Risky assets declined after yesterday's FOMC meeting. The Fed confirmed its intention to start a cycle of rate hikes in March with the simultaneous completion of QE. Yields sharply rose – 2-year UST increased to 1.12%, and 10-year UST peaked at 1.873%, but it is quite a moderate reaction since the peak of January 19 stood. Gold and stock indexes fell, but the fall in stocks was also moderate.

In general, the statement was expectedly hawkish, but the markets reacted with restraint, and the pause lasted exactly until the moment when J. Powell began his press conference. Powell exerted more pressure by announcing that he does not rule out a 50-point rate hike in March.

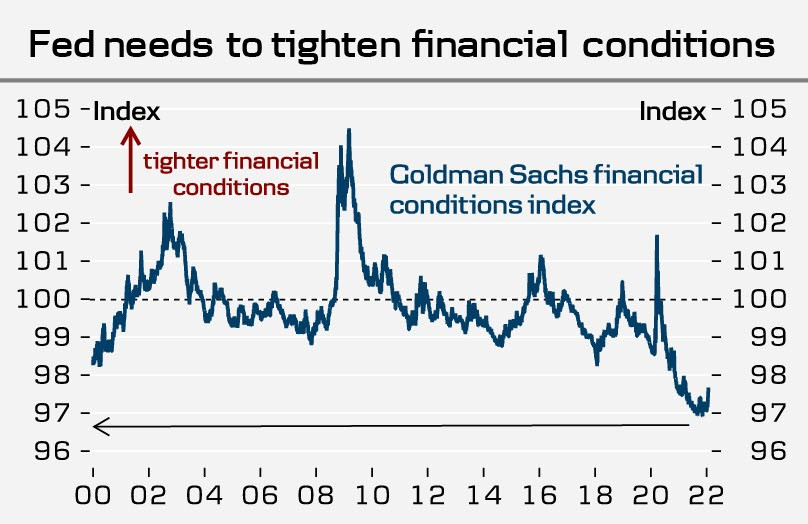

The core problem that forces the Fed to take practical steps is high inflation. It is clear that the Fed needs to tighten financial conditions in order to put an end to inflationary pressures. Financial conditions have never been so soft in recent history, and inflation is an obvious consequence.

Since the Fed usually controls investor sentiment between meetings, it is possible that Powell's reservation regarding an increase of 50p at once does not indicate intentions to actually make such an increase, but only to give a clear signal to the markets. A signal that inflationary pressure will be suppressed harshly is the threat of a faster rate increase.

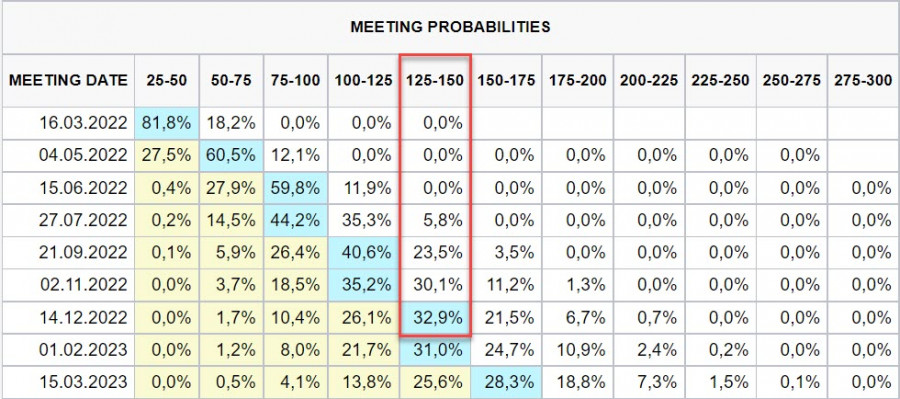

This conclusion is fully confirmed by the dynamics of futures at the CME rate. In December, the market saw 3 rate increases. This January, before the meeting, it was inclined to 4 increases, then as of January 27, expectations shifted towards 5 increases.

It will be simply impossible to implement a super-aggressive policy in the face of the threat of new lockdowns. Therefore, we are waiting for the announcement that COVID-19 pandemic is over.

Comments on the beginning of the reduction of the balance (quantitative tightening, QT) were quite ambiguous. From the specifics, there was only a confirmation of readiness to start this process after the rates begin to rise, without specifying the exact timing. Most likely, the Fed is being cautious here, because it is not sure that the US economy is really ready for such a powerful reversal.

As expected, the US dollar rose across the entire spectrum of the currency market. It should be expected that it will continue to dominate. At the same time, markets need to understand where funds will be found to fill the growing budget deficit if the Fed starts QT, and rising yields increase the budget's spending side. There are only 2 ways here – either new loans, which will not add confidence to investors, or an increase in budget revenues, which is also in question.

It was revealed yesterday that the US merchandise trade deficit widened unexpectedly to a record high of $101bn in December against the expected $96bn. This could lead to a downgrade in Q4 GDP estimates. In any case, the fiscal hole will widen amid tightening financial conditions, and to date, this has become a major concern of the Biden administration.

From other events of yesterday, it is necessary to highlight the results of the meeting of the Bank of Canada, which unexpectedly avoided the start of the rate hike cycle, although forecasts gave a 70% probability of this step. One of the reasons why the Bank of Canada refrained from raising it is due to Omicron. That's what we think. At the same time, the BoC specifically noted that "the general economic downturn has been neutralized," which means that every meeting, starting in March, will be considered as possible for another increase. In fact, little has changed in the forecasts. Market expectations still suggest 6 increases this year, but now, the Canadian dollar no longer looks like a favorite against the US dollar and the prospects for USD/CAD need to be revised.