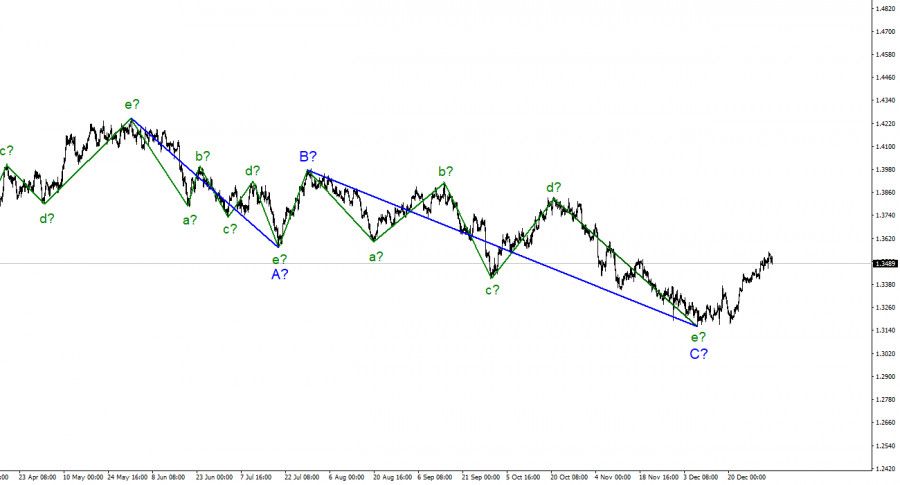

For the pound/dollar instrument, the wave markup continues to look quite convincing. In the last few weeks, the instrument has continued to build an upward wave, which is currently interpreted as wave D of the downward trend segment. If this assumption is correct, then the decline in quotes will resume after the completion of this wave, which may happen in the near future, given the size of the corrective wave B, which is visible in the picture below. Thus, the entire downward section of the trend may take an even longer form, and the GBP/USD instrument may continue to decline in the new year. At the same time, some confirmation of the intentions of the markets to resume sales of the British is required. Such confirmation can be a successful attempt to break through the 1.3456 mark, which corresponds to 50.0% Fibonacci. The internal wave structure of the proposed wave d is obtained so far as three-wave, which fully corresponds to the nature of wave D.

In the UK, the confrontation with Omicron continues. So far without success.

The exchange rate of the pound/dollar instrument decreased by 70 basis points during Monday. This is not very much and not very little for the tool. A successful attempt to break through the 50.0% Fibonacci level has not yet happened, so the construction of an upward wave D can resume. If it drags on, then it can transform into the first wave of a new upward trend segment, which will then have to take a five-wave form. But until that happens, I'm waiting for the decline of the British currency. The situation in the UK remains quite difficult. But it is now expressed only by an increase in the number of cases of infection with coronavirus and its Omicron strain. The number of diseases is growing, but the country's government is still not going to introduce quarantine. However, it promises to keep its finger on the pulse and, if the situation worsens, immediately take action. However, what it means to "worsen" is not entirely clear, since in recent days 150-300 thousand Omicron diseases per day have been noted in the country. Where is it even worse? In the absolute majority of cases, the disease proceeds very easily, but there are still cases of hospitalization. Considering that in recent weeks the pound has been in demand in the market, I cannot conclude that the increase in the number of diseases has somehow affected the pound/dollar instrument. Consequently, the news background is either absent now, or it does not affect the tool. And in this case, we can only wait for the news background to which the markets will turn their attention. Several important events and reports are planned in America this week. In particular, the minutes of the last FOMC meeting will be released, and the Nonfarm Payrolls report will be released on Friday. Thus, the first week of January may already turn out to be very important and productive. But let me remind you that not all the movements of the instrument depend on the news background. If the Payrolls are strong on Friday, this does not mean that wave E is guaranteed to be built.

General conclusions.

The wave pattern of the pound/dollar instrument assumes the completion of the construction of the proposed wave D in the near future. Since this wave has not yet taken a five-wave form, I expect that a new descending wave E will be built. And it will begin in the very near future. Therefore, I advise you to sell the instrument with targets located near the calculated marks of 1.3271 and 1.3043, which corresponds to 61.8% and 76.4% by Fibonacci, if a successful attempt to break through the 1.3456 mark is made.