According to the hourly chart, the GBP/USD pair continued to fall on Friday and secured under the corrective level of 523.6% (1.2146). On Monday, the fall of the British dollar continues in the direction of the level of 1.1933. Thus, in the same two days, the UK currency lost all the advantages it had worked so hard to achieve on Wednesday, when the report on American inflation was released. For the first time in a long time, inflation began to decline, due to which many traders and analysts concluded that now it would decrease constantly, and the Fed no longer made sense to tighten the PEPP by leaps and bounds. From my point of view, such a judgment is fundamentally wrong since this is just one inflation report. No one can be sure that the next one will be as positive. Moreover, several FOMC representatives said last week that the rate will still rise until the regulator is convinced that the trajectory of inflation has formed downward.

In the UK, the situation can be said to be worse. If lawmakers and economists in America deny the existence of a recession, then in the UK, the governor of the Bank of England, Andrew Bailey, said that a recession is inevitable and will be the longest and most serious in the last 10-20 years. It will last at least five blocks. However, statistics so far suggest the opposite. In Britain, GDP declined by only 0.1% in the second quarter, and in the United States, it has been falling for two consecutive quarters and by much higher values.

Nevertheless, the US dollar is growing again. From my point of view, all this talk about the recession does not particularly affect the mood of traders. If they had been influenced, then now the British and European would continue to grow since it is in the European Union and Britain that the probability of a recession is lower. At least because the rates there are increasing more slowly. In the European Union, we can say they do not grow at all. This question is multifaceted because now it is unclear what can be called a recession. If, for example, the economy shrinks for two consecutive quarters, is it a recession? In America, they think not. And in the UK, they believe that a recession is inevitable even when GDP has not begun to decline.

On the 4-hour chart, the pair performed a rebound from the corrective level of 127.2% (1.2250) and a reversal in favor of the US currency. Thus, the fall continues in the direction of the 1.1980 level. Emerging divergences are not observed in any indicator today. The rebound of quotes from the level of 1.1980 will work in favor of the British, and some growth in the direction of the level of 1.2250 and closing at 1.1980 will increase the likelihood of a further decline in the direction of the next Fibo level of 161.8% (1.1709).

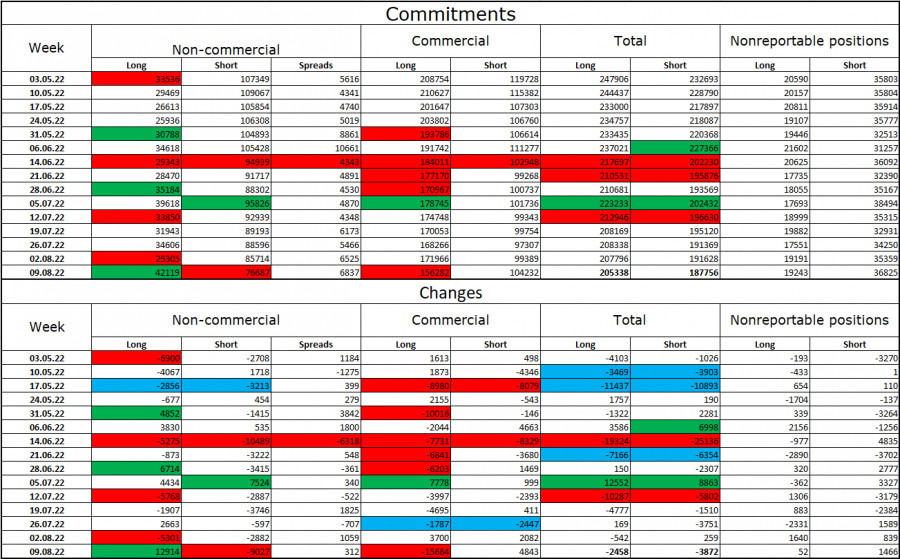

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has become much less "bearish" over the past week. The number of long contracts in the hands of speculators increased by 12914 units, and the number of short contracts decreased by 9027. Thus, the general mood of the major players remained the same – "bearish," and the number of short contracts still exceeds the number of long contracts, but much less than before. The big players stay in the pound sales for the most part, and their mood is gradually changing toward "bullish," but it is still a very long time before this process is completed. The pound has shown weak growth in recent weeks, and COT reports so far make it clear that the British pound will resume its decline rather than start a long upward trend.

News calendar for the USA and the UK:

On Monday, the calendars of economic events in the UK and the US are empty. Thus, the influence of the information background on the mood of traders will be absent on Monday.

GBP/USD forecast and recommendations to traders:

I recommended new sales of the British when rebounding from the level of 1.2250 on the 4-hour chart with a target of 1.1980. Now they can continue to be kept. I recommend buying the British when rebounding from the 1.1980 level on the 4-hour chart with a target of 1.2250.