There is a gradual redistribution of capital in the global financial markets. The cryptocurrency market is attracting more and more attention from investors all over the world due to the worsening overall economic situation.

Aggressive rate hikes by the central banks are rolling around the world, which leads to a lack of liquidity. At the initial stage of this process, high-risk assets and Bitcoin were the losers, but the situation is starting to change.

Economic factors

UK banks stopped issuing mortgage loans, which caused a negative reaction of the markets at the moment. It also led to the continuation of the upward trend of government bonds and had a negative impact on US government bonds. Stock indices and Bitcoin continued to decline as the policy of the UK central bank led to an increase in DXY.

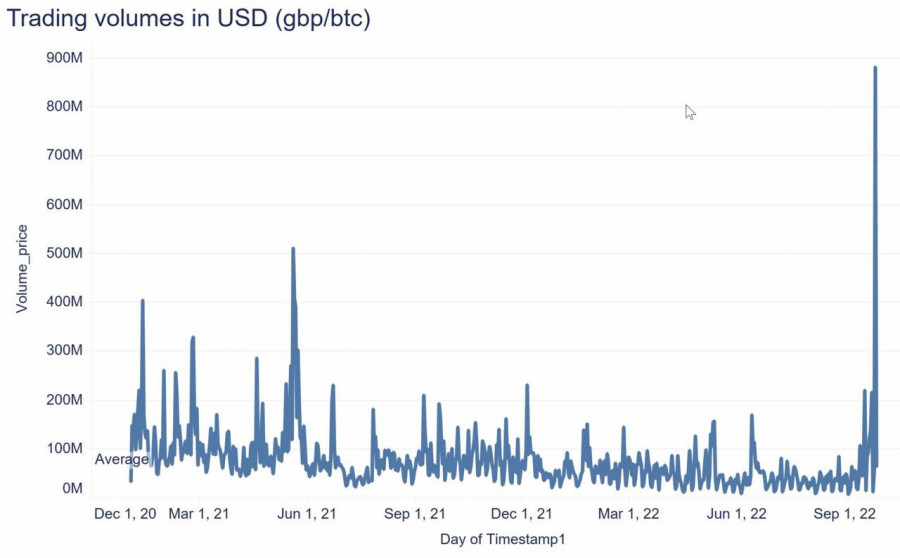

However, analyst James Butterfill later noted the growing trading volumes of BTC/GBP. The indicator reached the level of $881 million with average values around $70 million. There is a growing investor demand for Bitcoin amid unabated inflation and the onset of a recession.

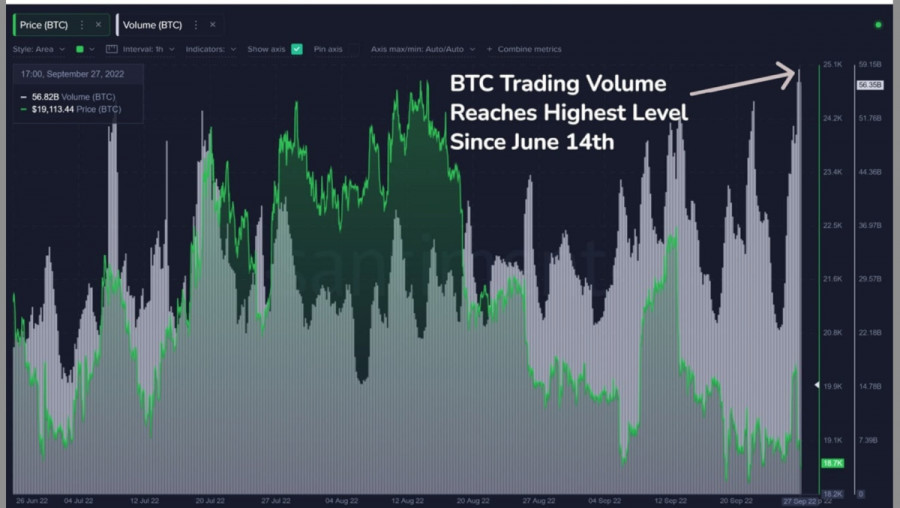

Santiment experts confirm a general increase in trading activity in the cryptocurrency market. Bitcoin trading volumes also reached their highest level since June 14, indicating some changes in the market and the emergence of a serious buyer.

DXY&SPX

At the same time, the crypto market is waiting for the start of a correction in the US dollar index, which should provoke a rally in Bitcoin and other digital assets. As a result of September 28, DXY formed a bearish engulfing, but technical metrics point to a resumption of bullish momentum.

The S&P 500 managed to form a bullish engulfing pattern on September 28, which directly indicates an inverse correlation with the DXY. Technical indicators of the stock index signal the beginning of an upward movement of the indicator. However, given the similar signals on the DXY, one cannot be completely sure about the upward movement of the SPX price.

BTC/USD Technical analysis

Bitcoin continues to move within the $18.5k–$20.5k range. The cryptocurrency shows impulse attempts to go beyond this range in order to resume movement in a wider area. Technical metrics remain weak and indicate a flat price movement.

The current situation around Bitcoin is completely tied to the SPX movement and the situation with US and UK government bonds . The cryptocurrency is still pulling towards the $20k mark, but there are no clear signals to play short or long. The $18.5k–$20.4k range is a raging storm, so we can expect movement in either direction.

If the $20.4k level is broken, the path to the $22.8k–$23k range will open for Bitcoin. However, for now, this scenario is unlikely, as SPX buyout volumes remain low, and therefore the movement of the cryptocurrency will be constrained by the stock index.

Conclusions

Bitcoin and the cryptocurrency market are actively reacting to world events. The situation with UK banks is a clear proof of this. In the near future, we should expect an improvement in the overall situation for digital assets due to the correction of DXY and the aggravation of recession processes.

Markets are reaching dangerous levels when rates are raised to record highs, but inflation continues to rage. The case with BTC/GBP trading volumes could be a prelude to a massive flow of capital into cryptocurrencies. However, this process will take time and will not be completed in the coming weeks.