While bitcoin and ether are trying to demonstrate at least some volatility, Bradesco, one of the largest banks in Brazil, said that it does not plan to enter the cryptocurrency market in the near future. In an interview, Bradesco CEO Octavio de Lazari Junior noted that the company is currently not interested in launching crypto services for its customers, given that the cryptocurrency market is very small.

It is worth noting that many private banks have recently been launching crypto-investment services as part of their portfolio so that customers can use them. Others, such as Bradesco, which, for a moment, is the second largest bank by assets in Brazil and Latin America with more than 70 million customers, are still not interested in the cryptocurrency market.

According to the CEO of Bradesco, such investments in cryptocurrencies will continue to develop in the country. However, this market is still too small for the banking sector and has dangerous characteristics for investors. "Cryptocurrencies are intangible and more risky investments, and people are aware of the risk they are taking. For me, this is a very small market." And not surprisingly, there is some truth in his statements. Large institutional players still have nothing to do in the cryptocurrency market, which is represented quite narrowly. Also, large volumes and high-risk investments will continue to scare away many prospective players in the new industry.

However, Octavio de Lazari Junior noted that although the company does not plan to enter the cryptocurrency market today, everything may change in the future. He also added that if any of his clients want to engage in cryptocurrency trading, they can do so through a separate investment unit.

As for digital currencies, the bank is currently engaged in debt tokenization projects. Another pillar of the crypto market is the integrated digital currencies of the central bank (CBDC). Brazil is already developing a digital actual pilot project. Its model will include the possibility for private banks to issue stablecoins backed by deposits in the central bank's digital currency.

Since last year, when the special activity began, central banks worldwide have begun to explore the benefits of CBDC. Some of them, for example, China and Nigeria, have already introduced digital currencies inside their countries. The European Central Bank is still in the middle of an experiment with the digital euro, which is due to end in October 2023. However, the bank's public announcement about the digital euro has been repeatedly criticized for its perceived dangers and risks.If we return to the real market and set aside the future, the further direction of bitcoin will depend directly on what the Fed representatives say. The statements of Fed Chairman Jerome Powell will have special weight, affecting not only the stock market but also the cryptocurrency market.

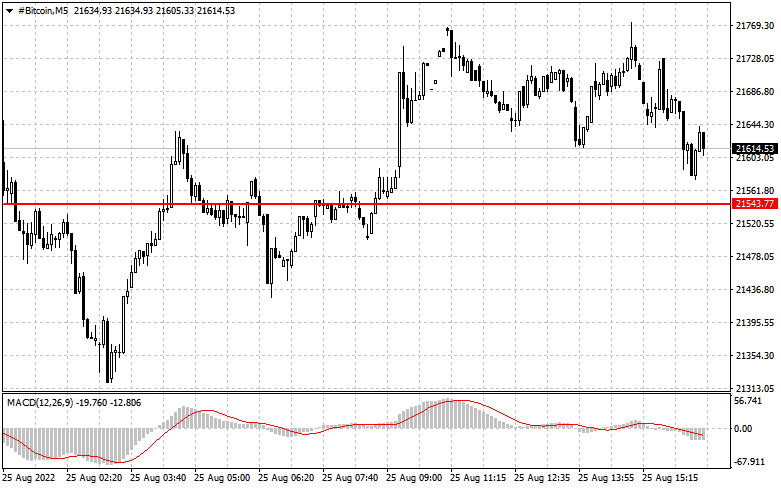

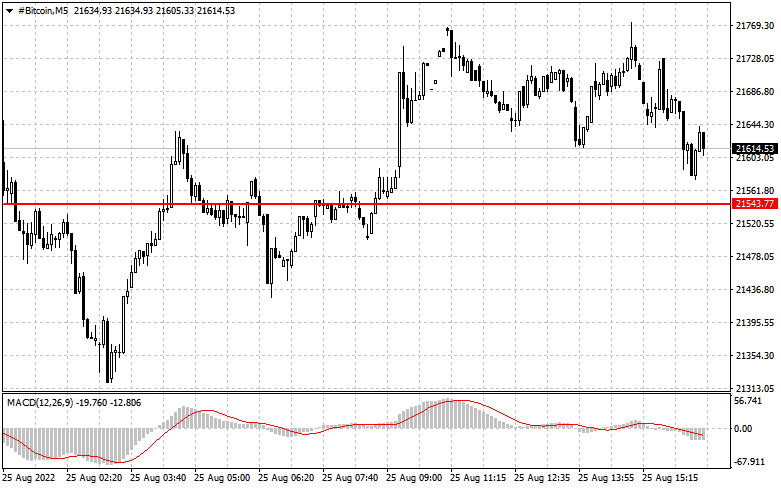

Bitcoin buyers again tried to go back to the $21,600 level, but so far, it has not been possible to gain a foothold above this range. Most likely, the pressure on the trading instrument will continue to increase as investors abandon risk. The bulls' focus is now on the nearest support of $20,800, a fall to which for the third time could be fatal for the bulls. In the event of a breakthrough in this area, the $19,966 level will play an equally significant role. Its breakdown will send the trading instrument back to the lows of $19,232 and $18,600. To return the demand for bitcoin, dovish statements by American politicians and consolidation above the $21,650 level are needed. To build an upward trend, you must break above the resistance levels of $22,180 and $22,670. Fixing this range will give a real prospect of returning to the highs: $23,180 and $23,680.

Ether has been recovering much more actively lately, but this growth can hardly be called directional. Yes, the technical prerequisites for the continuation of the bear market are broken, but much will also depend on the statements of the Fed representatives. In the event of a decline, ether buyers have every chance of missing the nearest support of $1,670. In this case, there will be a change in the market direction with a return to the level of $ 1,605. The area of $1,548 will be a more distant target. With the continued demand for the trading instrument, buyers will likely show themselves around $1,743. A breakdown of this level will quickly push the ether to a maximum of $1,819 with the prospect of an update of $1,885.