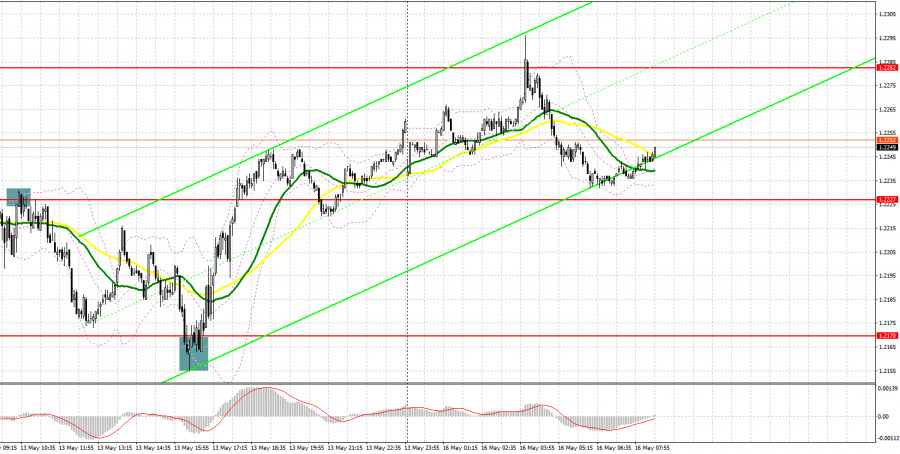

Several profitable market entry signals were formed last Friday. Let's take a look at the 5-minute chart and see what happened. In my morning forecast, I paid attention to the 1.2230 level and advised you to make a decision on entering the market from it. Lack of UK statistics expectedly led to a test of 1.2230, where in the morning I advised you to open short positions, which happened. As a result, the pair dropped more than 40 points, but fell short of the planned support by about 5 points. For this reason, it was not possible to get an entry point into long positions. The technical picture did not change in the afternoon, so I began to wait for a test and a false breakout at 1.2170. A signal for long positions from this level occurred at the time when disappointing US data was released, which led to a sharp jump in the pair with a return to 1.2227 - plus 50 points of profit.

When to go long on GBP/USD:

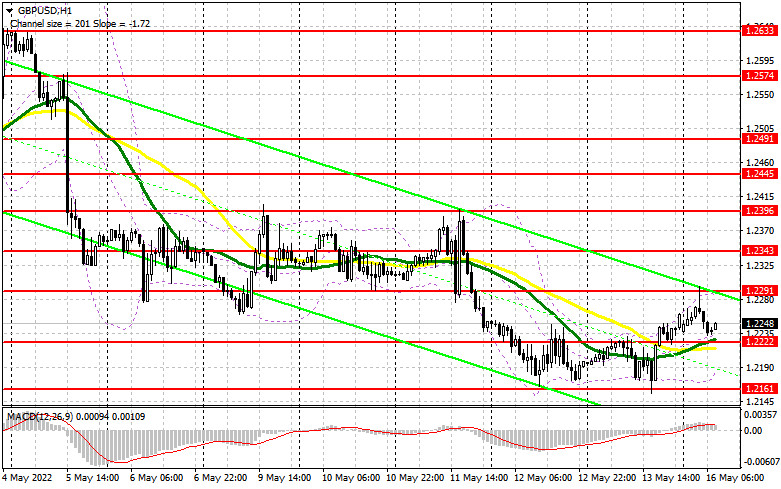

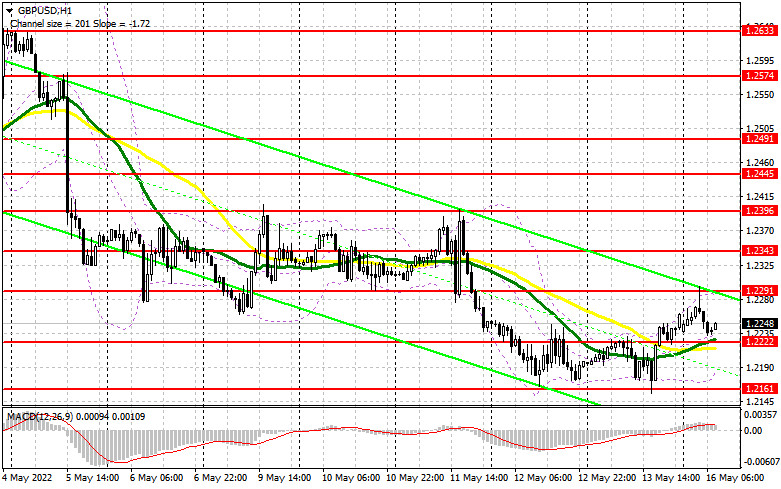

From a technical point of view, practically nothing has changed for the first half of the day today. The nearest support and resistance levels have been corrected. Most likely, today's emphasis will be on the speech of the Bank of England governor, which will take place in the afternoon, so I do not expect any particularly sharp movements of the pound during the European session. I advise you to leave the emphasis on the nearest support at 1.2222, as protecting it will be the main priority. If the pound falls, forming a false breakout there will lead to a signal to open long positions in anticipation of an upward correction and growth to the resistance of 1.2291. We can expect a sharper upsurge, as there will be no bad statistics in the first half of the day today, and the bears may start taking profits before BoE Governor Andrew Bailey's important speech. Consolidating above 1.2291 with a reverse test from top to bottom will lead to a signal for long positions with subsequent movement to the area of 1.2343. I recommend taking profit there. The 1.2396 level will be a more distant target. In case the pound falls further and the bulls are not active at 1.2222, where the moving averages are also playing on the bulls' side, most likely we will see another update of annual lows and a short position to the 1.2161 area. I also advise you to enter the market there only with a false breakout. You can buy GBP/USD immediately on a rebound from the low of 1.2122, or even lower - in the area of 1.2074, counting on a correction of 30-35 points within the day.

When to go short on EUR/USD:

The bears continue to act aggressively and will be active with every good correction in the pound. Protecting nearby resistances remains their top priority. During the Asian session, we observed active short positions in the area of 1.2291, so I advise you to focus on it. Protecting this range will be an important bearish strategy for today. In case the pound sharply rises, forming a false breakout at 1.2291 creates a sell signal in continuation of the bear market. You can also count on a breakdown of 1.2222, which will be quite interesting, since consolidating below this range will cause the bulls to completely lose control over the market. A breakthrough and reverse test from the bottom up of this range will provide a signal to open short positions that can pull the pound to the next low of 1.2161, where I recommend taking profits. A more distant target will be the area of 1.2122. Hopes for the implementation of this scenario is possible only in the afternoon following Bailey's speech and the announcement of the results of parliamentary hearings on monetary policy. In case GBP/USD grows and traders are not active at 1.2291, a new upsurge may occur against the background of dismantling stop orders. In this case, I advise you to postpone short positions until the larger resistance at 1.2343. I also advise you to sell there only in case of a false breakout. You can observe short positions immediately for a rebound from 1.2396, counting on the pair's rebound down by 30-35 points within the day.

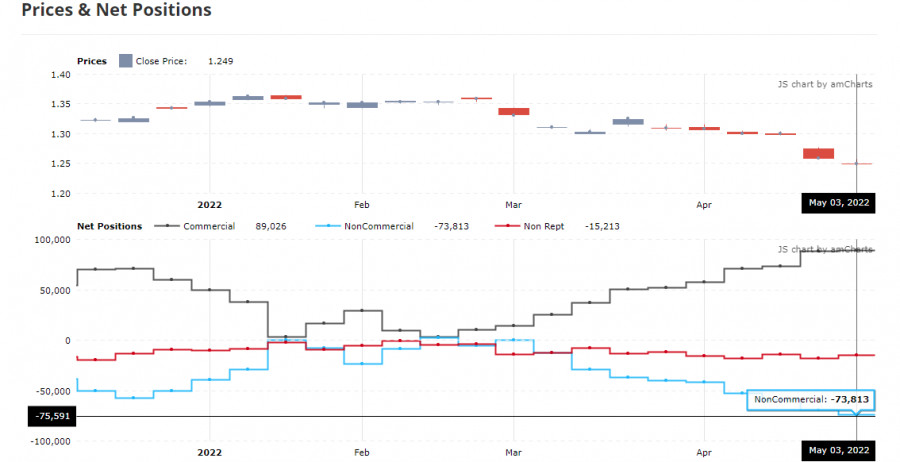

COT report:

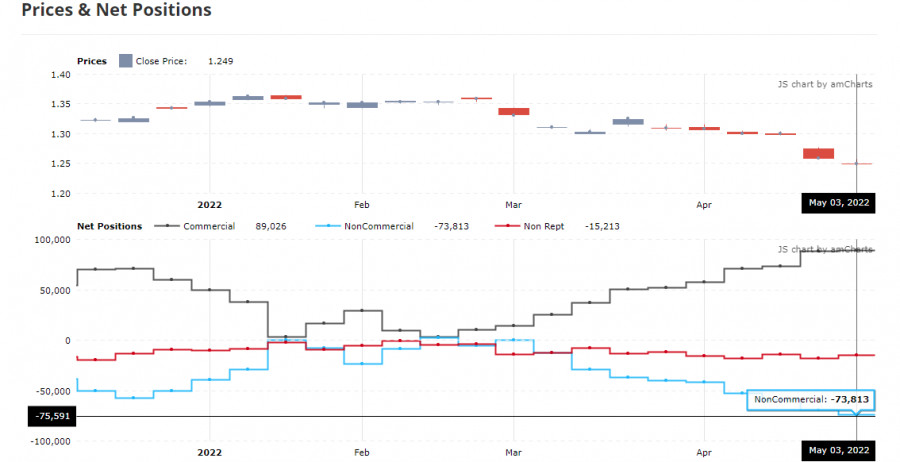

The Commitment of Traders (COT) report for May 3 showed that both short and long positions decreased, but the former turned out to be much smaller, which led to another increase in the negative delta. The fact that the UK economy is doing very badly, and the situation with a sharp increase in the cost of living is not changing for the better, makes investors rather cautious about the pound and what lies ahead for it. The monetary policy of the Federal Reserve, aimed at tightening the cost of borrowing, will continue to support the US dollar, pulling the British pound lower and lower. The only thing we can count on now is a slight decrease in inflationary pressure in the US, which could lead to an upward correction. The Bank of England's recent actions to raise interest rates have not yet brought the desired result, as the policy remains very restrained in the face of high inflationary pressures observed in the UK. Taking into account that recently BoE Governor Andrew Bailey confirmed that the economy is moving towards recession, nothing good can be expected in the near future, just as one should not count on a strong growth from the pound. The situation will only get worse, as future inflationary risks are now quite difficult to assess also due to the difficult geopolitical situation, but it is clear that the consumer price index will continue to rise in the coming months. The situation in the UK labor market, where employers are forced to fight for each employee, offering ever higher wages, is also pushing inflation higher and higher. The COT report for May 3 indicated that long non-commercial positions decreased by 6,900 to 33,536, while short non-commercial positions decreased by only 2,708 to 107,349. This led to an increase in the negative value of the non-commercial net position from -69 621 to -73,813. The weekly closing price fell from 1.2587 to 1.2490.

Indicator signals:

Trading is above the 30 and 50-day moving averages, which indicates an attempt by the bulls to build a correction.Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the upper border of the indicator around 1.2291 will act as resistance. In case of a decline, the lower border of the indicator around 1.2175 will act as support.

Description of indicators:

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.