The euro-dollar pair tested the third figure again today, reaching 1.0383 (a two-week price low). The dollar rose across the market after Federal Reserve Chairman Jerome Powell's speech from yesterday and ahead of today's inflationary release. However, the published report on the growth of the base price index for personal consumption expenditures (PCE) did not allow the EUR/USD bears to build on the success. The indicators came out in the red zone, falling short of the forecast levels. Bears were forced to retreat from the lows reached.

Here it is necessary to take into account that the bears are now facing a daunting task: they need not only to overcome the 5-year price low (1.0340), but also to cope with the 20-year lows at the bottom of the third figure. For such a downward breakthrough, an appropriate informational occasion is needed, which would allow traders to overcome powerful price barriers. While in recent days and weeks the signals are very contradictory. On the one hand, the current fundamental picture allows the dollar to be "afloat" and dominate in almost all pairs of the "major group". On the other hand, the greenback against the euro is unable to organize a large-scale attack to the downside, although the EUR/USD bears have repeatedly made attempts to reach the 1.0340 mark over the past few weeks.

In my opinion, this stalemate is due to the fact that market expectations are constantly "one step ahead" of real and objective circumstances. For example, after a record increase in US inflation in May, the euro-dollar pair appeared in the area of the 3rd figure, amid increased hawkish expectations. If prior to the inflation report the consensus forecast of the Fed rate hike was at the level of 50 points, then after this release the market already clearly allowed a 75-point increase. The Fed did raise the interest rate by 75 points at once, but did not voice the "ultra-hawkish" scenario of further actions. On the contrary, the central bank admitted that the rate could be raised by 50 points at the next meeting (as in September). At the same time, in order to continue the dollar rally, traders needed a more powerful boost, which would allow the EUR/USD bears not only to approach the support level of 1.0340, but also to drop impulsively to the bottom of the 3rd price level.

Powell rather cautiously announced plans for further prospects for a rate hike. During his speech in Congress, the head of the Fed actually "tied" the pace of monetary policy tightening to the dynamics of inflationary growth. Obviously, if inflation slows down in June, the pendulum will swing towards a 50-point rate hike at the July meeting. As for the September prospects, here Powell prefers to keep the intrigue at all, obviously hoping that by this time the effect of the previously taken measures will be noticeable.

Amid such cautious rhetoric, dollar bulls were forced to retreat, content only with the general hawkish mood of the Fed. Speaking directly about the EUR/USD pair, a kind of "window of opportunity" has formed here: when the dollar strengthens its positions, the price decreases to the range of 1.0370-1.0450, while when the greenback weakens, the pair changes the price level, trading within 1 .0450-1.0600. Looking at the weekly EUR/USD chart, we can see that the price has been "walking" within the 200-point range since the beginning of June, demonstrating a wavy trajectory.

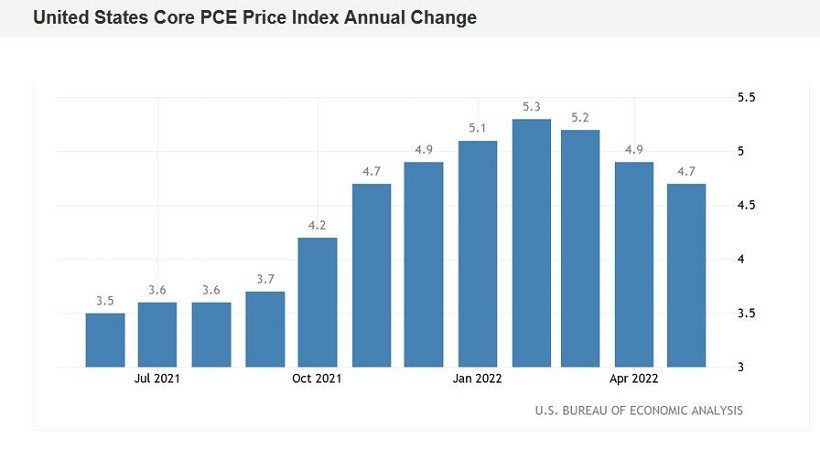

Today's inflation report on the growth of PCE offset the ambitions of EUR/USD bears to conquer the 5-year price low (1.0340). The release reflected the slowdown in the growth of this most important inflation indicator for the Fed. Moreover, now we can talk about the current trend. On an annualized basis, the core price index for personal consumption expenditures has been declining for the third consecutive month. The March result - 5.3% - turned out to be the peak, after which the indicator began to slowly slide down, reaching 4.7% at the moment.

The report plays an important role, especially amid Powell's hesitation, who recently announced that at the July meeting, the Fed will decide whether to raise the rate by 50 basis points or increase it again by 75 basis points.

After the release of the report on the growth of PCE, the EUR/USD pair rose by 100 points, updating the daily high at around 1.0480. It is likely that today the pair will fluctuate within the 4th figure, ahead of tomorrow's release. The fact is that an equally important inflation report will be published on Friday, which will reflect the growth dynamics of the consumer price index in the eurozone. European Central Bank President Christine Lagarde also tied the pace of monetary tightening to inflationary indicators, so tomorrow's numbers may provoke volatility.

Moreover, certain alarming signals have already been sounded: according to the latest data, German inflation indicators unexpectedly slowed down their growth (the harmonized CPI in monthly terms even fell into the negative area for the first time since January 2021). Given this "preview", traders are in no hurry to open large positions on the pair, neither in favor of the upside nor the downside. If European inflation shows the first signs of a slowdown, the pair may return to the area of the 3rd figure. Otherwise, the price will consolidate in the fifth figure, that is, it will actually return to the range of 1.0450-1.0600.

In conditions of such uncertainty, it is very risky to open trading orders for the pair - at the moment it is advisable to take a wait-and-see position.