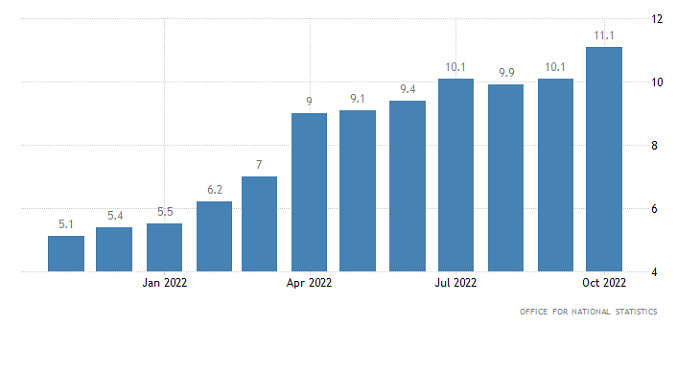

In the UK, inflation soared to 11.1% from 10.1%, thus setting the issue of the interest rate hike pace chosen by the Bank of England. Regardless of the situation, the pound sterling remained unchanged. It is almost obvious that at the next two meetings, the BOE will raise the benchmark rate by 75 basis points. This should have boosted the British pound. However, recently, the currency has increased so much and has become so overbought, that it has no room to rise. The market is waiting for just one reason to start a correction.

UK Inflation

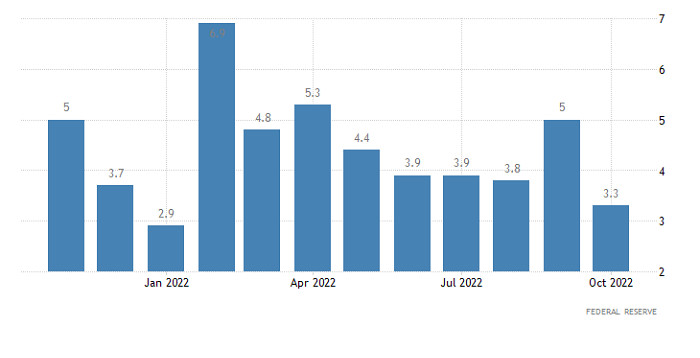

That is why it is quite surprising that traders did not react to the US retail sales figures. The indicator's growth slackened to 8.3% from 8.6%, whereas economists had expected a rise of 6.9%. Although consumer activity is falling, the data managed to exceed the forecast. Since the US dollar is extremely oversold, the data might cause a correction. However, the US industrial production figures prevented the greenback from a rise. Its growth pace slackened to 3.3% from 5.0%. What is more, the previous data was downwardly revised to an increase of 5.3%. According to the forecast, the growth was expected to slow down to 5.1%.

US Industrial Production

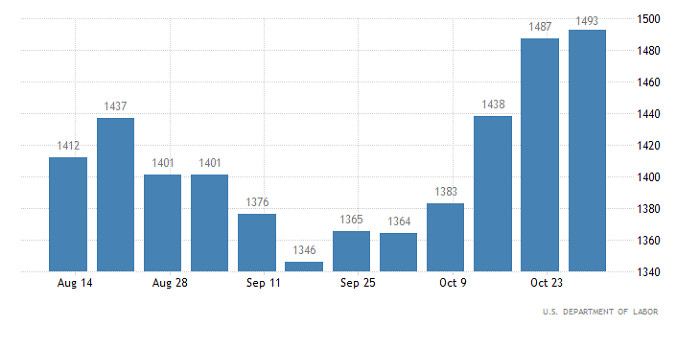

In any case, we see that traders are searching for reasons for the US dollar appreciation. However, today, this is hardly possible. The eurozone inflation data is unlikely to affect the market since it is the final estimate that is expected to meet the preliminary one, which was priced in by traders long ago. That is why only the US first-time claims may somehow affect the market. The number of initial claims may increase by 2,000, whereas the number of continuing claims may advance by 17,000. Such information may lead to the greenback's depreciation. However, it has no room to fall. That is why the market is likely to remain stagnant.

US Continuing Claims

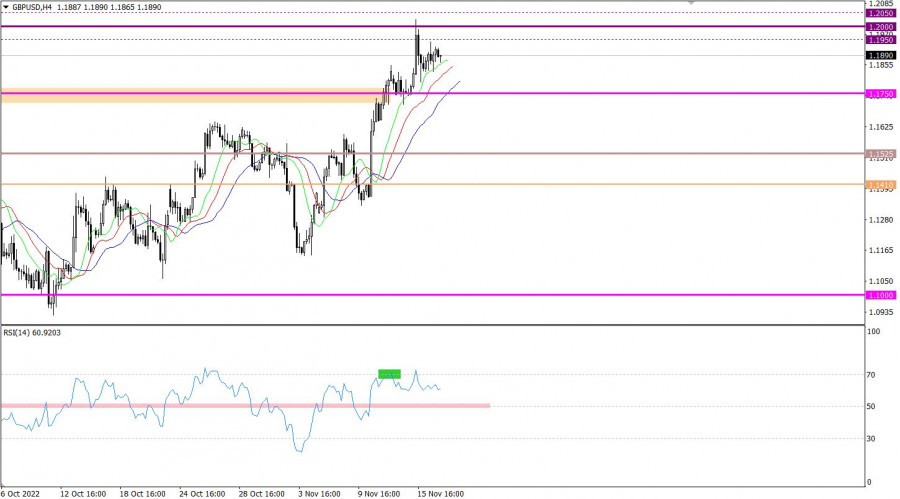

The pound/dollar pair may either stagnate or bounce off the psychological level of 1.2000. Since the pair has not launched a full-scale correction yet, traders are still interested in the long positions on the pound sterling.

On the four-hour chart, the RSI technical indicator is moving in the upper area of 50/70, which proves our assumptions about a bullish sentiment among traders.

On the four-hour and daily charts, the Alligator's MAs are headed upwards. This signal is corresponding to the general sentiment among traders of the pound/dollar pair.

Outlook

Under the current conditions, yesterday's stagnation may cause a change in the market sentiment. In this case, the price may show new swings. If the price consolidates above 1.2050, the current upward cycle is likely to continue. If the price settles below 1.1750, a bounce may turn into a full-scale downward correction.

In terms of the complex indicator analysis, we see that in the short-term and intraday periods, technical indicators are providing mixed signals amid the stagnation. In the mid-term period, indicators are pointing to an upward cycle.