GBP/USD

Short analysis

An upward wave determines the trend of the significant British pound sterling. You can categorize the scale as a weekly TF thanks to the wave level of this section. The quotes are close to a significant potential reversal zone. The upper boundary of the zone was made accessible by the price's push through the intermediate resistance.

Forecast for the coming week:

There is a good chance that the levels of the settlement support zone will move "sideways" at the start of the upcoming week. Its lower border could be punctured for a brief period. By the end of the week, volatility should rise, and movement should resume in an upward direction.

Potential zones for reversals

Resistance:

- 1.2590/1.2640

Support:

- 1.2160/1.1730

Recommendations

Sales: are risky and have little potential.

Purchases: They can be advised for short-term fractional lot transactions after the appearance of reversal signals in the support area.

AUD/USD

Short analysis

The main Australian dollar pair's weekly scale chart reveals a downward trend. The trend's final section is corrected by the ascending segment that began in mid-October. This movement's framework is nearly complete. The price is getting close to the lower boundary of the initial target zone.

Forecast for the coming week:

The quotes for the pair are anticipated to progressively move toward the estimated resistance area for the upcoming week. It is anticipated that fluctuations will have a flat nature. A brief decline, no deeper than the support zone, is not ruled out over the next few days. Closer to the weekend, an active growth phase is probably underway.

Potential zones for reversals

Resistance:

- 0.6950/0.7000

Support:

- 0.6710/0.6660

Recommendations

Selling is premature if done before the current wave has finished.

Purchases: After your vehicle's corresponding signals appear, make a smaller purchase from the support zone. The resistance zone restricts the potential.

USD/CHF

Short analysis

Since mid-May, a wave structure that is currently incomplete has been reported in the shape of a descending plane. The wave structure transitions to its final stage. The wave appears to be finished, but the chart shows no signs of an impending course change.

Forecast for the coming week:

You can anticipate a continuation of the price decline up to the calculated support after the likely pressure on the resistance zone on the pair's chart. Its boundary follows the upper edge of the entire current wave's preliminary target zone.

Potential zones for reversals

Resistance:

- 0.9450/0.9500

Support:

- 0.9250/0.9200

Recommendations

Purchases: In the upcoming days, there won't be any restrictions on these transactions.

Sales: After the corresponding signals appear, you can conduct trade transactions using your vehicles. The closest support constrains the potential.

EUR/JPY

Short analysis

The current ascending chart for the euro/yen, dated September 26, shows an unfinished wave construction. The rollback of the previous section was below the level of the downward correction that started in the middle of October, and it continued to grow. Quotes are getting close to the top of a strong potential reversal zone. There are no signs of a sudden course change.

Forecast for the coming week:

The pair's price will continue to decline smoothly over the next few days, up to the limits of settlement support. Following that, we can watch for the development of a reversal and the continuation of the movement's bullish attitude. Nearer to the weekend is when there is the most activity.

Potential zones for reversals

Resistance:

- 142.70/143.20

Support:

- 140.00/139.50

Recommendations

It is premature to make purchases before the current wave is finished.

Sales: Fractional lots may be used during different sessions. Deals should be closed as soon as a reversal signal appears.

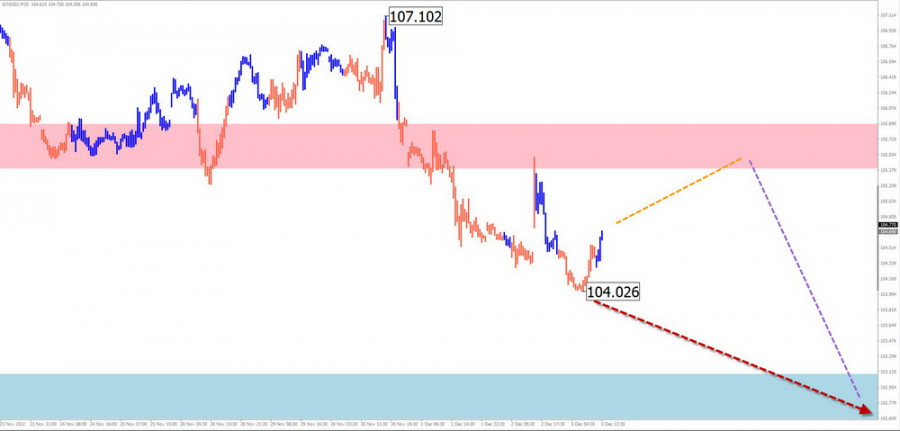

US Dollar Index

Short analysis

The US dollar index's weekly scale depicts an unfinished downward wave that began on September 26. After a brief correction, its scale was higher than D1 TF. Quotes have surpassed the lateral support. The road leading down to the following possible U-turn area is open.

Forecast for the coming week:

We anticipate the US dollar losing ground to other global currencies over the upcoming week. The swing downward limits the calculated support, so the trend is only temporary.

Potential zones for reversals

Resistance:

- 105.40/105.90

Support:

- 103.10/102.60

Recommendations

No restrictions are in place for selling national currencies in the upcoming week.

Purchases: Over the next few days, it might be profitable to make trades that strengthen other currencies against the US dollar.

Reasons: In simplified wave analysis (UVA), each wave has three components (A-B-C). The final, incomplete wave is examined at each TF. The dotted line depicts the predicted movements.

Be aware that the wave algorithm needs to account for how long the instruments' movements in time last!