And while the bitcoin and ether exchange rates are gradually recovering "from the ashes," according to the Nikkei report, the Japanese government plans to introduce new rules for money transfers to ensure that criminals do not use cryptocurrency exchanges for money laundering. And here we are talking not only about cryptocurrency transactions, which are now considered almost the only tool that allows various countries to circumvent sanctions, but also about their internal security – at least, that's what the Japanese authorities think.

The new rules, which will still be adopted, now require cryptocurrency and not only exchanges to transfer customer information, including customer names and addresses. The requirement also applies to the transfer of cryptocurrencies between platforms. This will provide the Japanese authorities with additional monitoring capabilities to track money transfers of people engaged in illegal activities. Violators will be brought to administrative or criminal responsibility.

The draft amendment to the law is scheduled to be presented at the parliamentary session scheduled for October 3, but it is expected that the rules will come into force in May 2023. Currently, many Japanese cryptocurrency exchanges are negotiating with the government on the exchange of customer information. In March last year, the Japanese Financial Services Agency ordered exchanges to implement a structure to comply with several user identification rules, including anti-money laundering regulations through cryptocurrencies.

Immediately, dissatisfied people were referring to the fact that this kind of work will be quite time-consuming and you will have to spend a lot of resources on it, increasing costs. It is worth noting that the new law is planned to be applied not only to cryptocurrencies but also to stablecoins - a type of cryptocurrency tied to the price of another asset, such as the US dollar or gold.

Let me remind you that the Japanese authorities are not very satisfied with the development of the crypto industry in the country. And although no one is going to ban it, the government has repeatedly expressed concern about several issues related to new digital money and coins, calling for the necessary legislation to be developed as soon as possible.

As for the current technical picture of bitcoin, as I noted above, a slight recovery has not yet led to a serious change in the overall market picture. The focus is now on the resistance of $ 20,000, the return of which is needed in the near future. In the case of a breakout in this area, you can see a dash up to $20,540 and $21,410. To build a larger uptrend, you must break above the resistance levels of $21,840 and $22,500. If the pressure on bitcoin returns, which will happen after the trade moves back under the psychological level of $ 20,000, the bulls should make every effort to protect the support of $19,520, just below the area of $19,103. Its breakdown will quickly push the trading instrument back to $18,625 and $18,100 and pave the way for an update of the $17,580 level.

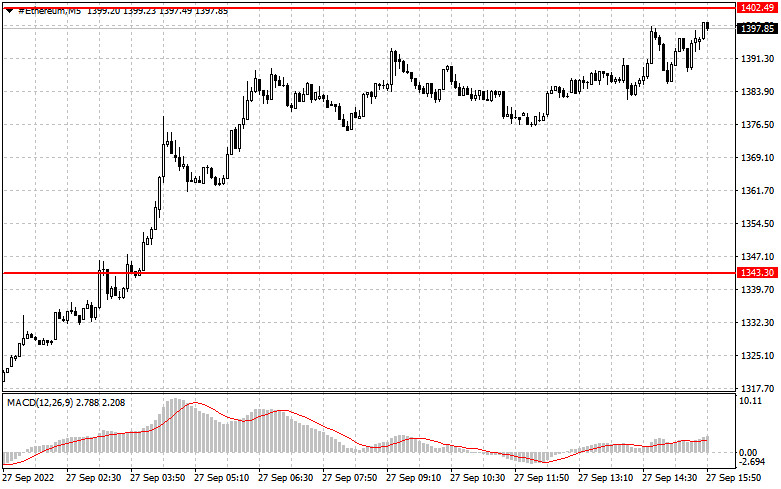

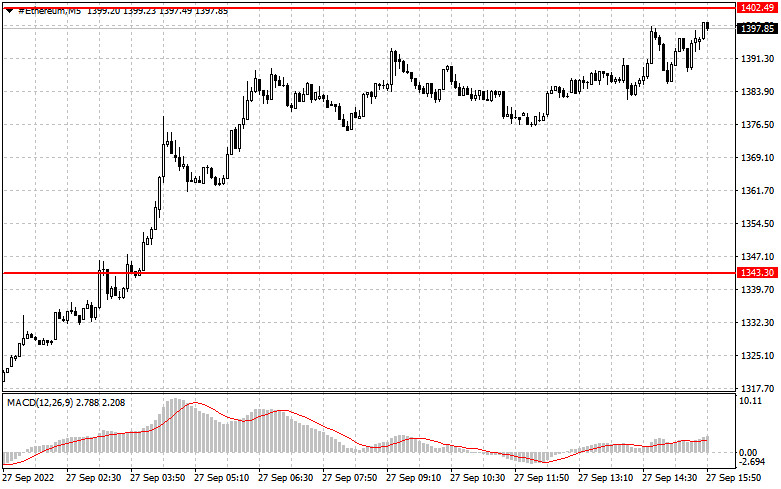

Ether has reached a fairly strong resistance of $ 1,400, the breakdown of which could lead to significant changes in the market. Consolidation above $1,400 will stabilize the market direction and push the ether to another correction in the $1,457 range. The areas of $1,504 and $1,550 will be a further target. While maintaining pressure on the trading instrument, it is important to protect $ 1,343 because, as a result of a breakthrough of this level, we may see a repeated movement of the trading instrument down to the support of $ 1,270. Its breakdown will push the ether to $1,210 and $1,150, where significant players will manifest themselves again in the market.