Analysis of previous deals:

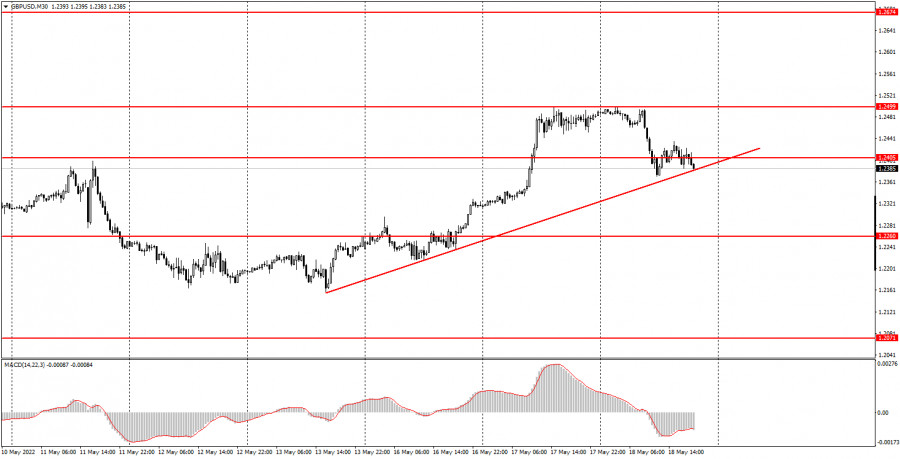

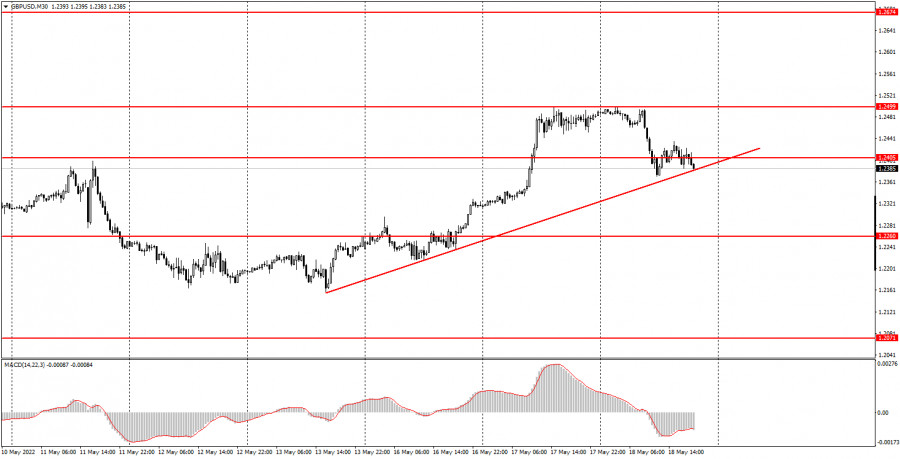

30M chart of the GBP/USD pair

Yesterday, the GBP/USD pair also began to correct against a fairly strong growth in recent days. As a result, the price ended up near the rising trend line by the end of the day, which was formed only yesterday. And at the moment it is not clear if the pair is going to bounce from it and maintain the upward trend. If the price breaks this line, then quotes are likely to fall, and the upward trend, which includes as many as four days, will be canceled. The pound managed to rise only to the level of 1.2500, and it can hardly be said that macroeconomic statistics definitely contributed to this. Four important reports were published in the UK yesterday and today. Wednesday's three reports (unemployment, jobless claims and wages) were very strong and could really push the pound up (though not as strong). But today's report on inflation turned out to be very contradictory. On the one hand, inflation rose to 9%, which is an anti-record. On the other hand, this increase absolutely does not mean that now the Bank of England will rush to raise the rate further (after four consecutive hikes). As a result, the pound was already falling today (immediately after the report was released). That is, the reaction of the market was unequivocal, but at the same time it is impossible to say that it was unambiguously logical.

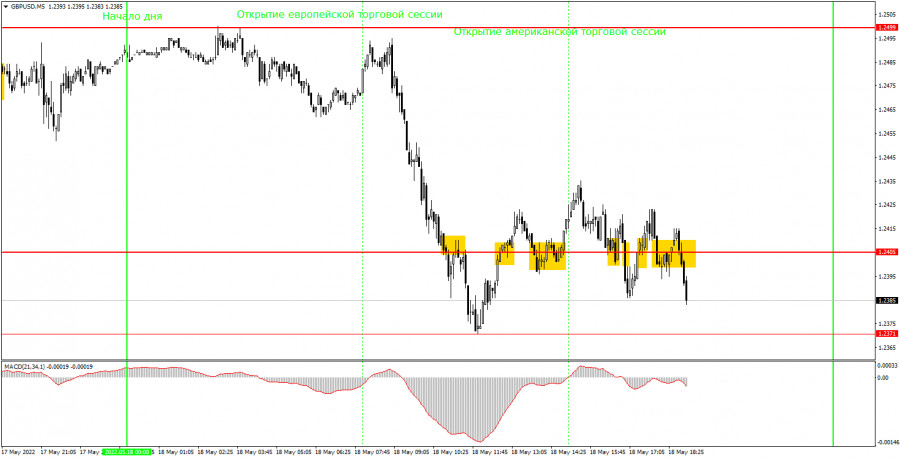

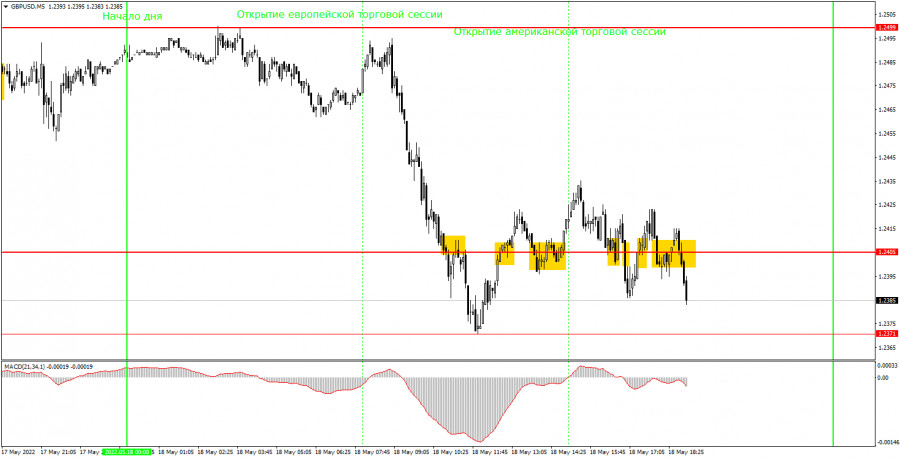

5M chart of the GBP/USD pair

Quite a lot of trading signals were formed on the 5-minute timeframe on Wednesday, but the pair, having shown a volatility of 130 points (which is still a lot), spent most of the day in a movement very similar to a flat. By and large, the trend movement was observed only in the morning, immediately after the release of British inflation. Therefore, the "swing" began, and the price "danced" around the level of 1.2405 for a long time, forming signals in batches. Naturally, most of them turned out to be false. However, it was impossible to predict this when the first signal for short positions was formed. Although the price at that time had already gone down by about 100 points, one could still try to open a short position. The pair managed to go down another 22 points, so Stop Loss should have been placed at breakeven and the deal was closed exactly on it. This was followed by two buy signals, after the formation of which the price again moved in the right direction by a little more than 20 points, which allowed novice traders to do without loss. All subsequent signals should be ignored, since the first three turned out to be false. We also want to note that at the very beginning of the European session, the pair was approaching the distance of 4 points to the level of 1.2499, but 4 points is still too much for an error. It's a pity, a very strong signal to sell could have turned out, 1-2 points were not enough.

How to trade on Thursday:

The ascending trend line is still preserved on the 30-minute timeframe, but the price may overcome it in the next hour. Therefore, the pound is on the verge of a new fall to the levels of 1.2260 and 1.2071. It may well be that the market, which does not have the strength to continue falling even from the level of 1.2180, decided to simply "accelerate" a little. As a result, it "accelerated" to the level of 1.2499 and now has real chances to restore the downward trend. On the 5-minute TF it is recommended to trade at the levels of 1.2260, 1.2296, 1.2371-1.2405, 1.2499, 1.2596-1.2601. When the price passes after opening a deal in the right direction for 20 points, Stop Loss should be set to breakeven. There are no important events scheduled for the UK on Thursday. In America, there are only secondary reports that are unlikely to be of interest to traders. However, now traders don't need macroeconomic statistics to be more active - volatility can remain high.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the American one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair.

Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.