Analysis and tips on how to trade EUR/USD

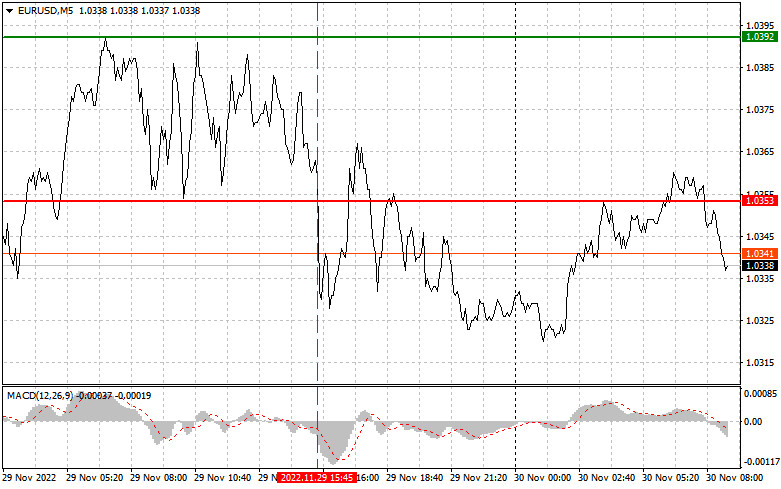

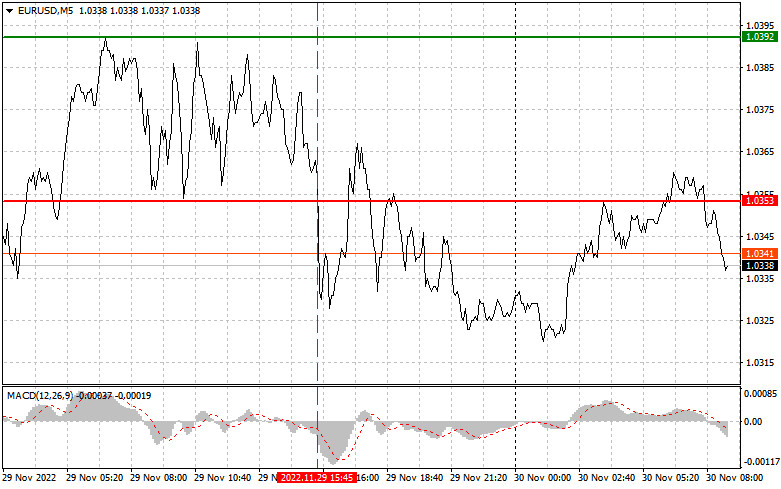

The price tested the mark of 1.0353 at the moment the MACD was well below the zero level, which limited the pair's downside potential. The pair traded within the sideways channel during the day. That is why I decided not to sell the euro. No more signals were generated.

The greenback strengthened slightly following the release of consumer sentiment data and the house price index in the US, which came in line with economists' forecast. Wednesday is likely to be a rather volatile day with a series of macro reports scheduled. Germany will see the release of statistics on unemployment. The CPI will be delivered in the eurozone. A slowdown in inflation in the region may push the euro down. Italy's and France's macro data are likely to be ignored by traders. Instead, they will focus on the ADP employment for November and Q3 GDP in the US. The GDP figures are expected to be upwardly revised, meaning the greenback should strengthen. At the same time, all eyes will be on Jerome Powell who is going to give an interview today. His hawkish statement will cause a drop in the value of the euro and boost the greenback as the difference in the policies of central banks may become more noticeable.

Buy signal

Scenario 1: long positions could be opened today when the quote touches the mark of 1.0361 (green line of the chart) with the target at 1.0461 where it would be wiser to close buy trades and sell the euro allowing a correction of 30-35 pips. The pair may grow steeply after the Fed boss speaks. Important! Before buying the instrument, make sure the MACD is above zero and just starts moving up from this level.

Scenario 2: it will become possible to go long when the price reaches 1.0319 with the MACD being in the oversold zone. This would limit the pair's downside potential and lead to a bullish reversal in the market. The quote may go either to 1.0397 or 1.0461

Sell signal

Scenario 1: today, short positions could be considered when the price hits 1.0319 (red line on the chart). The target is seen at 1.0253 where it would be wiser to close sell trades and go long, allowing a correction of 20-25 pips. The euro may come under pressure in case of disappointing results in the eurozone and upbeat GDP results in the US. Important! Before selling the instrument, make sure the MACD is below zero and just starts moving down from this level.

Scenario 2: the euro could be sold today when the price approaches 1.0361 and the MACD is in the overbought zone at the same time. This could limit the pair's upside potential and lead to a bearish reversal in the market. The quote may then go either to 1.0319 or 1.0253.

Indicators on charts:

The thin green line indicates a buy entry point.

The thick green line is the estimated price where you should place a take-profit order or close positions manually since the quote is unlikely to grow above this level.

The thin red line indicates a sell entry point.

The thick red line is the estimated price where you should place a take-profit order or close positions manually since the quote is unlikely to fall below this level.

MACD. When entering the market, it is important to pay attention to the overbought and oversold zones.

Remember that novice forex traders should be very careful when deciding to enter the market. Before the release of important fundamentals, you should stay out of the market in order to avoid sharp fluctuations in the rate. If you decide to trade during news releases, make sure always to place a stop-loss order to minimize losses. Without it, you may quickly lose your entire deposit, especially if you do not use money management but trade large volumes.

Remember that in order to succeed in the market, you should have a clear trading plan, like the one I presented above. Spontaneous decisions based on the current state of the market are a losing strategy for an intraday trader.