The euro/dollar pair returned to the range of 1.1260-1.1360 where it was trading last year. Bears almost completely recouped the losses of last week. Yesterday, they pushed the pair to the 13th pattern. The strong pullback turned out to be a correction despite expectations of a trend reversal. The euro is vulnerable to changes in the US currency. Therefore, the euro/dollar pair weakened as soon as the US dollar resumed an upward movement.

Last week, the pair grew solely because of surging inflation in the United States, the hawkish rhetoric of Fed policymakers, and the dovish statements of the ECB. Apparently, fundamental factors favored the US currency. At that time, the greenback was decreasing across the board. As a result, the euro/dollar pair almost approached the 15th pattern. According to some analysts, traders began to close open positions on the US dollar after Jerome Powell's speech in the Senate. The Fed chair did not clarify when exactly the regulator would hike the interest rate, which disappointed investors. There are those who believe that the US dollar faced a massive sell-off due to the Buy the Rumor, Sell the Fact trading strategy. Apart from that, the US currency incurred losses amid high demand for risky assets.

As it turned out, the greenback recovered from its short-term decline. Currently, there are no reasons for a sharp drop. Expectations of monetary policy tightening will continue to push the US dollar higher. Judging by the rhetoric of FOVC members, the hawkish scenario (three or four key rate hikes) looks likely. Now, Fed policymakers do not provide comments on this issue. However, last week, Brainard, Williams, Daly Bostic, Mester, George, Barkin, Harker, and Bullard spoke in favor of the interest rate hike. Almost all of them said that the first key rate hike may take place at the March meeting. Regarding the future prospects of tightening monetary policy, they were more evasive, avoiding a direct answer. At the same time, some representatives of the Fed (in particular, Bostic, Bullard) reported that they expect three or four interest rate hikes within the current year.

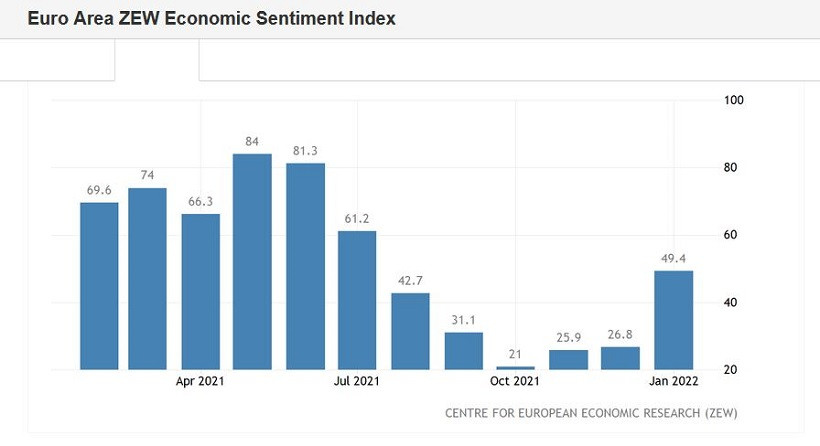

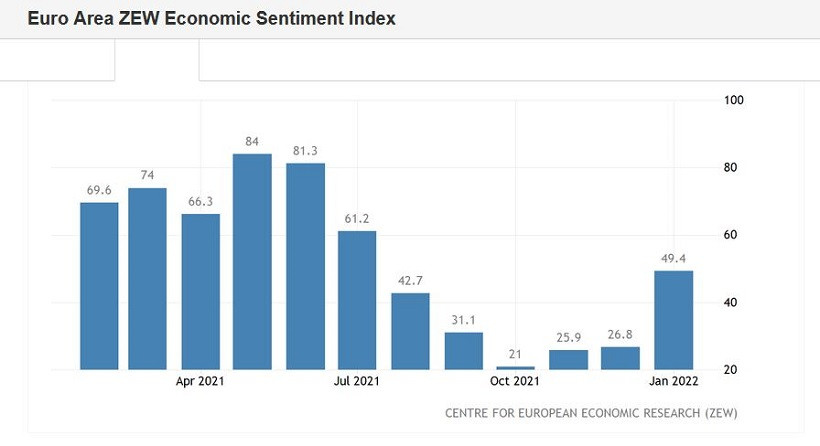

The US dollar began to gain momentum this week amid such comments, rising Treasury yields, and a decline in the stock market. Moreover, weak US macroeconomic reports (retail sales data) did not undermine its rise. At the same time, the euro weakened despite the strong ZEW indicators of Economic Sentiment for Germany and the EU. Preliminary estimates were very optimistic. Nevertheless, the actual figures significantly exceeded forecasts. Indicators for Germany and in the eurozone were quite upbeat. In Germany, the index jumped to 51 points versus the forecast reading of 32. This is the best result since July last year. Back then, the figure totaled of 63 points. The Pan-European indicator also rose, reflecting traders' confidence about investment conditions. In January, the January index climbed to 49.4 versus the forecast reading of 29, reaching a 5-month high.

However, speculators ignored this data. Yesterday, the pair declined by almost 100 pips due to the recovery of the US dollar. Bears were unable to push the pair to the 12th pattern, settling at the 13th level. Hence, market participants remain cautious ahead of the January FOMC meeting, scheduled for next Wednesday.

In my opinion, the euro/dollar pair will soon return to the range of 1.1260-1.1360 in anticipation of the Fed's meeting results. At the same time, bears may take the upper hand thanks to the different approaches of the ECB and the Fed on monetary policy, as well as the US 10-year vs Germany 10-year spread bond yield. While analysts are discussing the possibility of three or four key rate hikes, the eurozone money markets are pricing in only a 20% chance of an ECB rate hike in December 2022. The majority of economists polled by Reuters are confident that the European Central Bank may raise the interest rate no earlier than the first half of 2023.

Thus, it is recommended to open short positions in the range of 1.1260-1.1360.