframe than on the 4-hour one, however, and here it is also clearly visible that the pound has grown by 300 points over the past two weeks. At a time when there were no macroeconomic statistics or fundamental background in either the UK or the US. By the way, the movement of the euro/dollar and pound/dollar pairs very eloquently explains why the "coronavirus" now does not affect the mood of the markets. If it did, then both pairs would react approximately the same. However, the pound is growing, and the euro is standing still. What is the result? As a result, the current upward movement of the British currency does not raise any questions from a technical point of view. On the 4-hour TF, the pair bounced four or five times from the Murray level of "0/8" - 1.3184, which was supposed to provoke a round of correction, and on the 24-hour TF, the price bounced from the most important Fibonacci level of 38.2%. Moreover, for most of 2021, the pair was declining, that is, an upward correction was emerging on all timeframes. The only unexpected thing was its beginning at the very end of the year. On the other hand, when it started, then it started.

Not Omicron, but perhaps the Bank of England?

We have already said several times that omicron does not have any influence on the pound, the euro, or the dollar at this time. And hardly any other currency in the world. Central banks are waiting, markets are waiting, what will happen next and what consequences will the new strain bring them? In the UK, the situation is very complicated and almost catastrophic. If Omicron had led to the same percentage of deaths and hospitalizations as Delta, then Boris Johnson would most likely not have been in power. Only a low percentage of complications and deaths from the new strain saves the situation. The British authorities want to defeat it with the help of vaccination and revaccination, and while they want, +300 thousand new diseases were recorded in the UK on December 27. For a second, it's more than in the States. However, as we can see, the pound continues to strengthen calmly against the US dollar. What does this mean?

In recent weeks, we assumed that the growth of the euro and the pound could begin quite unexpectedly. The only significant factor that has pushed the US dollar up in recent months - the tightening of the Fed's monetary policy - could have already been worked out by the markets several times. Thus, it is possible that in the pound/dollar pair, traders no longer see on what basis they should continue to buy the US dollar. But the pound sterling has one indisputable advantage - the Bank of England has already raised the key rate, unlike the Fed. Of course, no one knew what would happen in January before, and now - even more so, given the gigantic pace of distribution of omicron. It is not known what economic consequences will be in this or that country, therefore, monetary policy may change greatly in January both in the States and in the Kingdom. And not in the direction of tightening. At the very least, both central banks may postpone their plans for further normalization for several months. And this will be a "bearish" factor for the currency whose bank makes such a decision. In general, we believe that the Fed will not accelerate the pace of tightening in January, then in the medium term, the pound can continue to grow quite calmly. At least until we find out about the value of UK GDP in the fourth or first quarter.

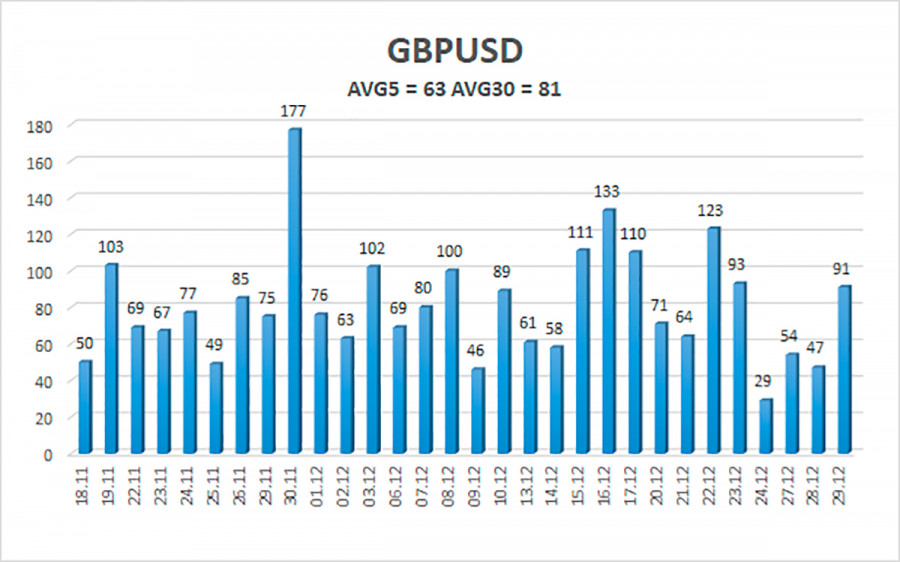

The average volatility of the GBP/USD pair is currently 63 points per day. For the pound/dollar pair, this value is "average". On Thursday, December 30, we expect movement inside the channel, limited by the levels of 1.3407 and 1.3533. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 1.3458

S2 – 1.3428

S3 – 1.3397

Nearest resistance levels:

R1 – 1.3489

Trading recommendations:

The GBP/USD pair broke out of the side channel on the 4-hour timeframe and continued its strong upward movement. Thus, at this time it is possible to stay in the longs open after a new reversal of the Heiken Ashi indicator upward. The goals are 1.3489 and 1.3533. Exit the longs if the Heiken Ashi indicator turns down. Short positions should be considered if the pair is fixed back below the moving average with targets of 1.3367 and 1.3336.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.