Last week, Bitcoin set a new local low at $17.7k. Subsequently, the price began to recover and the asset established an acceptable range of movement of $19k–$21k. Such a sharp and deep decline is the norm during the main phase of the bear market, however, the breakdown of $20k has caused a number of negative factors that may exacerbate further price recovery. Last week saw the largest capitulation of miners and long-term investors in the history of Bitcoin. In general, all groups of investors suffered losses, and the sale of BTC by miners and hodlers indicates that the final stage of the market correction is approaching.

Miners and long-term owners are the main market bearers in serious downward trends. Their capitulation indicates that the market bottom is approaching, as these categories of players sell their assets in the most extreme cases and the very last. With this in mind, we can make a superficial conclusion that the local bottom of the market will be formed in the range of $10k–$20k. Why did we write "will"? This is indicated by on-chain metrics and fundamental factors. The asset really fell to the very bottom of market expectations, but did not go deep enough into the final range, which will definitely have to be done in the current economic situation.

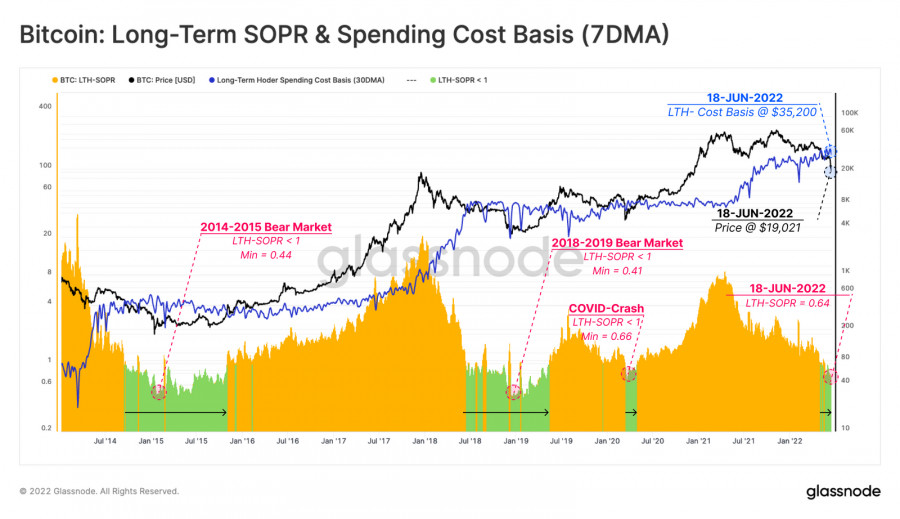

Let's start with the SOPR on-chain indicator, which hit a local bottom at 0.64 on June 18. For comparison, in previous bear markets, this indicator reached the area of 0.4–0.6. This suggests that the metric is close to the market bottom, but hodlers need one more dive to reach the required level of loss realization.

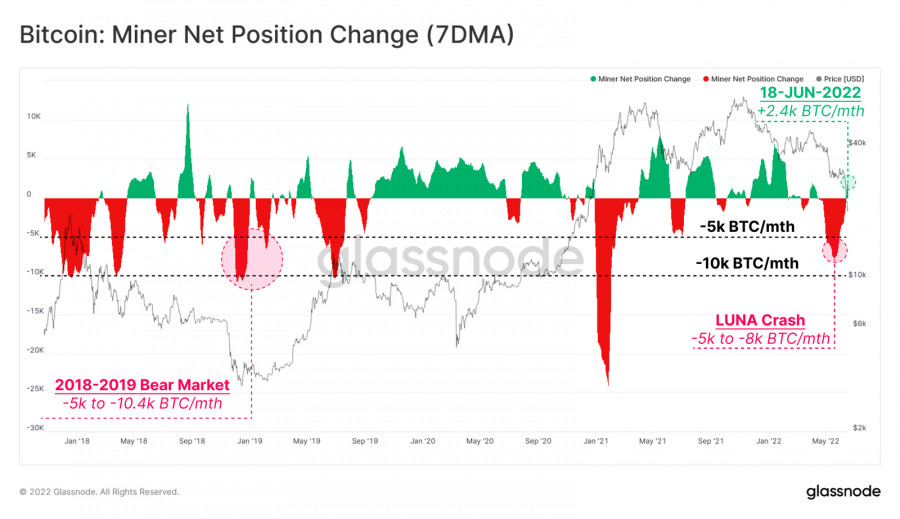

Miner volumes are the only single metric that has reached comparable numbers to previous downward cycles. The monthly sale of BTC by mining companies reached 5,000–8,000 coins, which is commensurate with the figures of 2018. As of June 23, cryptocurrency mining companies have resumed the accumulation of Bitcoins, but the problem of energy resources has not gone away, and therefore it is likely that we can expect the next stage of BTC implementation by miners.

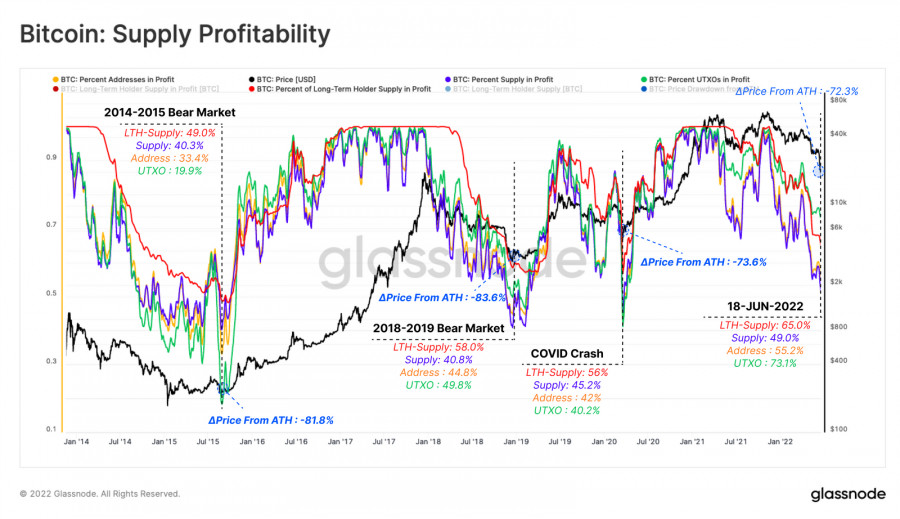

The profitability of Bitcoin coins also decreased and reached the level of 49%. That is, the indicator also came close to the required zone of 40%–45%, but failed to work it out. The metric of unspent transaction outputs indicates that 26.5% of the coins turned out to be at a loss, and when the local market bottom was reached, this figure reached 60%–80%.

All of these factors indicate that on-chain metrics have come close to the final bear market area, but have not fully entered it. Some indicators have indeed reached the required level for the formation of a local bottom, but it is important to understand that the current situation is much more complicated than in 2018. This suggests that Bitcoin will survive another round of declines to the $10k–$15k area.

This is also hinted at by the percentage of the fall in the price of Bitcoin. As of June 23, the asset is down 74%, which means there is open potential for another 10% fall, i.e. in the $10k–$15k range.

In addition, it is worth noting that the bear market will last at least until the end of summer. This is evidenced by the statistics of previous bear markets. In 2013, the price fell for 407 days, and in 2018 for 364 days.

There is a trend of 10% contraction, indicating that the 2022 bear market will contract by approximately one calendar month. If we take November 10 as the initial starting point of the bear market, then we can conclude that the global market correction will be completed by the end of September and the beginning of October 2022.