Hello!

Japan, like most countries in the world, is treating the COVID-19 pandemic very seriously and cautiously. For example, Japanese Prime Minister Kishida has advocated reducing the time between the first vaccination and the re-vaccination, the gap between which is currently eight months! The Japanese Prime Minister seriously fears that the next wave of the coronavirus pandemic, caused by the emergence of the Omicron variant, could trigger new lockdowns in Japan. Obviously, this fact will hurt Japan's economy, which has been facing hard times lately. The introduction of new or tougher restrictions would be evidently bad news for all businesses in the country. However, if necessary, Japan's government will have to take these unpopular and exasperating measures.

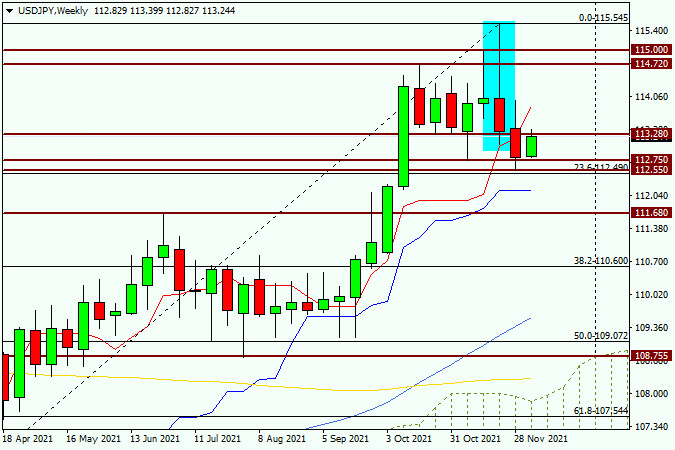

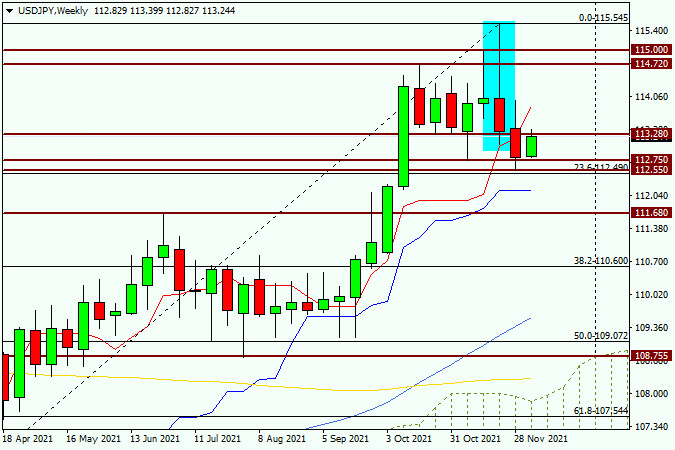

Weekly

To discuss the technical picture of the USD/JPY pair, it is recommended to start analyzing the week's progress on a weekly timeframe, considering the trading week that ended on Friday and the new just started trading five-day period. Evidently, after the marked reversal pattern of the candlestick analysis was formed, which can be classified as a "shooting star", the decline continued as expected. Now, it is too early to discuss whether the market has started working out of the reversal pattern and the trend change of the trend or it is just a corrective pullback. As before, I favour the option of the trend change. The outlined candlestick signal looks very obvious. However, at the moment the pair is rising considerably and is trading near the strong technical level of 113.30. It is likely to be just a correction pullback to the previous two-week decline, after which the rate will turn southward again. If so, according to the weekly timeframe, the correction might continue to 113.85, where there is the red Tenkan line of the Ichimoku indicator. According to the author of the article, this line is able to stop the rise and turn the price down. Let's see how it will turn out in reality, meanwhile let's analyze the smaller time frame.

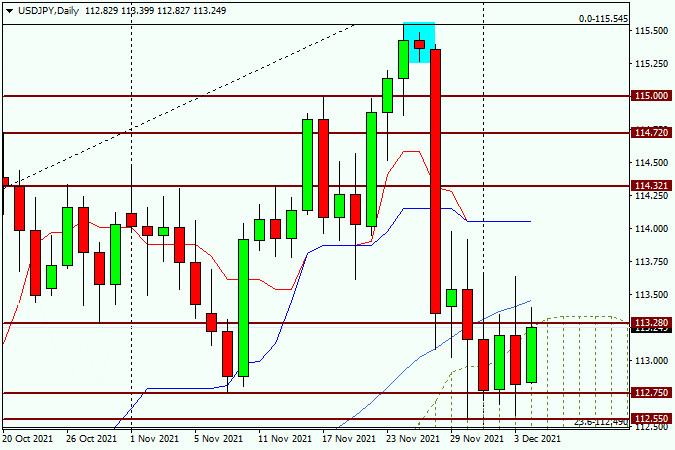

Daily

The technical pattern of this chart is characterized by the pair's break and fixation under the 50-simple moving average. Currently, it will be likely to perform the function of a strong resistance. Notably, the USD/JPY is barreling around the upper boundary of the Ichimoku indicator's cloud, not going to break it or to consolidate within the daily cloud. In case the price returns above the 50MA, a further rise to the significant technical level 114.00 is possible. Exactly at this level, the red Tenkan line and blue Kijun line of the Ichimoku indicator have converged. In my view, if it occurs, the pair risks facing very strong resistance from sellers. Besides, the pair's reversal downwards is possible.

Bears have their own targets. To resume the control of the trading they need to pass the support levels 112.75 and 112.55 in turn. At the moment, the first level can be considered a false break. Besides, at 112.55 the lows of the December 3 trades were shown. At the same time, long lower shadows of both candlesticks indicate strong support in the price zone 112.75-112.55. In case of a breakdown of the last level on a pullback to this area it is recommended to expect bearish candlestick patterns. Then, it is better to try opening sell trades. I recommend looking for short positions at more competitive prices in case of the pair's rise to the area of 113.80-114.00. As for the purchases, I recommend not to buy so far. I believe, at the moment, selling USD/JPY is the main trading idea.

Good luck!