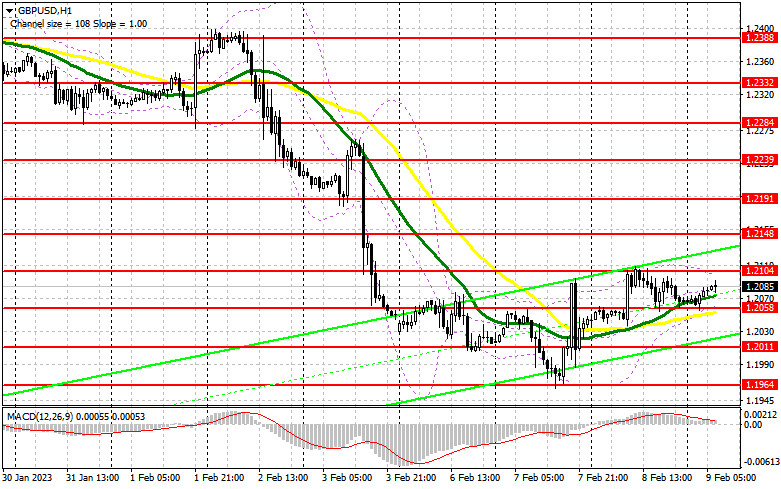

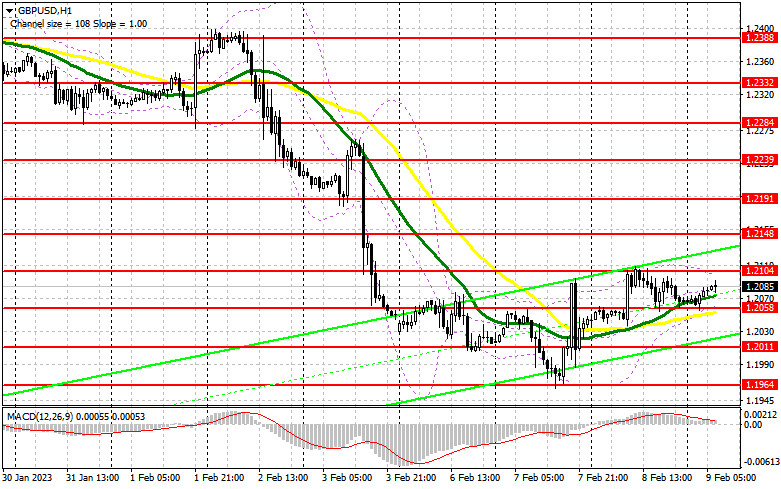

Yesterday, there was only one entry point. Let's have a look at the 5-minute chart and analyze the situation. In my previous forecast, I drew your attention to the level of 1.2090 and recommended entering the market from it. The British pound jumped but failed to pierce 1.2012. This created a sell signal. However, the pair did not decline sharply. After revising the technical picture in the second half of the day, the pair did not form new entry points.

Long positions on GBP/USD:

Bulls still try to recoup the decline that happened at the end of last week after the Bank of England meeting on monetary policy. Today, there are a lot of events that could lead to another major sell-off in the pair. We are talking about monetary policy report hearings. Bank of England Governor Andrew Bailey will deliver a speech, as well as Bank of England MPC members Huw Pill, Jonathan Haskell, and Silvana Tenreyro. If the regulator convinces the policymakers of the need to switch to a softer policy in the future, which is what was said after last Thursday's monetary policy meeting, the pressure on the British pound may return. Thus, there would be no reason to buy the currency. If the pair falls, we should monitor bulls' activity after a false breakout at 1.2058, a new support level, created after yesterday's meeting. There are also the moving averages, which support bulls. They may allow the British currency to increase to 1.2104. If the pair settles above this level and tests this level from above, the GBP/USD pair is likely to soar to the high of 1.2148. Breaking through this level, GBP may rise to 1.2191 but that is unlikely to be possible without some unexpected news during the parliamentary hearings. If bulls fail to protect 1.2058, the pressure on the GBP/USD pair will return. In that case, it would be better to postpone opening long positions until the price reaches the next support at 1.2011 after forming a false breakout. One may buy GBP on a rebound from 1.1964, allowing an intraday correction of 30-35 pips.

Short positions on GBP/USD:

Bears are trying to push the pair lower but nothing comes out as big players refrain from acting in the market. Perhaps, today's speech by BoE Governor Andrew Bailey will help decide on the pair's future direction. If bears want to take control of the market in the near future, they need to increase their activity at yesterday's high of 1.2104, from which the price moved down. Only a false breakout at this level may give an entry point into long positions with the target at 1.2058, where the moving averages are located. Currently, the MAs are supporting bulls. Suppose Bailey manages to convince the lawmakers to keep the rates down. In that case, we can expect a breakout and a downward test of 1.2058, which would ruin bulls' plans of returning back to higher levels quickly after the sell-off and would increase the bears' exposure, and would create a sell signal to 1.2011. The next target is located at 1.1964. If the price reaches this level, a new downtrend may develop. Traders may lock in profits at this level. If the pair grows and we see a lack of activity from bears at 1.2104, bulls may become strong again. In that case, a false breakout near the next resistance at 1.2148 may form an entry point into short positions. If there is no activity at this level, it is possible to sell GBP from the high of 1.2191, counting on an intraday rebound down by 30-35 pips.

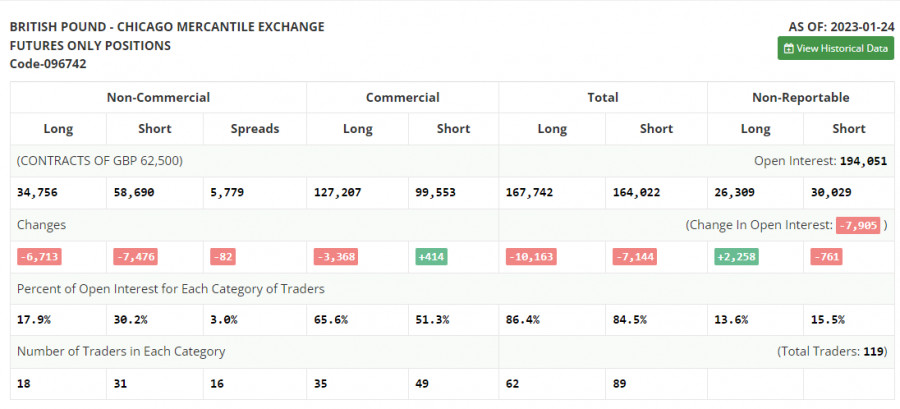

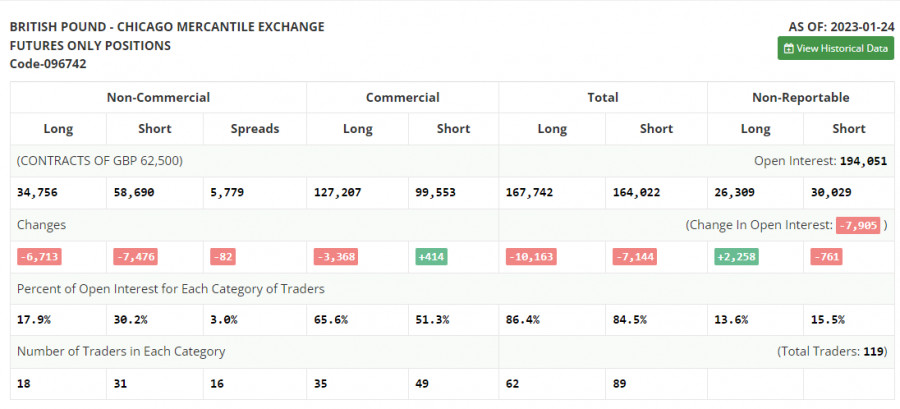

COT report

The COT report from January 24 logged a sharp drop in long and short positions. However, the current decline was quite acceptable. The fact is that the UK government is coming across tough times. It is struggling with strikes and demands to raise wages and at the same time, it is trying to achieve a steady decline in inflation. However, this is of less importance at the moment since traders are waiting for the meetings of the Fed and the BoE. The Fed is expected to switch to a less hawkish stance, whereas the BoE may remain aggressive, refraining from increasing the interest rate by 0.50%. This may have a positive effect on the pound sterling. That is why I will bet on its further rise. The recent COT report showed that the number of short non-commercial positions decreased by 7,476 to 58,690, while the number of long non-commercial positions decreased by 6,713 to 34,756. As a result, the negative value of the non-commercial net position dropped to -23,934 from -24,697 a week earlier. Such minor changes will hardly affect the market situation. Thus, we will continue to closely monitor the economic indicators for the UK and the decision of the Bank of England. The weekly closing price rose to 1.2350 against 1.2290.

Signals of indicators:

Moving averages

Trading is carried out above 30- and 50-day moving averages. This indicates that bulls are trying to build an upward correction.

Note: The author considers the period and prices of moving averages on the one-hour chart which differ from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair increases, the upper band of the indicator at 1.2105 will offer resistance. If the pair declines, the lower band of the indicator near 1.2050 will act as support.

Description of indicators

- Moving average determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- Total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.