At last week's auction, the British pound showed a rather impressive growth against the US dollar. And this is although the epidemiological situation in the United Kingdom of Great Britain is very difficult. However, it is also possible to characterize the problem of COVID-19 in the United States, where the fourth wave of the insidious epidemic is gaining momentum. If you look at the economic calendar, the price dynamics of GBP/USD may be influenced by statistics from the UK on the consumer price index, the publication of which is scheduled for Wednesday. Bank of England Governor Andrew Bailey is scheduled to speak tomorrow. Regarding today, I recommend paying attention to the data on industrial production in the United States. In the current situation, the main influence on the price dynamics of the trading instrument in question is exerted by the technical picture, which we immediately proceed to consider.

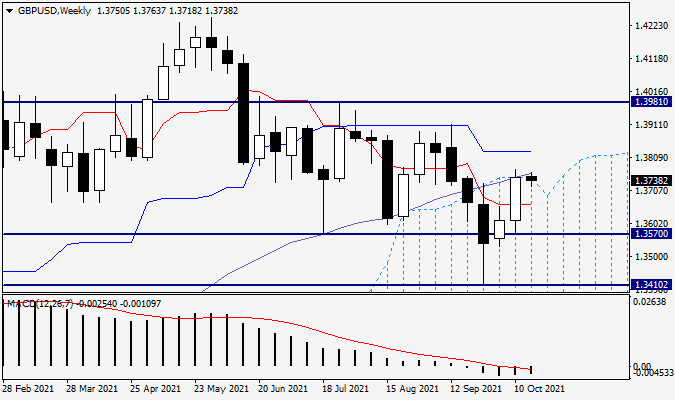

Weekly

As usual, on Mondays, we start with the results of the completed trading week, which means that we begin debriefing with a weekly timeframe. Looking at this chart, we can again note the strong and significant level of 1.3570, which was mentioned more than once in previous articles on this currency pair. I believe that a false breakdown of this mark had the effect of strengthening the exchange rate. So, at last week's auction, the pound/dollar pair rose exactly to the upper border of the weekly Ichimoku indicator cloud and stopped right at the upper border of the Ichimoku cloud, where there is also a 50 simple moving average.

As you can see, the bulls on the pound did not have enough strength to bring the quote up from the cloud and breakthrough 50 MA. Well, this task will be the most important one at the auctions of the current five-day period. If successful, the next goal of the players to increase the exchange rate will be the blue line of the Ichimoku Kijun indicator, which is located at 1.3828. I would venture to assume that the subsequent bullish prospects of this trading instrument will depend on the passage of the Kijun up. In my opinion, the pound bears have more complex tasks at this stage. They need to lower trades below several fairly important technical levels, including 1.3660, 1.3600, and 1.3570. In the case of consolidation below the last mark, we count on the subsequent implementation of the downward scenario for GBP/USD.

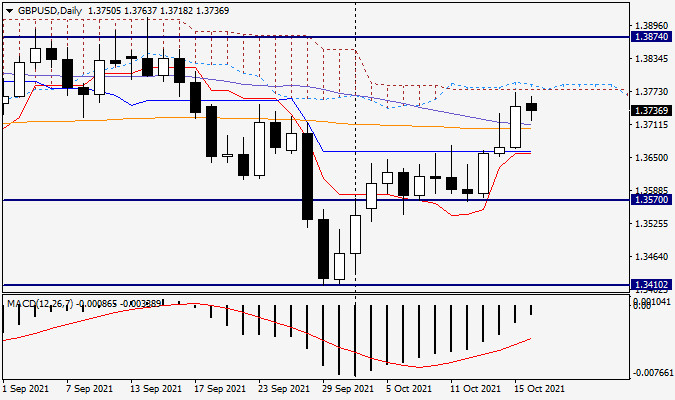

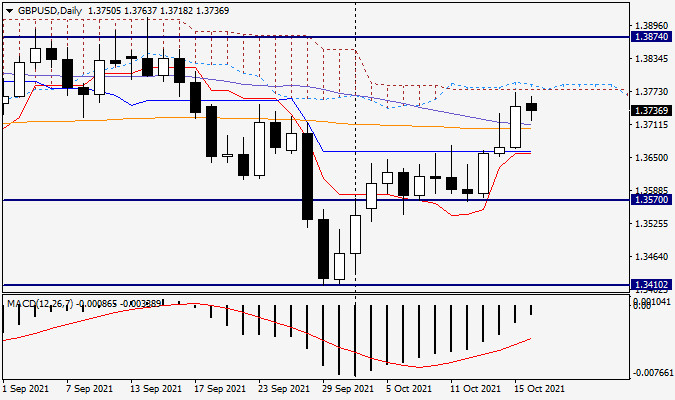

Daily

The daily chart of the pair shows a bullish look, and that's why. After the appearance of the candle for October 14 with a particularly long upper shadow and a small bearish body, it was just right to expect downward dynamics from the quote. However, the bulls found the strength to absorb this candle with growth the next day. It is to break the signal for a decline in the exchange rate. However, as on the weekly timeframe, the pair rested on the border of the Ichimoku indicator cloud, which can resist and push the quote down. Given such an ambiguous picture for GBP/USD, I suggest taking a wait-and-see position and staying out of the market for this instrument for the time being. If the pair comes out of the daily cloud and fixes higher, we will look for options for purchases on the rollback to its broken border. If this does not happen and a bearish candlestick analysis model appears under the cloud boundary, we will already have to prepare for the sales of the "Briton." In more detail, considering the consideration of smaller charts, we will determine the positioning tomorrow. At the moment, I will give more preference to the growth of the quote.