Euro and pound rallied on Thursday, but then dropped again amid strong US statistics.

EU faces risk of stagflation

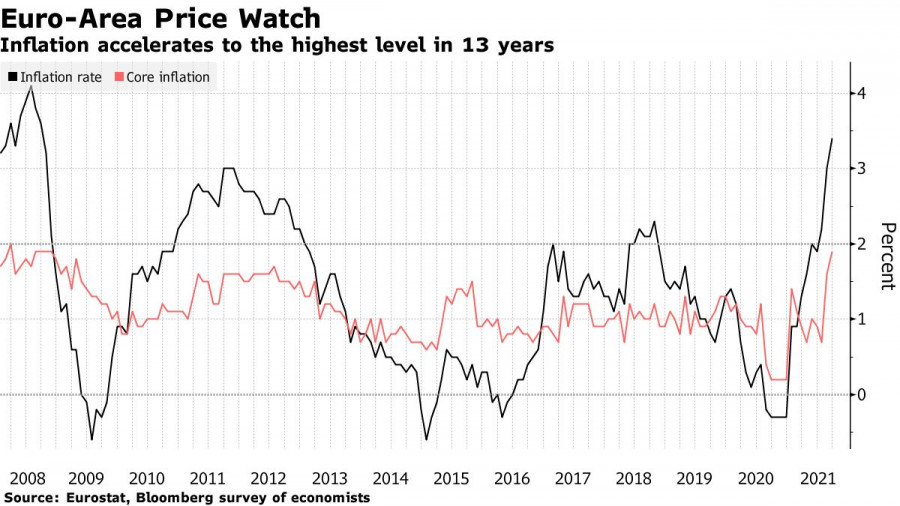

ECB member Klaas Knot expressed his concerns over inflation in the Euro area. He said prices may rise faster than expected, all due to supply disruptions and skyrocketing wages.

"The risks for headline inflation are again tilted to the upside," Knot said. "Upside risks, in the short to medium term, are mainly linked to more persistent supply side bottlenecks and stronger domestic wage-price dynamics."

Knot is considered one of the more aggressive members of the central bank. Lately, it seems that he is taking the likelihood of rising inflation very seriously.

Problems in wage growth are also observed in the United States. It is increasing more aggressively than expected, which, amid a slowdown in economic growth, is likely to lead to stagflation and create additional problems for governing bodies within the country.

The same is seen in Europe, but ECB President Chrstine Lagarde is not worried because in her opinion, the current surge is temporary, so she remains penchant for super-soft monetary policy.

Obviously, the ECB's Governing Council is much broader than that of the Fed's Open Market Committee, so it is not surprising that there is much more controversy and debate on this issue. The ECB has already hinted that they are actively preparing for post-pandemic stimulation of the economy and are not going to seriously curtail support measures. Meanwhile, the Federal Reserve is already talking about curtailing programs in November this year.

Currently, consumer prices in the EU are showing 3.4% growth, well above the ECB's 2% target. In the United States, this figure has long exceeded 5.7%.

Knot said that even if the ECB ends the emergency bond purchase program in March 2022, it does not mean the end of soft monetary policy.

IMF revises its forecasts

The International Monetary Fund is concerned that the global economic recovery has lost momentum and become increasingly divided. As such, it lowered its forecast for this year to 5.9%, which is down 0.1% from its forecast in July. Meanwhile, the forecast for 2022 was 4.9%.

The organization warned that risks have increased, particularly pointing to the highly-contagious Delta strain, supply chain problems and accelerating inflation. It said significant downgrades may be seen in some countries, especially in low-income ones where access to vaccines remains limited.

But it reassured investors that inflation will drop to 2% in advanced economies by mid-2022, so there is no need to worry about stagflation. They see US experiencing growth to 6% this year, followed by a drop to 5.2% next year. Meanwhile, China will rise to 8%, while Europe will increase to 5%. Forecasts for Japan, UK, Germany and Canada have been lowered for this year.

Sadly, in emerging markets and countries, consumer prices will likely grow to around 4.9% next year.

As for GDP, advanced economies should see a return to pre-crisis levels in 2022, and may even exceed it by 0.9% in 2024.

Macro statistics

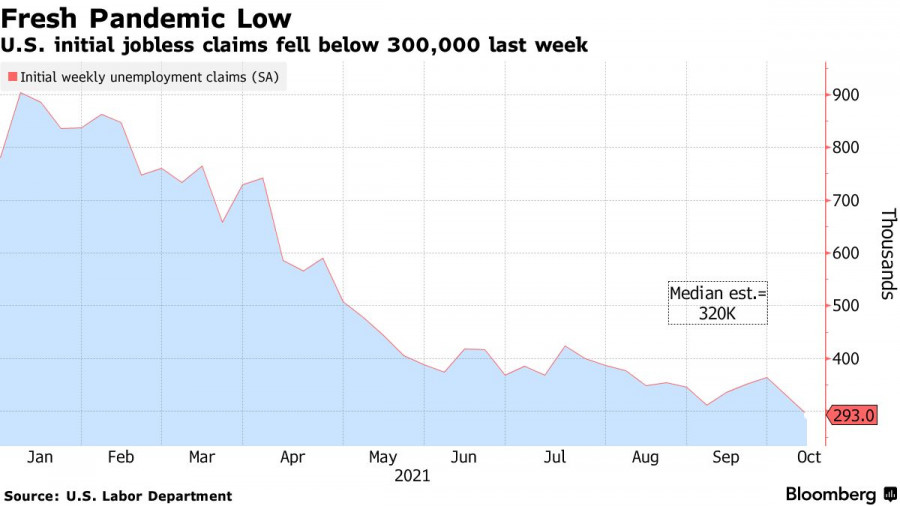

The US Department of Labor reported that jobless claims fell to their lowest level last week, amounting to only 293,000, which is down 36,000 from the previous week. It seems that the latest spike in coronavirus cases has not resulted in mass layoffs, suggesting that companies have sought to hire more employees and retain those they already have.

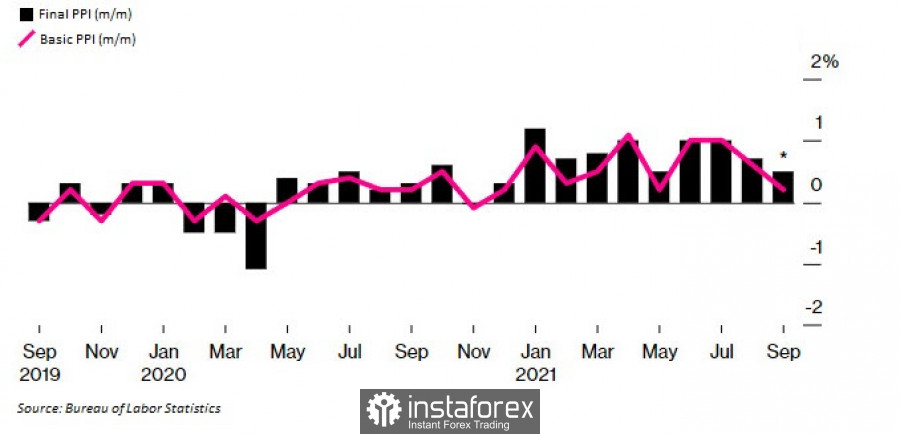

Meanwhile, PPI reportedly rose 0.5% m / m and increased 8.6% y / y. Core PPI, which excludes volatile product and energy categories, increased 0.2% m / m and jumped 6.8% y / y.

Looking closely, the cost of services appears to have increased by only 0.2%, which is the lowest increase in three months. On the other hand, food prices jumped by 2.0%, while energy prices rose 2.8%

Producer prices have risen steadily this year as supply disruptions and restrictions, including material and labor shortages, have increased production costs. Companies tried to shift some of these costs onto their customers, prompting increases in consumer prices. This was received with indignation by the regulator, and its representatives spoke very negatively about it this week.

Technical analysis for EUR/USD

Bulls made an attempt to overcome 1.1620, but failed. Now, a lot depends on 1.1580 because dropping below it will result in a further decline to 1.1550 and 1.1510. Meanwhile, an increase above will provoke a jump to 1.1625.