According to the results of yesterday's trading, the balance of power for the main currency pair remained the same. The technical picture for EUR/USD has not undergone any changes. We will return in more detail to the consideration of the technical picture for the euro/dollar a little later but for now a small portion of other information. According to the forecast of the International Monetary Fund (IMF), the omicron strain COVID-19 may damage the growth of the global economy. The reasons are still the same - these are supply disruptions, slower rates of private consumption, and, of course, a significant increase in the cost of energy carriers. If earlier the IMF predicted the growth rate of the world economy at the level of 4.9%, now it has changed its forecast downward and expects global economic growth within 4.4%. At the same time, economic growth in the euro area countries is projected at 3.9% this year. And the omicron strain is not as simple as it was thought before. First of all, virologists from South Africa say, where it originated.

If we go back even deeper into the history of 2 years ago, when the world epic with COVID-19 began in the Chinese city of Wuhan, then now everything is calm there, and so much so that there is not a single person infected with an insidious infection. If we turn to the most important event of today and the whole week, then at 19:00 London time, the US Federal Reserve System will announce its decision on rates. Experts do not expect any changes, the federal funds rate will remain at 0.25%. But half an hour after that, the press conference of Fed Chairman Jerome Powell will begin, which is likely to cause increased volatility in the market. However, as has been repeatedly noted recently, expectations of something supernatural often remain expectations. I don't think the head of the Fed has significantly changed his rhetoric in one direction. With a high degree of probability, it will remain moderately hawkish. If so, then we may not see any strong directional movements today. In the meantime, let's look at the technical picture observed for EUR/USD at the moment.

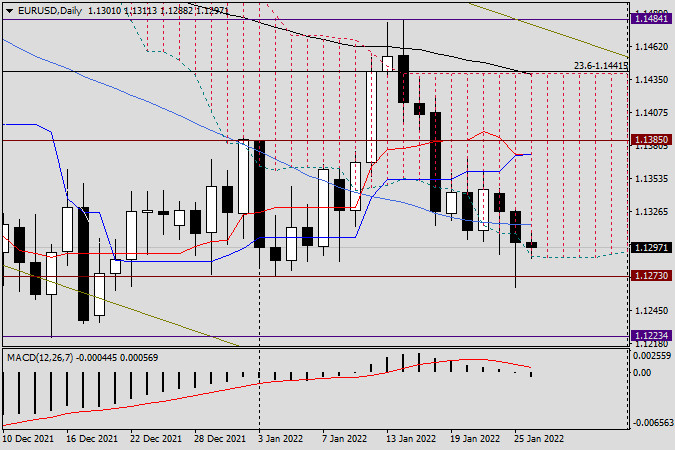

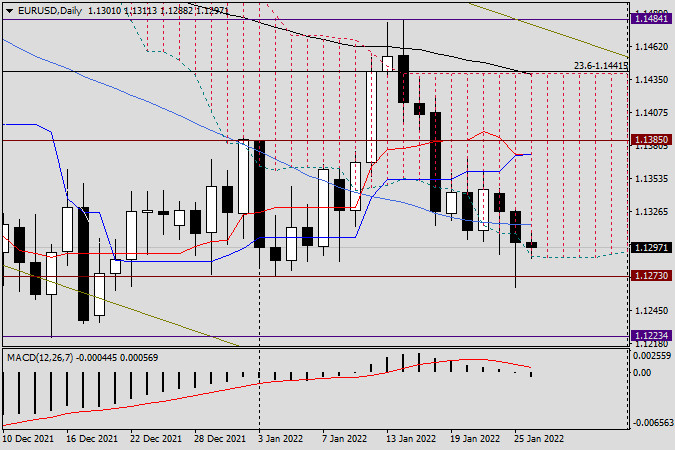

Daily

Yesterday's bear pressure on the instrument again did not bring any tangible progress. Trading on January 25 ended with the formation of a candle with a bearish body, but it still had a rather long lower shadow. This factor indicates the wait-and-see attitude of investors on the eve of the results of the Fed meeting and the speech of the head of this department Jerome Powell. Tuesday's session closed again just above the already iconic 1.1300 mark. Although yesterday's trades closed below the 50 simple moving average, this cannot serve as a basis for a clear determination of the further direction of movement. In the case of today's strong bullish sentiment, the pair may soar to the key resistance level, which runs around 1.1385-1.1400. Otherwise, we expect a fall to the 1.1200 mark, and maybe even lower, to the 1.1160/50 area. I consider it incorrect to give any specific trading recommendations on such a day, so I will refrain from them. Everything will depend on the Fed's rhetoric and the reaction of market participants to this. Perhaps tomorrow the technical situation for the main currency pair will clear up and we will try to find the most acceptable trading options for opening positions.