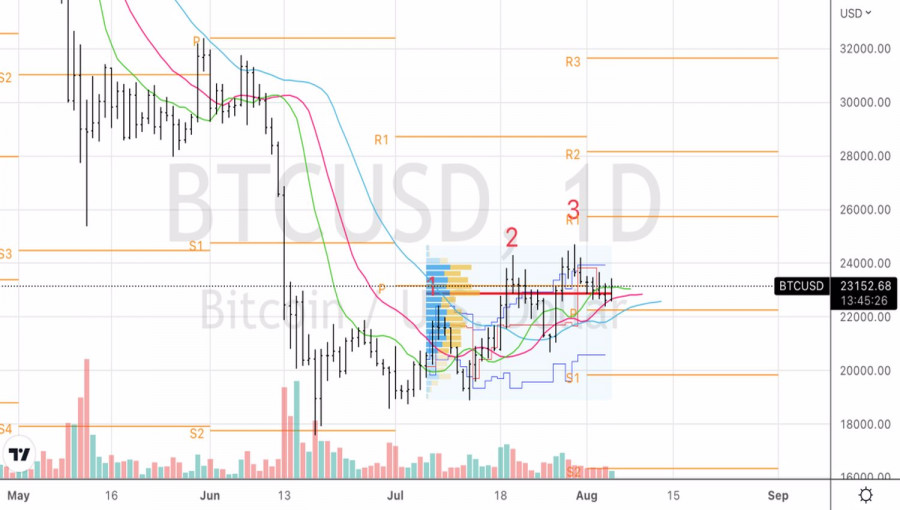

The market begins to beat against the walls of a narrow trading corridor when traders do not know which news to trust more. Bad or good. Options are signaling that 25,000 is a kind of ceiling for BTCUSD, while 20,000 is a floor. This is due to the high backlog of puts and calls at these levels and suggests that token consolidation is just what the doctor ordered.

An increasing number of institutional investors are entering the crypto asset market, new instruments are emerging that are supported by reputable companies. In particular, CME Group announced the introduction of euro-denominated Bitcoin and Ethereum futures into trading practice. According to the exchange, in 2022, the share of Europe in the volume of trade in cryptocurrencies increased from 23% to 28%. In general, the scale of the derivatives market is larger than spot trading, as they allow large players not only to speculate, but also to hedge risks.

The collaboration between the world's largest asset manager BlackRock and crypto exchange Coinbase can also be regarded as good news for BTCUSD. At the same time, information about the theft of money from the Solana ecosystem undermines the credibility of the crypto industry. Estimates of the scale of losses vary. Someone talks about 7,900 wallets and $5.2 million, while someone says that $8 million was stolen from only four wallets.

Note that not only crypto assets but all financial markets are currently in a tug-of-war. After the Fed canceled direct guidance in July, an indication of how federal funds rates will change at the next FOMC meeting, uncertainty has entered the market. Some investors believe that the Fed, due to the threat of a recession, will begin to slow down monetary restrictions and reduce borrowing costs in 2023. The rest believe the officials of the Committee, who claim that the Central Bank is not going to stop without a complete victory over inflation.

Alas, bitcoin has not become a reliable tool for protecting against inflationary risks: despite the rise in consumer prices in the US to 9.1%, the crypto winter in the BTCUSD market continues.

Dynamics of BTCUSD and inflation in the USA

In my opinion, the market has decided on the essence of the token and rightly classified it as a risky asset, which is clearly seen from the high correlation of bitcoin with American stock indices. At the same time, the Nasdaq Composite in early August is growing faster than the leader of the cryptocurrency sector. Personally, I attribute this to the bad news about the thefts at Solana.

The further dynamics of BTCUSD will certainly be influenced by the US employment report for July. Stocks are now operating in "bad news from the economy is good news for us" mode, as investors are betting on a slowdown in the Fed's monetary restriction.

Technically, there is a Three Indians corrective pattern on the Bitcoin daily chart. Given the existing downward trend, it makes sense to sell BTCUSD on a break of support at 22,400 or a rebound from resistance at 24,000.