To open long positions on EUR/USD, you need:

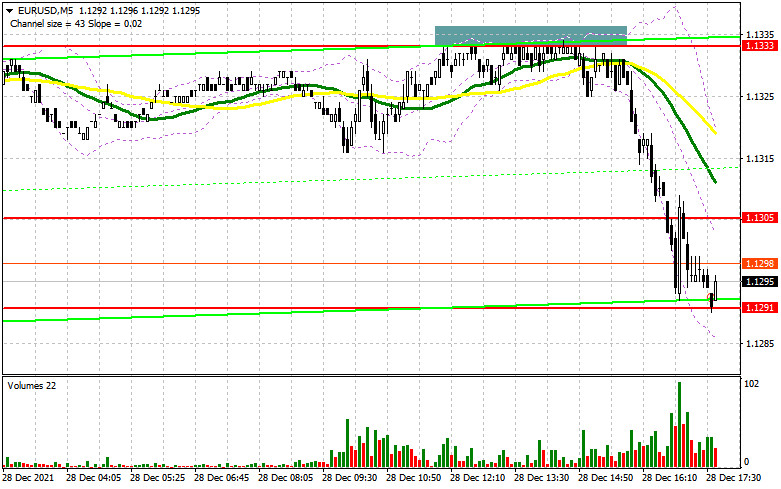

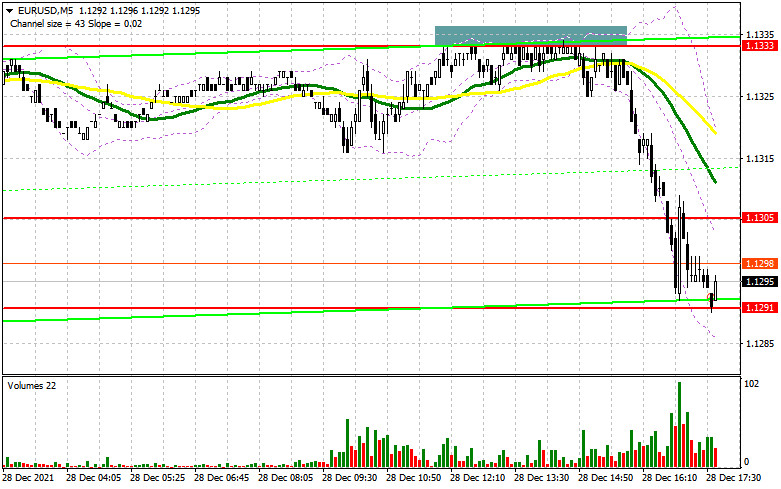

Yesterday there was only one signal to sell the euro. Let's take a look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to the 1.1333 level and advised you to make decisions on entering the market. Against the background of the absence of fundamental statistics in the first half of the day and low market volatility before the New Year holidays, traders did not reach the above-mentioned level. Therefore, there were no signals to enter the market. During the US session, traders made a number of attempts to rise above 1.1333, but all of them ended in failure, which led to forming a signal to sell the euro. As a result, the pair dropped 40 points to the support area of 1.1291.

The Commitment of Traders (COT) report for December 21 revealed that both short and long positions increased, but the latter declined slightly more, which led to a reduction in the negative delta value. This data takes into account the recent meetings of the Federal Reserve and the European Central Bank. However, judging by the alignment of forces, nothing has changed much, which is generally confirmed by the schedule. Many problems in the economies of the eurozone and the United States remain due to the Omicron strain of coronavirus, which does not allow representatives of central banks to live peacefully. Most likely, the further monetary policy of the Fed and the ECB will depend on how the situation with the coronavirus will develop after the New Year. The report shows that the buyers of risky assets, and we are talking about the euro, are in no hurry to build up long positions even after the recent statements by the ECB that it plans to fully complete its emergency bond buying program as early as next March. On the other hand, the US dollar also has support: the Fed is planning to raise interest rates as early as next spring, which makes the US dollar more attractive. The COT report indicated that long non-commercial positions rose from 189,530 to 196,595, while short non-commercial positions rose from 201,409 to 206,757. This suggests that traders will continue to actively fight for further direction. market. At the end of the week, the total non-commercial net position decreased its negative value from -11,879 to -10,162. The weekly closing price, due to the horizontal channel, remained almost unchanged - 1.1277 against 1.1283 a week earlier.

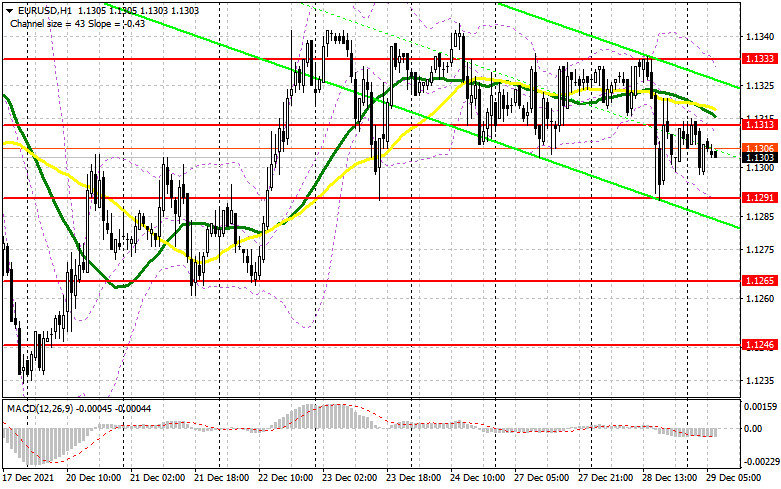

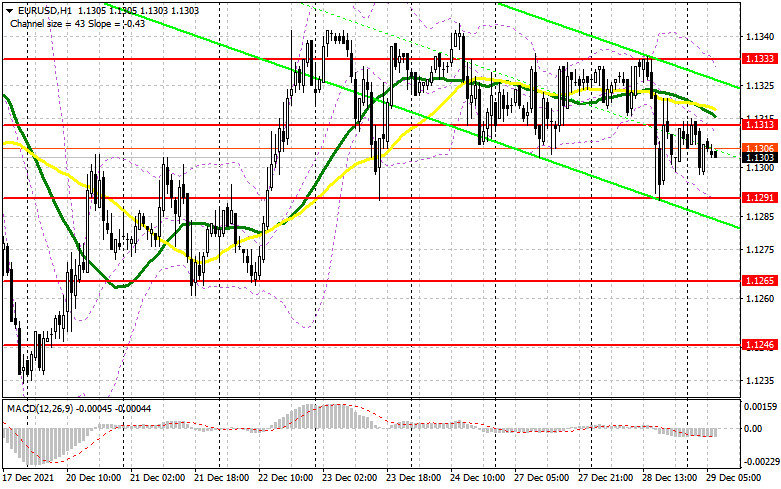

The technical picture has slightly changed compared to yesterday. Although trading continues within the horizontal channel, bears now control the market more than they did yesterday. No important statistics for the euro area in the first half of the day, which would help the euro bulls to return to the market. Reports on the volume of lending to the private sector in the eurozone and changes in the M3 aggregate of the money supply are unlikely to seriously affect the mood of market participants, so they can be ignored. In case the euro falls in the first half of the day, forming a false breakout at the level of 1.1291, by analogy with yesterday, will lead to creating a good entry point into long positions. But, besides this, an active upward movement of the pair is also necessary. If the bulls can not offer anything when 1.1291 is tested,it is better not to rush with long positions. Surpassing the channel's lower border could lead to a larger sell-off in the euro. In this case, I advise you to buy EUR/USD only after updating the next support at 1.1265, and then, subject to forming a false breakout there. It is possible to immediately open long positions on a rebound only from the low around 1.1246, counting on an upward correction of 15-20 points within the day. An equally important task for the euro bulls is to return to the control of the midpoint of the 1.1313 horizontal channel, just above which are the moving averages playing on the bears' side. A breakthrough and consolidation above this range will surely return risk appetite, which will create an excellent entry point for long positions on EUR/USD in order to renew the upper border of the 1.1333 channel, which could not be broken yesterday. Going beyond this range can seriously affect the direction of the EUR/USD pair, so be very careful at this level. A breakthrough and a downside test of 1.1333 would see a larger rally towards the highs of 1.1358 and 1.1381. The 1.1415 level is a more distant target, where I recommend taking profits.

To open short positions on EUR/USD, you need:

The bears are in control of the market and the fact that they did not let the pair rise above 1.1333 yesterday indicates a gradual return of interest in safe haven assets at the end of the year. The best scenario for selling the euro in the first half of the day today is a test of the 1.1313 level. Forming a false breakout there creates an excellent entry point into short positions with the prospect of a repeated collapse of EUR/USD to the support area of 1.1291. A breakthrough and a reverse test from the bottom up this range, together with weak data for the eurozone, form an additional signal to enter the market, which will push the pair to a low of 1.1265 and open a direct road to 1.1246. The 1.1224 level is a more distant target, where I recommend taking profits. If the pair recovers during the European session and bears are not active at the 1.1313 level, the optimal scenario would be to sell when a false breakout is formed in the area of the upper border of the 1.1333 horizontal channel, similar to yesterday. Selling EUR/USD immediately on a rebound is possible from the highs: 1.1358 and 1.1381, counting on a downward correction of 15-20 points.

Indicator signals:

Trading is carried out just below the 30 and 50 moving averages, which indicates the formation of pressure on the euro.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the upper border of the indicator in the area of 1.1330 will lead to an increase in the euro. A breakout of the lower border of the indicator in the area of 1.1290 will increase the pressure for the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.