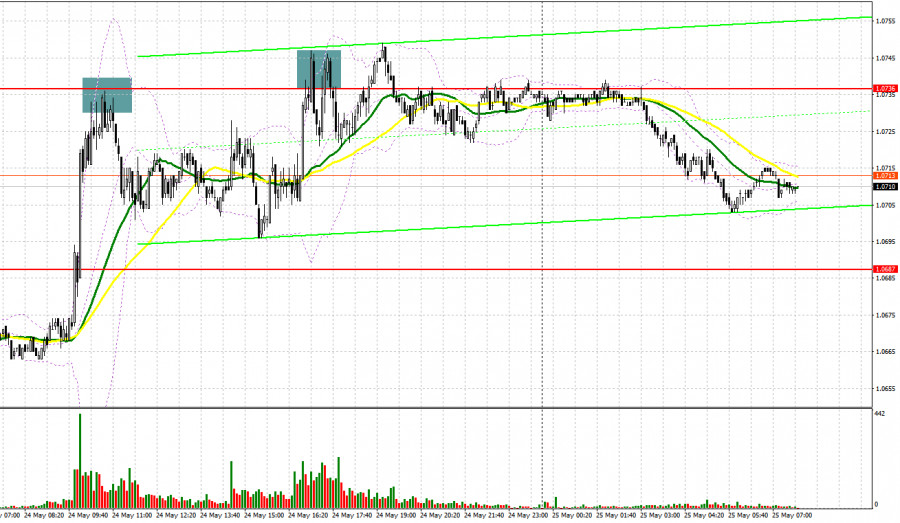

Yesterday, traders received several signals to enter the market. Let us take a look at the 5-minute chart to clear up the market situation. Earlier, I asked you to pay attention to the level of 1.0736 to decide when to enter the market. The pair broke the nearest resistance level of 1.0691, but did not downwardly test it. That is why I missed a jump in the euro that took place after the publication of poor macroeconomic data. After a false break of 1.0736, traders received a perfect sell signal. As a result, the pair dropped by 30 pips. In the second part of the day, the technical picture was almost the same. After bulls once again failed to break above 1.0736, traders got a sell signal. However, the price showed only a minor decline since the US data did not surprise traders.

Conditions for opening long positions on EUR/USD:

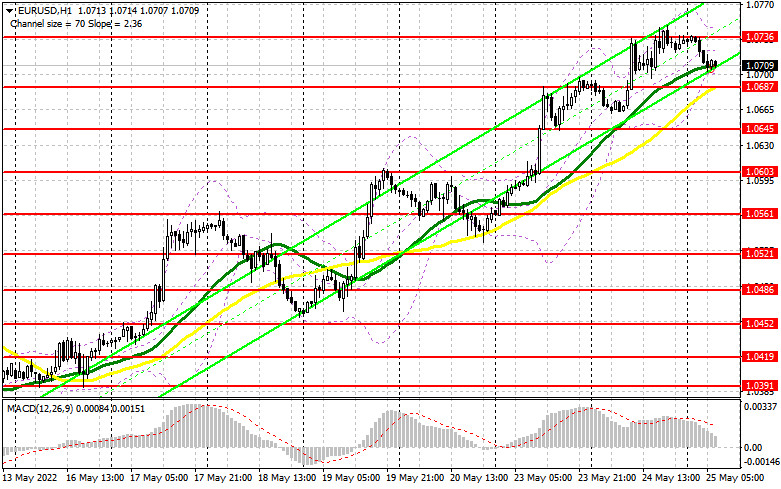

Today, buyers of the euro should protect the nearest support level of 1.0687. If they fail to do so, the situation may change dramatically, thus increasing pressure on the euro and causing a downward correction. Statistical reports slated for release early today will hardly affect the market situation. Thus, Germany's GDP data for the first quarter is likely to meet the forecast or unveil a slowdown compared to the fourth quarter. In addition, some representatives of the ECB will provide a speech in the first part of the day. In the best-case scenario, traders may open buy positions from the support level of 1.0687, which the price did not hit yesterday. A weak report from Germany may lead to a decline in the euro/dollar pair. Only a false break of 1.0687 will give a buy signal with the target at the resistance level of 1.0763. A break and a downward test of the level will give a new long signal, allowing the pair to reach a new high of 1.0775, where it is recommended to lock-in profits. A farther target is located at 1.0811. However, the pair will hit it only after Christine Lagarde's comments that may unveil a more aggressive approach to monetary policy tightening. There are no other reasons for a rise. If the euro/dollar pair drops and buyers fail to protect 1.0687, it will be better to avoid buy orders. Bulls may start to lock-in profits expecting the FOMC meeting minutes. Thus, traders should wait for a false break near the low of 1.0645. Long positions could also be initiated after a rebound from 1.0603 or lower – from 1.0561, expecting a rise of 30-35 pips within the day.

Conditions for opening short positions on EUR/USD:

Sellers have already begun regaining control over the market. If the euro/dollar pair rises amid Germany's report, a false break of 1.0736 will give a perfect short signal. In this case, the pair may reverse and start falling to the support level of 1.0687. If during the European session, bulls fail to touch 1.0736, it will mean that the uptrend has lost momentum and it is possible to go short. A break and settlement below 1.0687 as well as an upward test of this level may lead to a sell signal, thus affecting buyers' stop orders and causing a slump to 1.0645. Traders are better to lock-in profits at this level. A farther target is located at 1.0603. However, the price will be able to approach this level only after the publication of the FOMC meeting minutes, which will contain hints about the key interest rate hike of 0.75%. If the euro/dollar pair climbs in the first part of the day and bears fail to protect 1.0736, the uptrend will continue, enabling the pair to reach new highs. Against the backdrop, short orders could be initiated after a false break of 1.0775. It is also possible to sell the pair after a bounce off 1.0811 or higher – off 1.0844, expecting a drop of 30-35 pips.

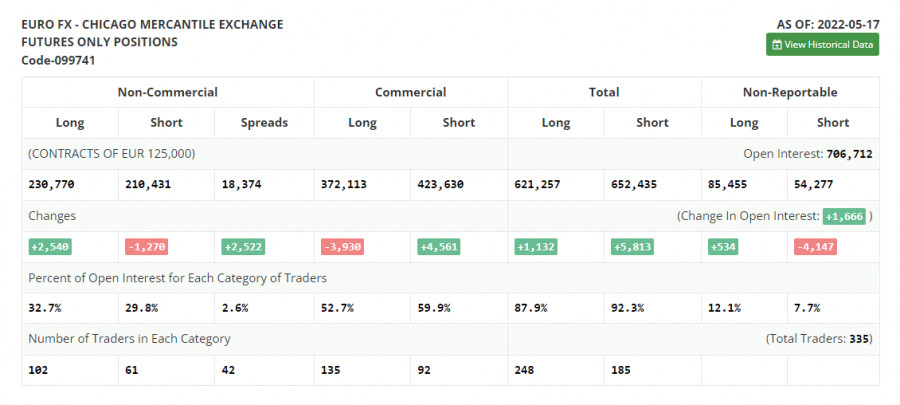

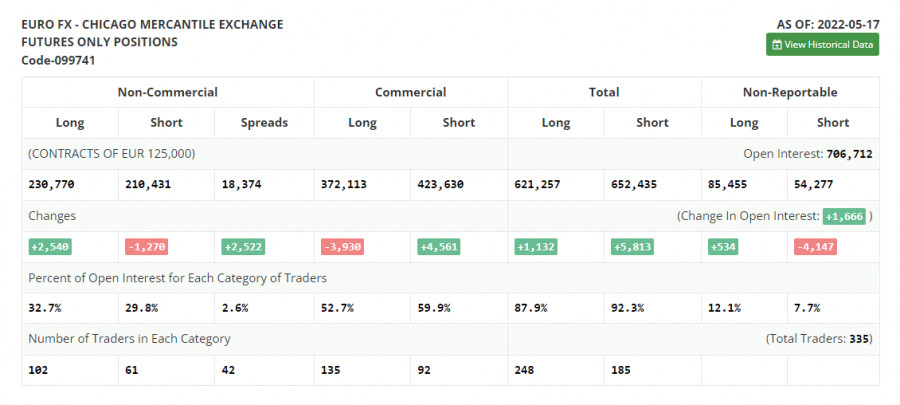

COT report

According to the COT report from May 17, the number of long positions continued rising, whereas the number of short positions dropped. Traders continue buying the asset at a rather low price amid the ECB's announcements about the upcoming key interest rate hike. The intention was proved by various ECB's representatives. Now, traders expect that the regulator will raise the deposit rate by 0.25% as early as July. Then, they are planning to raise the rate up to 0.2% in September and in December. However, some European politicians are criticizing this plan. They are demanding more aggressive actions from the ECB to combat the surging inflation. It is anticipated that the benchmark rate will be hiked in September and December up to 0.5% from the current zero level. The euro's upward potential could be boosted by rumors that the US Fed may slacken its monetary policy tightening in September. According to the COT report, the number of long non-commercial positions increased by 2,540 to 230,770 from 228,230. Meanwhile, the number of short non-commercial positions dropped by 1,270 to 210,431 from 211,701. As I have already mentioned, a low price of the euro is making it more attractive for traders. The weekly results showed that the total non-commercial net position increased to 20,339 against 16,529 a week earlier. The weekly closing price also inched up to 1.0556 from 1.0546.

Signals of indicators:

Moving Averages

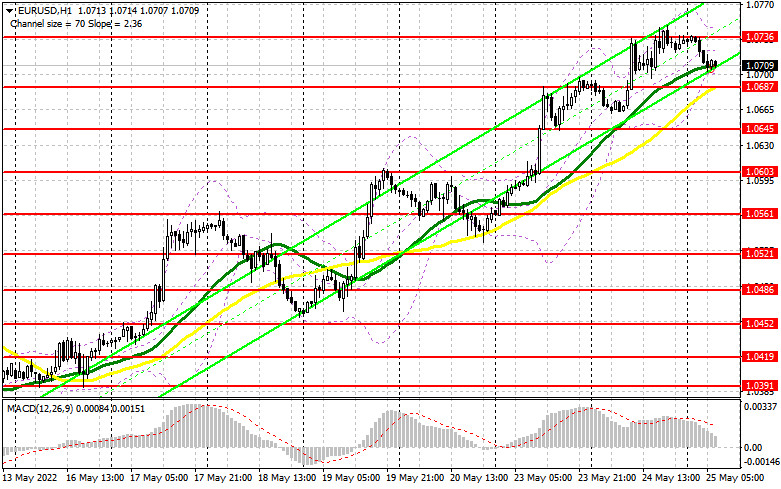

Trading is performed slightly above 30- and 50-day moving averages, thus pointing to the ongoing rise in the euro.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

In case of a decline, the lower limit of the indicator located at 1.0700 will act as support. If the pair grows, the resistance level will be located at 1.0755.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions is a total number of long positions opened by non-commercial traders.

- Short non-commercial positions is a total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.