The pound-dollar pair retreated from local price highs today, despite the general weakening of the US currency. A sharp decline in the PMI indices, as well as vague prospects for further tightening of monetary policy, put pressure on the pound. The GBP/USD bears have regained almost all the positions lost yesterday. But at the same time, the situation is uncertain: at the moment, both long and short positions on the pair look unreliable.

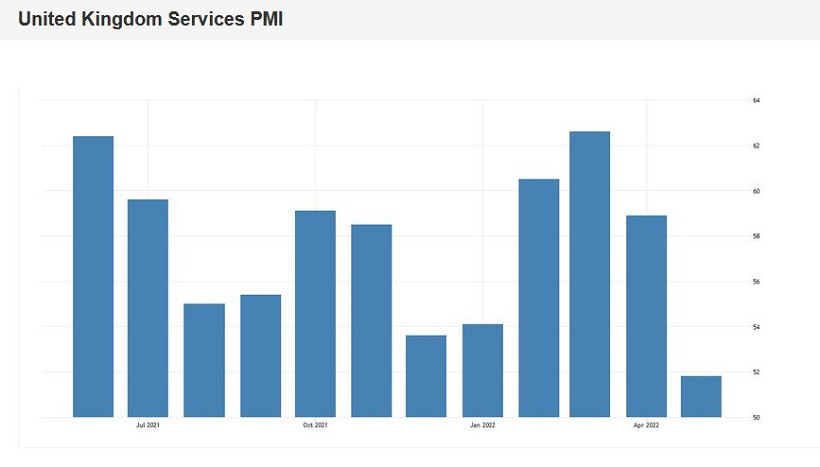

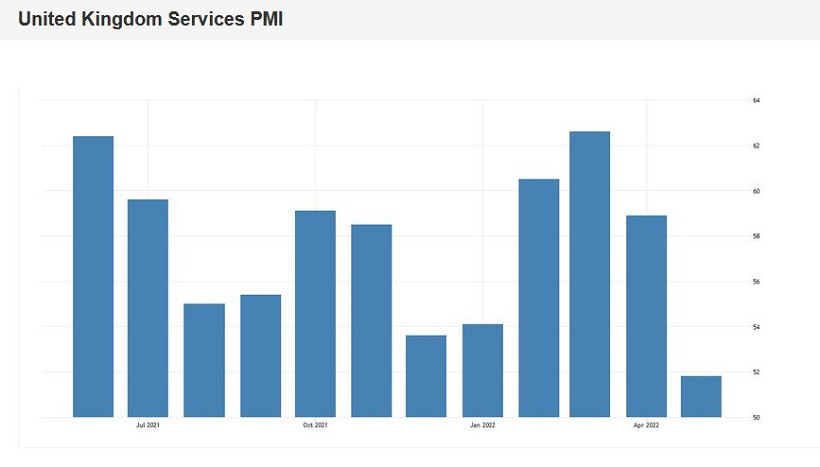

British macroeconomic statistics continue to disappoint. Against the background of record inflation growth, all other economic indicators are declining, and at a stronger pace relative to the forecasts of most experts. Therefore, the word "stagflation" is mentioned by economists more and more often, especially after the pessimistic results of the last Bank of England meeting. Today's reports only added to the gloomy picture. Thus, the composite PMI business activity index collapsed to 51 points in May with a forecast of a decline to 57 points. This indicator came out at the level of 58 points in April. A similar situation has developed with the index of business activity in the UK services sector – a drop from 58 to 51 points was recorded in May. The PMI index also came out in the red zone in the manufacturing sector, although here the depth of the fall was not so impressive.

The above reports should be considered in a comprehensive manner – with the rest of the reports that have been published over the past two weeks. For example, the volume of UK GDP in the first quarter of this year increased by only 0.8% on a quarterly basis, with growth forecast to 1.0% and the previous value of 1.3%. On a monthly basis, the indicator fell into negative territory (for the first time since December last year) with a forecast of zero growth. The volume of industrial production in the last reporting period decreased by 0.2%, while experts expected a minimal increase of 0.1%.

It should be recalled here that the BoE at its last meeting warned of a projected sharp slowdown in GDP growth – not only this year, but also next year. In particular, in 2023, the central bank expects the economy to shrink by 0.25%, whereas previously it was expected to grow by 1.25%. In 2024, according to the published forecast, the volume of GDP will increase by 0.25%, while earlier forecasts spoke of one percent growth. At the same time, the central bank has significantly increased its estimate of inflation in the UK in 2022 (from 5.75% to 10.25%, that is, to a 40-year high). With such forecasts, it is not at all surprising that both the head of the BoE and many "ordinary" experts started talking about the risks of stagflation. And in the same context, many doubted that the British central bank would maintain a "sporty pace" in terms of tightening monetary policy. The first bells have already sounded: following the results of the May meeting, BoE Governor Andrew Bailey said that the members of the Committee "do not agree with those people who believe that they should raise interest rates at a more aggressive pace." According to Bailey, "The central bank is concerned about the inflationary effects of the next round".

These words had a ringing effect on the positions of the British currency. Immediately after the final press conference, the GBP/USD pair collapsed by almost 300 points - from the 26th figure to the twenty-third. Then the dollar increased the pressure, as a result of which the pound updated two-year lows, reaching 1.2155. Now the US currency has weakened due to renewed interest in risk – amid US President Joe Biden's statements that the White House may partially reconsider increased customs duties for Chinese imports. Taking advantage of the opportunity, bulls on GBP/USD had the opportunity to go for a correction: the pair returned to the borders of the 26th figure. But further growth was questionable.

Unlike EUR/USD bulls, who receive hawkish signals from the European Central Bank, GBP/USD bulls doubt that the English central bank is at the beginning of a long journey. For example, according to analysts at Standard Chartered, the BoE will raise the rate in June and August, after which it will take a pause for an indefinite period.

Such conclusions, on the one hand, increase the priority of short positions on the GBP/USD pair. But on the other hand, shorts now look risky – due to the temporary weakness of the US currency. If the discussion about the partial cancellation of increased customs duties on goods from China intensifies in the information field, the greenback will continue to be under pressure.

Let me remind you that Biden promised to hold consultations on this with US Treasury Secretary Janet Yellen. As you know, she is an opponent of the trade war unleashed by Trump with China. At the end of last year, she stated that even a partial abolition of customs duties on Chinese imports could help reduce prices in the US. According to Reuters, at the moment Yellen has not only not changed her point of view, but also defends it in disputes with opponents in the White House. Actually, that's why Biden's words provoked such a violent reaction: the dollar sank throughout the foreign exchange market, while the US stock market rose – on expectations of easing trade restrictions for China.

All this suggests that the decline in the GBP/USD price may be deceptive. And although the pound is showing weakness, the dollar may not pick up the banner of the downward movement. As a result, the pair will either get stuck in the flat, or the corrective growth will resume, with a repeated attempt to consolidate in the area of the 26th figure. In conditions of such uncertainty, it is most expedient to take a wait-and-see attitude.