EUR/USD to show growth

Hello, dear colleagues!

Today, when reviewing the main currency pair in the forex market, we will once again outline possible future steps of both the US Federal Reserve and the European Central Bank, look at the macroeconomic calendar, and carry out technical analysis of EUR/USD.

The Federal Reserve, like many other leading central banks in the world, is primarily concerned about inflation hikes triggered by supply-chain disruptions caused by the COVID-19 pandemic. The regulator stopped referring to rising inflation as 'transitory'. Apparently, we will see consumer prices rising for a longer-than-expected period of time. Earlier, Chairman Jerome Powell said inflation would fall to 4-5% by the end of the year. As we can see, it did not happen. So, it seems that the central bank will try to bring inflation under control already in 2022. Anyway, a rapid acceleration of consumer prices continues, urging the Federal Reserve to take more radical and tougher measures and speed up the winddown of the QE program. We will see the US regulator announcing the outcome of the two-day meeting, the last one this year, in a week.

As for its European counterpart, sharp jumps in inflation are urging the ECB to begin tapering earlier. According to the ECB's forecasts, inflation has already reached its peak and inflationary pressure will start to reduce next year. Both of the world's leading central banks have high hopes for 2022 as it will mark the end of the QE and PEPP programs and the start of interest rate hikes.

The eurozone economy advanced 2.2% on quarter and 3.9% on year (above preliminary estimates of 3.7%). In addition, the ZEW Sentiment Index in Germany and the eurozone exceeded market expectations. Job openings will be the only report in the United States worth paying attention to. However, this data is unlikely to somehow affect the market. Therefore, the technical picture will be of more importance to the quote's further movement.

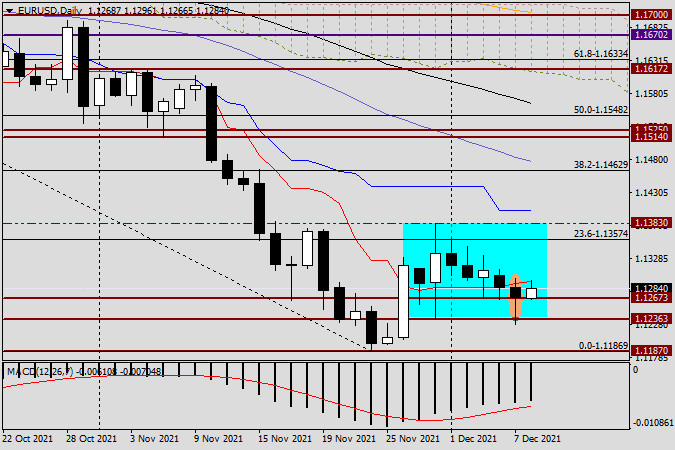

Daily chart

In the previous review, it was assumed that if the euro/dollar pair left the established range on the daily chart, it would become possible to determine the further movement of the price. So, bears pushed the quote down. We can see two false breakouts of support at 1.1267 and 1.1236 on the chart. As a result, a candlestick was formed, with its lower shadow longer than its bearish body. As for me, it is a nice bullish signal, indicating the market's unwillingness to extend the downtrend. Although the pair closed below the red Tenkan-Sen yesterday, the price is rising today. Anyway, the pair has not returned adobe the Tenkan-Sen yet. However, it still has time to settle above it until the close of daily trading. Meanwhile, a breakout and consolidation above the important technical level of 1.1300 are likely to generate a stronger bullish signal.

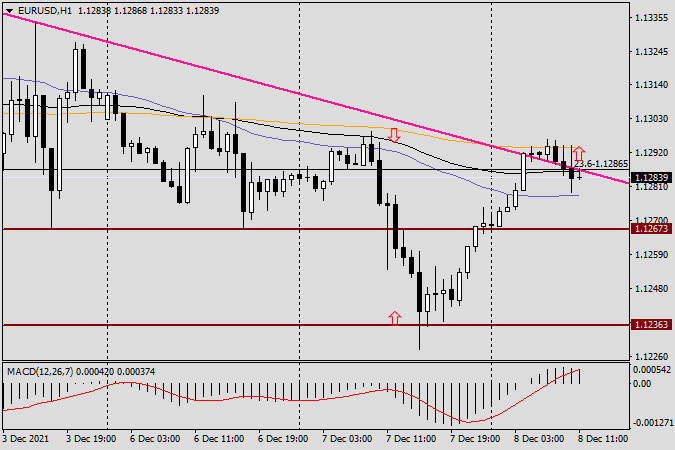

H1 chart

As for the H1 chart, the pair encountered resistance from the pink line drawn in the range between points 1.1383 and 1.1334, as well as the orange EMA (200). Notably, both the resistance line and the EMA (200) pass below the important level of 1.1300. Taking into account yesterday's daily candlestick, the pair is highly likely to be bullish. Traders could try to buy the euro/dollar pair on a pullback to the price range of 1.1300-1.1290 after a breakout of the red line, the EMA (200), and the 1.1300 mark. Meanwhile, to open short positions, the pair should return below the resistance line and settle there after breaking the MA (50) located at 1.1278. Technically, traders may risk buying the euro at the current market price but in a smaller lot size, which could be increased after a true breakout of the 1.1300 mark.

Good luck!