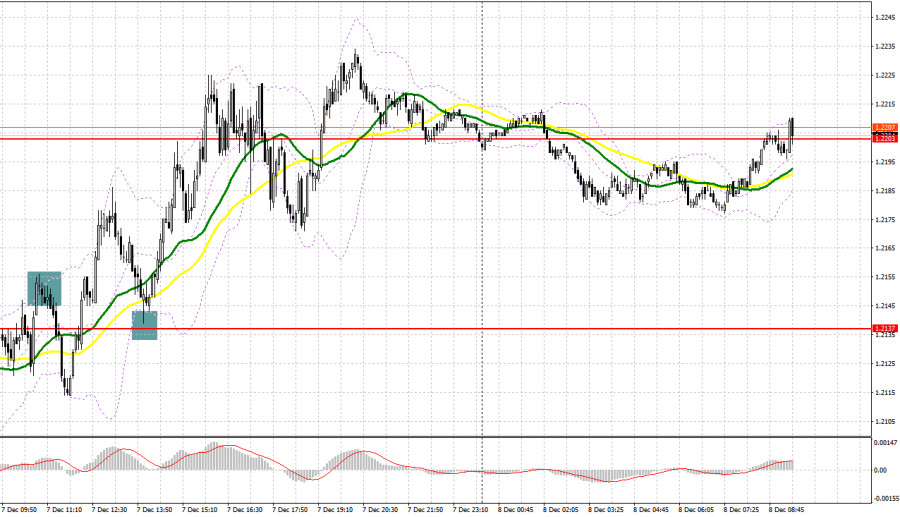

There were several good entry signals yesterday. Let us have a look at the 5-minute chart and see what happened. In my morning outlook I highlighted the level of 1.2146 and recommended making decisions with this level in mind. The pair rose to 1.2146 and performed a false breakout, allowing traders to increase their short positioning and extending the bearish trend which began early this week. However, sell pressure on the pair decreased significantly after GBP moved down by 30 pips. A downward retest of the new support level of 1.2137 in the second half of the day created an excellent sell signal and pushed the pair up towards 1.2203, allowing traders to take a profit of about 60 pips.

When to open long positions on GBP/USD:

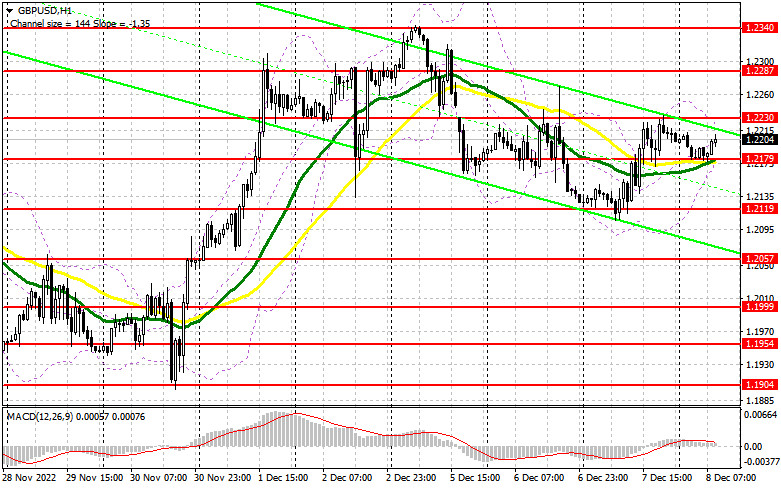

The pound climbed yesterday along with increased demand for risky assets. However, upside potential of the pair is still limited, as it is trading below the upper boundary of the descending channel. Taking into account the fact that there are no data releases in the first half of the day, bulls will likely have the initiative during the day, and a breakthrough of the nearest resistance at 1.2230 is possible. A better opportunity to buy GBP would arise if the pound sterling declines and performs a false breakout of 1.2179. The moving averages, which lie at this level, favor the bulls. That will create an entry point and bring the pair back to 1.2230, which was yesterday's high. The main goal for bulls today is breaking above this level and settling there, which would resume the GBP/USD rally. A downward test at 1.2230 will help strengthen bullish positions and open the way to 1.2287. If GBP/USD moves above this level, it will open the way towards the monthly high at 1.2340, where I recommend taking profits. If the bulls are not up to the task and lose 1.2179, the best course of action will be opening long positions when the pair declines to 1.2119 and performs a false breakout of this level. I recommend buying GBP/USD if it bounces off 1.2057, keeping in mind an upward correction of 30-35 pips intraday.

When to open short positions on GBP/USD:

Bears still have a chance to extend the downtrend, but in order to do that they will need to defend a rather important resistance level of 1.2230. A false breakdown of this level would be a good sell signal, assuming the pair will decline to the support at 1.2179. This will probably lead to a tug-of-war for this level, as bears will get an additional advantage should they get this level back under their control. A breakout and an upward test of the range will create an entry point for short positions. GBP/USD may return to 1.2119 afterwards. The most distant target is the area of 1.2057, where I recommend taking profit. If GBP/USD moves up and bears are inactive at 1.2230, which is also possible given the events of yesterday, bulls will take control of the market. Only a false breakout near 1.2287, the next resistance level, will form an entry point with a downside target. In case there is no activity there either, I recommend you to sell GBP/USD immediately if it bounces off its high and 1.2340, keeping in mind a downward correction by 30-35 pips intraday.

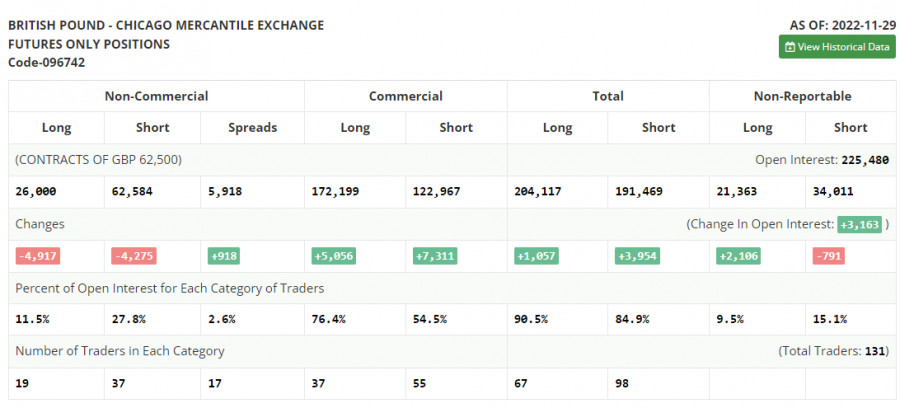

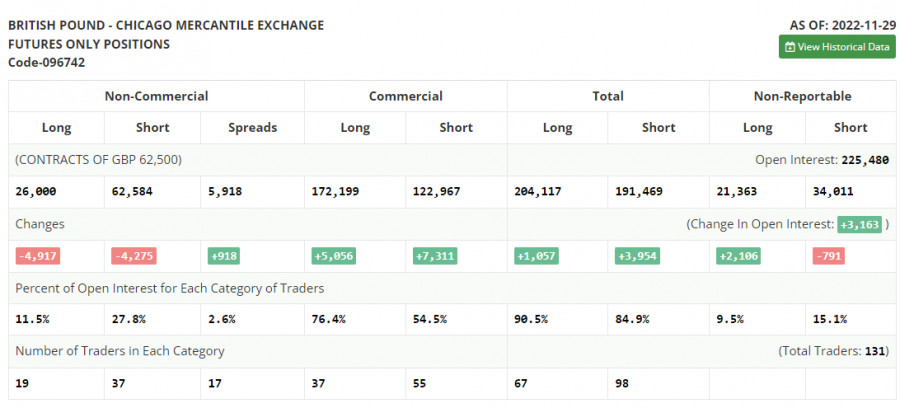

COT report:

According to the Commitment of Traders (COT) report for November 29, both net long and net short positioning decreased. The latest statistic data is hardly optimistic. The contraction in UK manufacturing and services sectors indicates that recession has begun. The Bank of England does not plan to deal with the recession at this point because it is primarily focused on dealing with high inflation, which continues to climb, judging by the latest data. As a result, traders prefer to sit on the sidelines without buying or selling the pound sterling. Furthermore, given the pair's upside trajectory since November, it is not particularly desirable to go long on GBP/USD at its current highs. The latest US data has been strong, which will likely lead to renewed demand for the US dollar after the Fed policy meeting next week. The latest COT report indicated that long non-commercial positions decreased by 4,197 to 26,000, while short non-commercial positions fell by 4,275 to 62,584. As a result, the total non-commercial net position remained negative and stood at -36,584 against -35,942 a week ago. The weekly closing price increased to 1.1958 from 1.1892.

Indicators' signals:

Moving averages

Trading is carried out near the 30-day and 50-day moving averages, which indicates that market participants remain uncertain.

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD moves up, the upper band of the indicator near 1.2230 will serve as resistance.

Description of indicators

• Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

• Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

• MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

• Bollinger Bands (Bollinger Bands). Period 20

• Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• Total non-commercial net position is the difference between the short and long positions of non-commercial traders.