Analysis of previous deals:

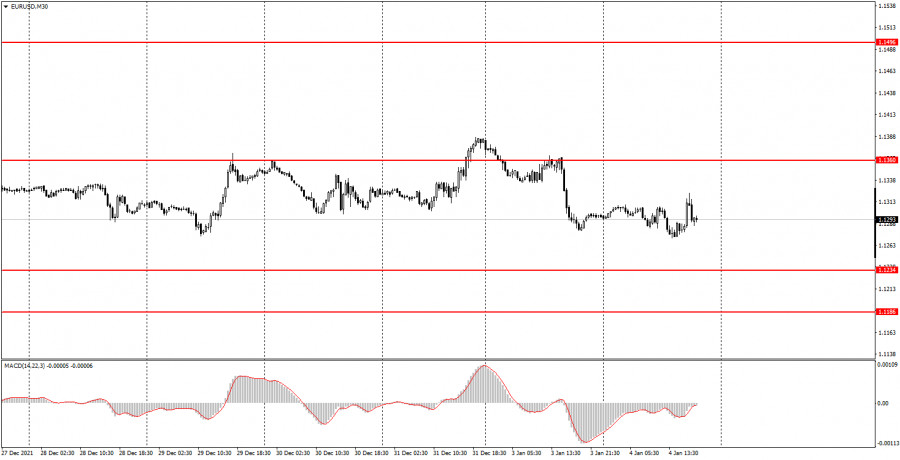

30M chart of the EUR/USD pair

The EUR/USD pair continued to remain inside the horizontal channel, limited by the levels of 1.1234 and 1.1360. Thus, if we delete a short period of time at the very end of December 31 and a short period of time on January 3, that is, at the junction of two years, it turns out that the pair did not leave the horizontal channel. Consequently, it has been trading in it for over a month now. Hence, nothing has changed at the end of 2021 and at the beginning of 2022. You can still use the levels 1.1234 and 1.1360 as signal sources, but the price rarely approaches them, not every day. Therefore, we have to admit that there is no trend now, so trading the pair is, in principle, not very convenient. As for the macroeconomic background, novice traders could pay attention to only one report today - the ISM index in the US manufacturing sector for December. Its value decreased from 61.1 points to 58.7 points. And you could see on the 5-minute timeframe that the US dollar fell against the euro after this report was published, but in general, this report did not bring any serious damage to the US currency.

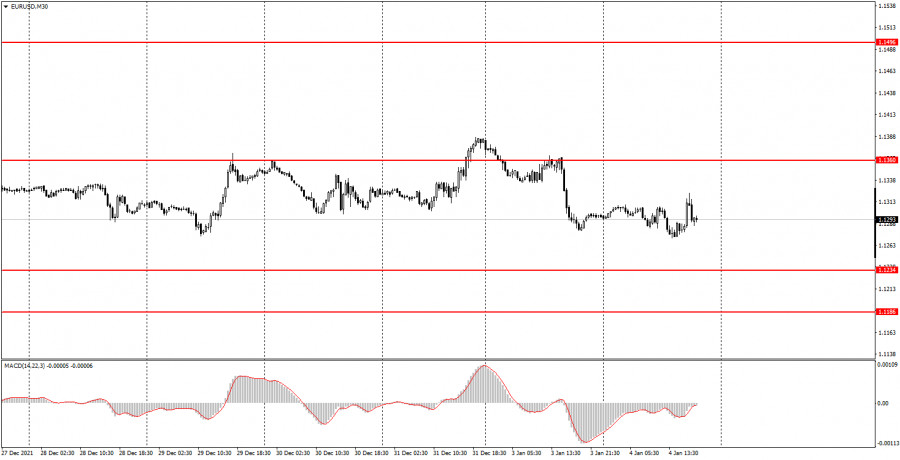

5M chart of the EUR/USD pair

The movement on the 5-minute timeframe does not look the best today. There is no such trend, but several trading signals were still formed during the day, which were able to bring profit to novice traders. The first signal - to sell - was formed near the level of 1.1304. According to it, novice traders had to open short positions. After its formation, the price went down 14 points and returned to the level of 1.1304 in order to bounce off it again and form another sell signal. Thus, all this time it was necessary to stay in short positions. On the second try, the price still reached the level of 1.1274 and bounced off it. Therefore, one should close short positions (profit 15-18 points) near this level and open long ones. After the formation of a buy signal, the price went up 40 points, which was enough for any Take Profit. In addition, novice traders could manually close long positions when the price dropped below 1.1304. In any case, the second trade made a profit, just like the first.

How to trade on Wednesday:

The sideways trend still persists on the 30-minute timeframe, although the pair had every chance of completing it. However, the price still remains between the levels of 1.1234 and 1.1360, so there is still no trend now, and it is extremely difficult to trade on the current TF right now. There are many more levels on the 5-minute timeframe, and many of them are located close to each other, so they should be considered as areas of support or resistance. Tomorrow we recommend trading at the levels of 1.1227-1.1234, 1.1262-1.1274, 1.1304, 1.1324-1.1335. Recall that for any trade, you should set Take Profit 30-40 points and Stop Loss at breakeven after passing 15 points in the right direction. The deal can also be closed manually near important levels or after the formation of an opposite signal. As for tomorrow's fundamental events and macroeconomic statistics, we can only single out the ADP report on the change in the number of employees in the US private sector, as well as the minutes from the last Federal Reserve meeting. These events may provoke a reaction, but the Fed minutes will be published very late, so you should leave the market before it.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.