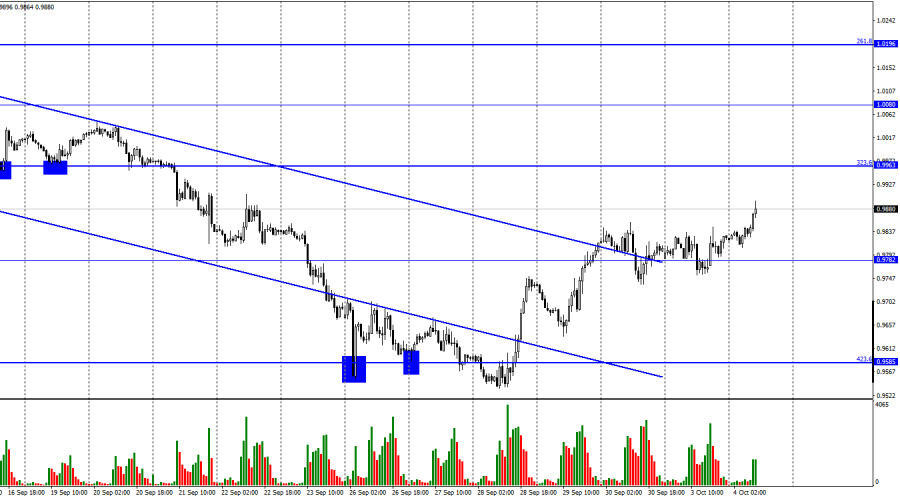

On Monday, the EUR/USD pair reversed to the upside and resumed growing towards the correctional level of 323.6% - 0.9963. The euro has been growing for the fifth day in a row, and traders might have already become weary of the movement in this direction. Nevertheless, the current growth of the euro is still too weak to speak about the end of the downtrend. However, I assume that after some weeks or months we may see a full-fledged uptrend. The price consolidated above the downtrend channel. On the hourly chart, traders' sentiment has changed to bullish. This factor allows counting on further growth. On Monday, the news background was quite scarce. The index of business activity of S&P in the EU manufacturing sector posted 48.4 points, although a month earlier it was 49.6. The index of business activity of S&P in the US increased to 52 from 51.5. The US Services PMI fell from 52.8 to 50.9 points.

All three indices showed mixed results so we cannot draw a definite conclusion. As we can see, two identical indexes in America showed different trends. Therefore, the uncertain movement of the pair on Monday, in my opinion, was justified. On Tuesday, on the other hand, the European currency went up in the morning, though there is no information background. The only event of the day is the speech of ECB President Christine Lagarde, which will be given in the evening. In my opinion, her rhetoric is unlikely to change and she will talk about the need to keep hiking the interest rate. The latest inflation report showed that the measures that had already been taken did not have the necessary effect of slowing down inflation. The CPI has already risen to 10%, while in the US and the UK the figure has begun to decline. However, in the UK and the US, the interest rates began to rise earlier. Lagarde's speech may support the euro today.

On the 4-hour chart, the euro/dollar pair reversed in favor of the EU currency and resumed growing towards the upper line of the downtrend channel. The current price range shows that the traders' sentiment is bearish, which makes me cautious about all sorts of forecasts about the future strong growth of the euro. The pair's fixation above the trading channel increases the probability of the pair's growth.

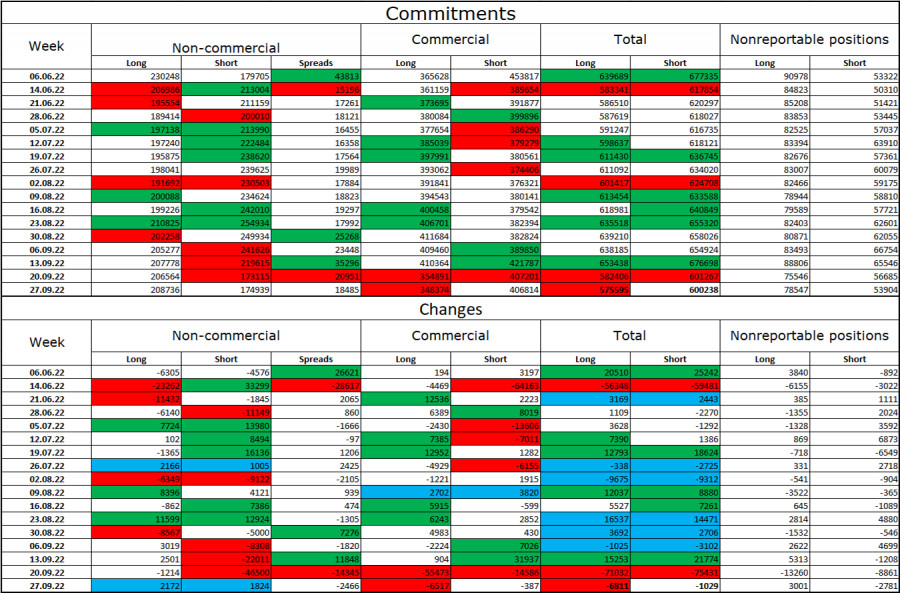

COT report:

During the previous reporting week, traders opened 2,172 long and 1,824 short contracts. It means that the sentiment of large traders did not change during the reporting week. The total number of long contracts, which are in the hands of speculators, is now 208,000, and short contracts - 174,000. Thus, the sentiment of big players is now bullish but the euro is still experiencing serious problems with growth. In the last few weeks, the euro has been rising little by little but traders are much more active in buying the US dollar. So, I would bet on the important downward channel on the hourly and 4-hour charts. I also recommend keeping a close eye on the geopolitical news, as it greatly affects the sentiment of traders.

Economic calendar for US and UK:

US - JOLTs Job Openings (14-00 UTC).

EU - ECB President Lagarde will give a speech (15-00 UTC).

On October 4, the EU and US economic calendars each have one interesting entry, but I think traders will only pay attention to Lagarde's speech. The influence of the information background on traders' sentiment may be weak today.

EUR/USD forecast and recommendations for traders:

It is recommended to sell the pair on the rebound from the upper boundary of the trading channel on the 4-hour chart with a target of 0.9581. You may buy the euro currency if the price fixes above the upper boundary of the channel on the 4-hour chart with a target of 1.0638.