Euro declined again on Tuesday amid weak macro statistics from the Euro area. But the fall was only brief as dollar bulls were not that active in the market. As such, EUR / USD traded horizontally for the rest of the day.

Contrastingly, pound climbed to monthly highs, thanks to a strong PMI report for the services sector.

But the most noteworthy event was the speech of US President Joe Biden, who again tried to unite the Progressive Democrats with their more moderate counterparts. Biden said he is willing to set spending limits on some of his social programs in order to reduce the total cost of his new spending plan. He agreed to a range of $ 1.9 trillion to 2.2 trillion - up from the originally proposed $ 3.5 trillion. The White House expects that this amount will be able to get the consent of Democrats from the Senate.

Upon knowing this, many began to have a positive opinion over Biden, given that he has been actively involved in recent years to bridge the gap between progressive and moderate Democrats. The stalemate the Democrats are now in jeopardizes the entire package, which covers spending on health initiatives, care for the elderly, children, and tax increases for wealthy Americans and corporations. This puts additional pressure on the stock market, which was not going through the best time in September.

There was also a meeting between House Speaker Nancy Pelosi, Senate Majority Leader Chuck Schumer, economic adviser Brian Dees and domestic policy adviser Susan Rice. An economic package was discussed during the meeting, and according to the latest rumors, progress was made on many issues.

On a different note, St. Louis Fed President James Bullard expressed concern over the sharp rise of inflation this year. He said it could provoke a new pricing psychology as it is clear that both businesses and consumers are gradually getting used to rising prices, which poses significant risks for the economy in 2022. "I am concerned about the changing mentality that consumers and companies have about prices, as well as the relative freedom with which companies can easily shift their additional costs onto customers, "Bullard said. "For many years in the United States, such a maneuver was out of bounds."

Bullard explained that manufacturers know that if prices are raised, they would lose market share, which would then hurt their businesses. Consumers also used to look for places with cheaper goods and services, which created fair and healthy competition. But now, this practice seems to be on the verge of passing.

Latest data indicate that inflation rose by 3.6% in August, and this is without taking into account the volatile category of goods. Bullard also noted that core inflation in 2022 could be well above the Fed's target of 2.0% and rise to 2.8%.

Unsurprisingly, this is one of the reasons why Fed Chairman Jerome Powell recently said that the central bank could begin reducing the monthly bond purchases by $ 120 billion as early as November this year and complete the process by mid-2022. Most likely, by this time, a decision will be made to raise interest rates, but this may happen much earlier if the inflationary spiral begins to unwind with renewed vigor.

In Europe, the IHS Markit reported that final composite PMI fell to 56.2 points in September, from 59.0 points in August. Meanwhile, service PMI decreased to 56.4 points, from 59.0 points in the previous month. "While overall growth is currently relatively stable by historical standards, the economy is entering the last quarter of the year on a slowdown trajectory," the IHS Markit said.

Composite PMI from Germany also posted a decline, reaching only 55.5 points from 60.0 points in August. Service PMI, on the other hand, dropped to 56.2 points.

As for France, composite PMI to 55.3 points, while Italy showed growth.

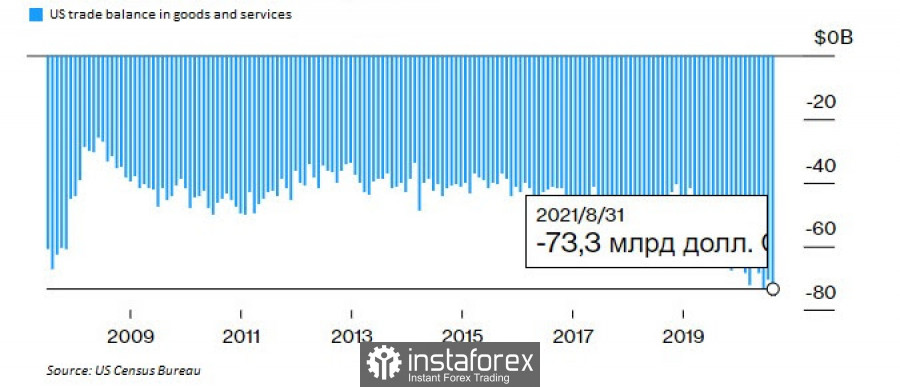

Going back to the US, the Department of Commerce reported that trade deficit rose to a record high in August due to soaring imports of consumer and industrial goods. It jumped 4.2% to $ 73.3 billion, from a revised $ 70.3 billion in July. Growth in imports of goods and services jumped 1.4% to a record $ 287 billion, while exports rose 0.5% to $ 213.7 billion.

On the bright side, service PMI rose to 61.9 points in September, from 61.7 points in August. This shows that the economy is still recovering despite hindering factors.

Talking about EUR/USD, the key task of bullish traders is to protect 1.1625 because going above it will set off a further increase to 1.1660. On the other hand, a drop below the level will result in a plunge to 1.1600, and then to 1.1565.

GBP

Pound managed to hold its ground against the US dollar, thanks to good reports from UK. The IHS Markit reported that service PMI rose to 55.4 points in September, after falling to 55.0 points in August. Composite PMI, on the other hand, hit 54.9 points, from 54.8 in August.

Now, the task of bullish traders is to protect and break through 1.3640 because going above it will lead to a jump to 1.3675 and 1.3760. Meanwhile, a drop below the level will result in a plunge to 1.3570, and then to 1.3530 and 1.3490.