EUR/USD

Analysis:

The direction of intraday price movements of the European currency is set by the bullish wave algorithm from November 24 last year. The structure of the wave has a pronounced flat character. So far, it doesn't look complete. After contact with the lower border of the reversal zone, the price rolled back down.

Outlook:

Today we expect the completion of the decline, a reversal, and a resumption of price growth. The expected range of the daily course is indicated by the calculated zones. When changing the course, a short-term puncture of the lower support boundary cannot be excluded.

Potential reversal zones

Resistance:

- 1.1470/1.1500

Support:

- 1.1400/1.1370

Recommendations:

Prior to the appearance of confirmed buy signals in the support zone, trading transactions in the euro market are not recommended today.

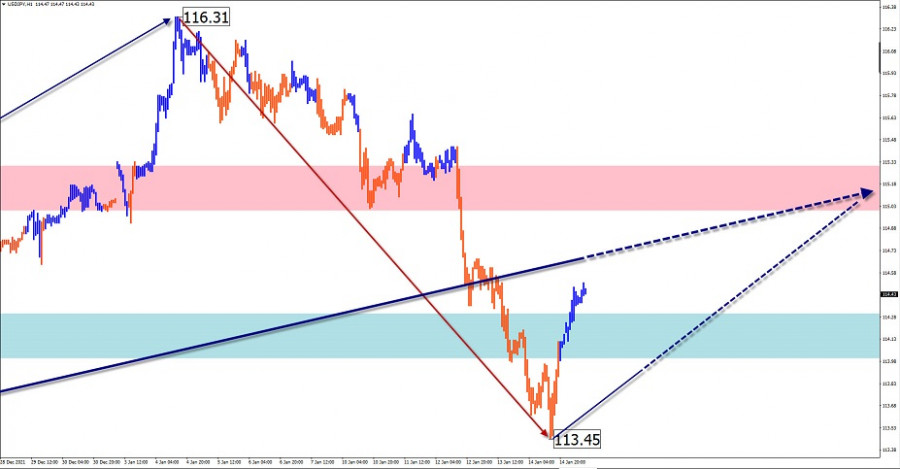

USD/JPY

Analysis:

The market is dominated by a bullish trend. Its unfinished section has been counting down since November 30 last year. In the last two weeks, the price has been rolling down from strong resistance, forming the middle part of the wave (B). The ascending section that started at the end of last week has a reversal potential. When it is confirmed, the final part of the current wave will begin.

Outlook:

In the coming days, a general upward vector of movement from support to the calculated resistance zone is expected. Today, a break of the upper boundary of this zone is possible, but unlikely.

Potential reversal zones

Resistance:

- 115.00/115.30

Support:

- 114.30/114.00

Recommendations:

In the next trading sessions on the USD/JPY pair, intraday purchases are recommended. Profit-taking is optimally done in the area of the calculated resistance.

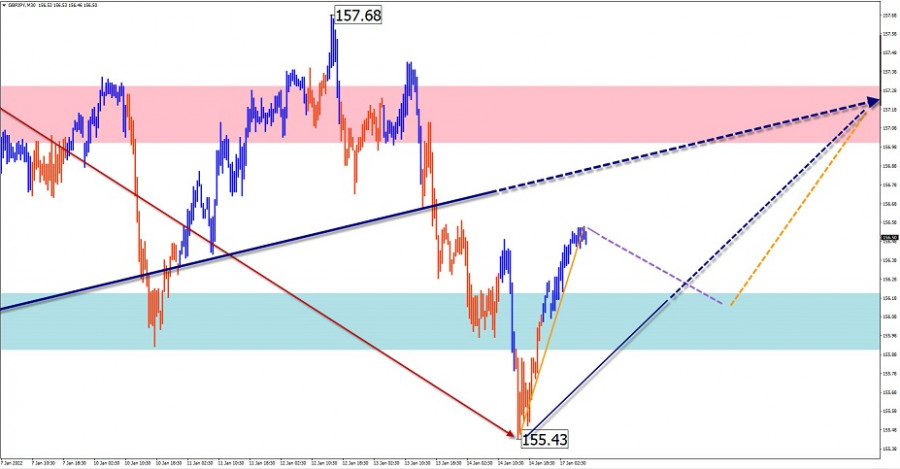

GBP/JPY

Analysis:

As part of the dominant bullish trend at the end of November last year, a corrective shifting plane ended on the chart of the pound/yen cross pair. Over the past month and a half, price quotes have reached the lower limit of strong resistance. In the last decade, the price of the pair rolls back down.

Outlook:

Today, a flat price movement is expected, with a general upward vector. At the next session, a short-term decline to the support area is not ruled out. The active growth phase is more likely at the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 157.00/158.30

Support:

- 156.20/155.90

Recommendations:

There are no conditions for sales on the cross market today. It is recommended to track the buy signals of your trading systems in the area of the calculated support zone.

GOLD

Analysis:

Despite the general flat nature of its movement, an upward wave has been setting the trend direction on the gold chart since last year. Its unfinished section started in November. The structure of this wave has entered the final phase of formation. Since the end of last week, the price has been rolling back in a sideways channel along the support zone of a large TF.

Outlook:

In the next 24 hours, we can expect the completion of the sideways movement, the formation of a reversal, and the resumption of growth in the instrument's quotes.

Potential reversal zones

Resistance:

- 1835.0/1840.0

Support:

- 1810.0/1805.0

Recommendations:

There are no conditions for selling on the gold market today. It is recommended to refrain from entering the market until confirmed buy signals appear in the area of the support zone.

Explanation: In simplified wave analysis (SWA), waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed. The solid arrow background shows the structure formed. The dotted arrow shows the expected movements.

Attention: The wave algorithm does not take into account the duration of the instrument movements over time!