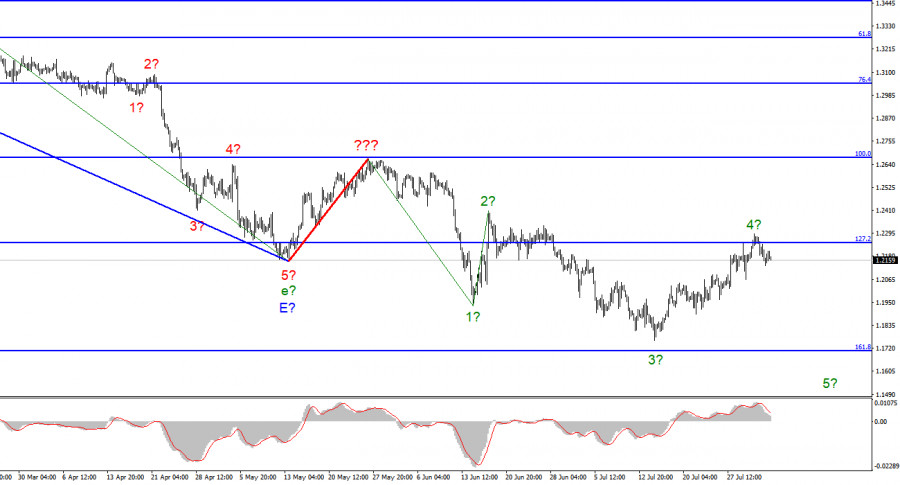

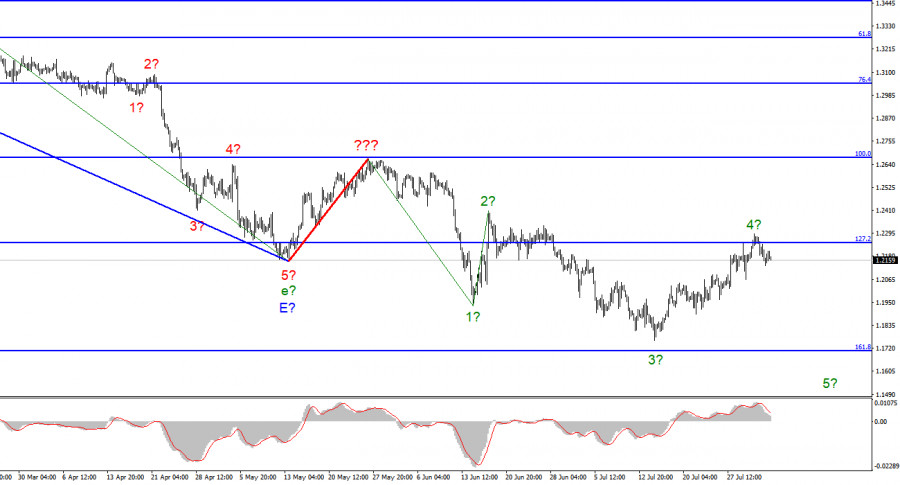

For the pound/dollar instrument, the wave marking at the moment looks quite difficult, but does not require adjustments. The upward wave, which was built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the construction of the upward correction section of the trend is canceled, and the downward section of the trend takes a more extended and complex form. I am not a big supporter of constantly complicating the wave marking when we are dealing with a strongly lengthening trend area. I think it would be much more expedient to identify rare corrective waves, after which new impulse structures would be built. At the moment, we have completed waves 1, 2, and 3, so we can assume that the instrument is now in the process of building wave 4 (which may also be already completed or nearing completion). The wave markings of the euro and the pound differ slightly in that for the euro, the downward section of the trend has an impulse form (for now). But the ascending and descending waves alternate almost equally, and at this time, both instruments can complete the construction of their fourth waves simultaneously. I still expect a new decline in the British pound in the coming days.

The market has lost its appetite for risk amid the Taiwan events and the meeting of the Bank of England

The exchange rate of the pound/dollar instrument decreased by another 10 basis points on August 3. This is a slight decrease, but an unsuccessful attempt to break through the 127.2% Fibonacci level indicates the market's readiness to complete the construction of the expected wave 4. And until a successful attempt to break this mark is made, I suggest considering this option as a working one. The conflict between China and Taiwan persists, but has not yet entered an active phase, and this is already good, since we have been seeing too many military conflicts lately. Therefore, we are returning to the economy for now.

In the UK, a report on business activity in the service sector was released today. Its value is 52.6, and it should be noted that the market was waiting for a higher figure. The composite index of business activity also decreased. Let me remind you that the latest report on UK GDP showed good growth, so the British economy is not in danger of a recession yet, as well as the European one. But still, the decline in some individual indicators makes economists start to worry about this. However, it is possible to worry now for various reasons, since in the last few years, fate has repeatedly confronted humanity with various global problems. And tomorrow, the Bank of England will present the results of the meeting, which will also not remain without the attention of the market. Analysts have no doubt that the interest rate will be raised immediately by 50 basis points. But will the pound be able to resume the promotion after that? Let me remind you that the "fall" of the instrument is now being supported by the completion factor of wave 4 and an unsuccessful attempt to break through the 127.2% Fibonacci level. But an increase in the interest rate, in most cases, supports the local currency. Thus, the market may be hyperactive on Thursday.

General conclusions

The wave pattern of the pound/dollar instrument suggests a further decline. I advise now selling the instrument with targets located near the estimated mark of 1.1708, which equates to 161.8% Fibonacci, for each MACD signal "down." An unsuccessful attempt to break through the 1.2250 mark indicates that the market is not ready at this stage of time to continue buying the British pound.

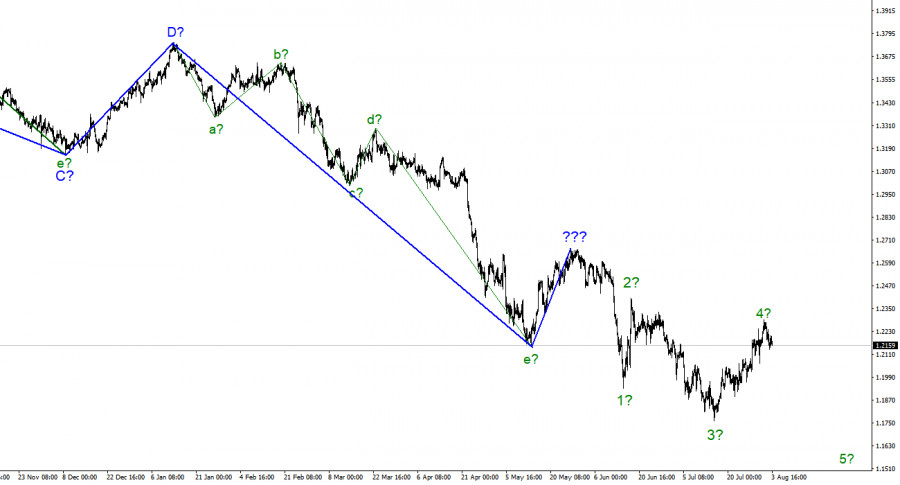

At the higher wave scale, the picture is very similar to the euro/dollar instrument. The same ascending wave that does not fit the current wave pattern, the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.