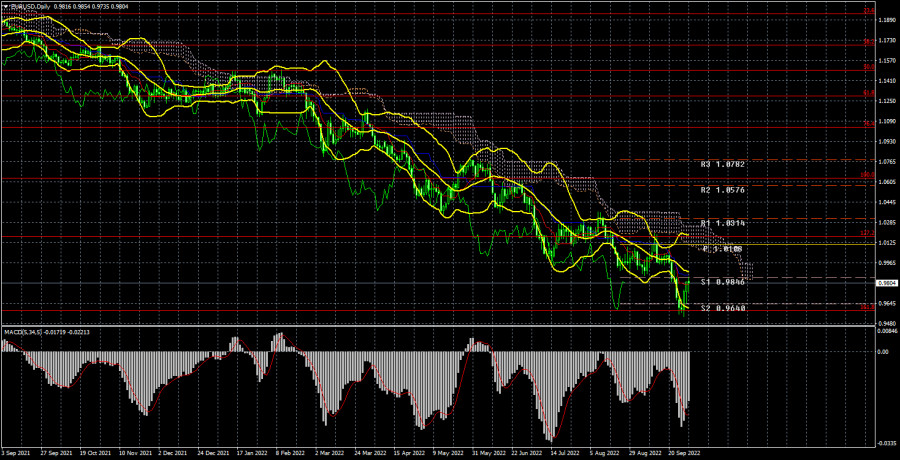

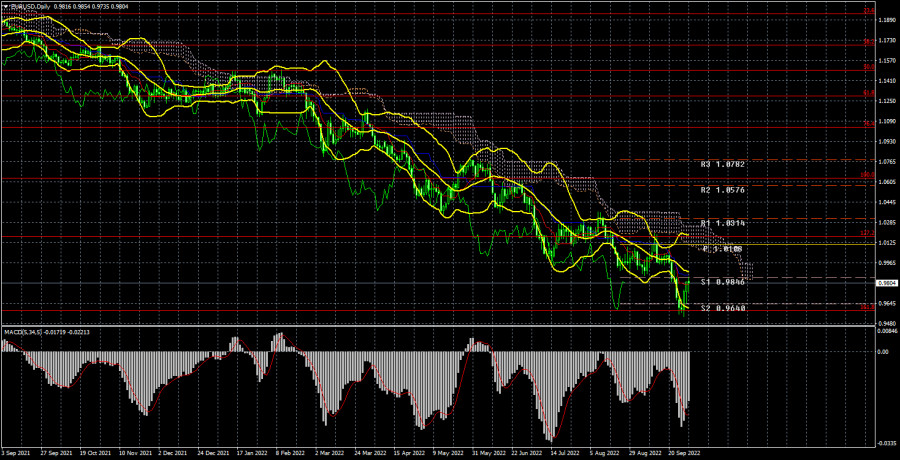

Long-term perspective.

The EUR/USD currency pair has increased by 130 points during the current week. Throughout this week, many experts have been saying that the downward trend is now over, and the euro has nowhere to fall further. Buy signals began to appear on the lower TF. We also assumed that the euro and the pound could complete their long-term decline. First, such assumptions were caused by a rather sharp and strong pullback from the week's lows. However, now is the time to look at the 24-hour timeframe and draw conclusions. And what do we see on this graph? The fact that the euro currency has not yet crawled even to the critical Kijun-sen line. The growth of the European currency was observed for only two days. From our point of view, this is too little to talk about a trend reversal. The pair very accurately worked out the 161.8% Fibonacci level, from which the rebound followed. Thus, this may be another technical correction. We remember that within the framework of the entire downward trend, the euro currency has almost never managed to adjust by more than 400 points. At the moment, the price has been adjusted by 300 points. Therefore, from a technical point of view, we are still dealing only with a banal rollback, which has been quite a lot over the past year and a half. And each time, the downward trend resumed. The fundamental background remains the same as when the euro was desperately falling. That is, there are no fundamental grounds for any drastic changes.

Geopolitics has deteriorated significantly over the past two weeks. We all remember the decision to mobilize in Russia, which led to the rapid end of the military conflict in Ukraine. We have all repeatedly heard the statements of some nuclear states' top officials about their readiness to press the "red button" if necessary. On Friday, it was decided to annex four Ukrainian regions to Russia. Kyiv, the West, and NATO said that this does not change the goals and objectives of the Armed Forces of Ukraine to liberate the occupied lands in any way. The news about undermining the Nord Stream-1 and Nord Stream-2 pipelines. We believe that the fall of risky currencies may well resume.

COT analysis.

COT reports on the euro currency in 2022 can be entered into the textbook. For half of the year, they showed a frank "bullish" mood of professional players, but at the same time, the European currency was steadily falling. Then, for several months, they showed a "bearish" mood, and the euro currency also steadily fell. The net position of non-profit traders is bullish again, and the euro continues to fall. This happens, as we have already said, because the US dollar's demand remains high. Therefore, even if the demand for the euro currency is growing, the high demand for the dollar does not allow the euro currency itself to grow. During the reporting week, the number of buy-contracts from the non-commercial group increased by 2 thousand, and the number of shorts decreased by 1.8 thousand. Accordingly, the net position increased by about 0.2 thousand contracts. This is very small, which does not matter much since the euro remains "at the bottom" anyway. Professional traders still prefer the euro to the dollar at this time. The number of buy contracts is 34 thousand higher than the number of sell contracts for non-profit traders, but the European currency cannot extract any dividends from this. Thus, the net position of the "Non-commercial" group can continue to grow, and it does not change anything. Even if you pay attention to the total number of buy and sell positions, their values are approximately the same, but the euro still falls. Thus, we need to wait for changes in the geopolitical and fundamental background.

Analysis of fundamental events.

There were practically no macroeconomic statistics in the European Union this week. It was only on Friday that the inflation report was published. Inflation has already risen to 10%, which, on the one hand, increases the likelihood of a further increase in the ECB rate, and on the other hand, does not change absolutely anything. Recall that ECB President Christine Lagarde spoke three times at the beginning of the week, and each time assured that the regulator would continue to tighten monetary policy at a high pace at the next few meetings. Consequently, in any case, it was about a further increase in the rate. This information could have supported the euro currency but did not support it. The euro grew on purely technical grounds. And if so, then next week, the pair may rush down again.

Trading plan for the week of October 3-7:

1) In the 24-hour timeframe, the pair continues to move south. Almost all factors still support the long-term growth of the US dollar, although euro support factors are beginning to appear. The price is below the Ichimoku cloud and the critical line, so purchases are not relevant now. To do this, you must wait for consolidation above the Senkou Span B line and only consider long positions.

2) The sales of the euro/dollar pair are still more relevant now. The price is located below the critical line, so we expect the fall to resume with a target below the 0.9582 level (161.8% Fibonacci). In the long term, if the fundamental background for the euro currency does not improve and geopolitics continues to deteriorate, the euro currency may fall even lower.

Explanations of the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels – targets when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts is the net position size of each category of traders.

Indicator 2 on the COT charts is the net position size for the "Non-commercial" group.