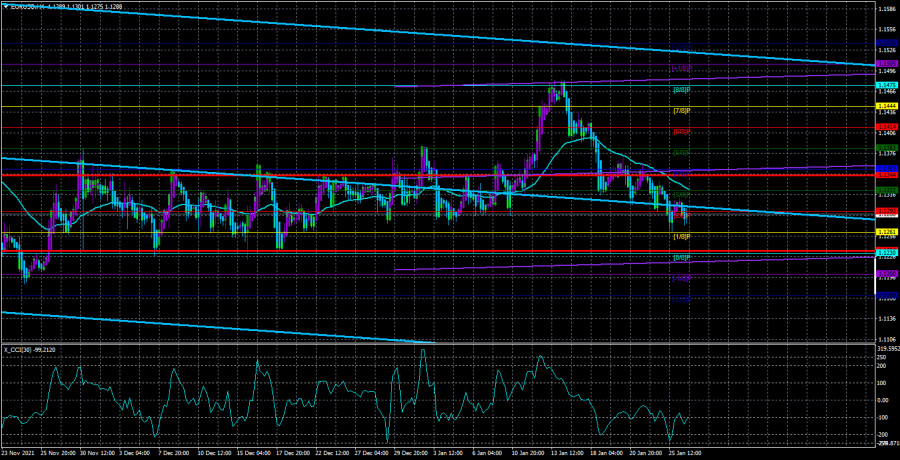

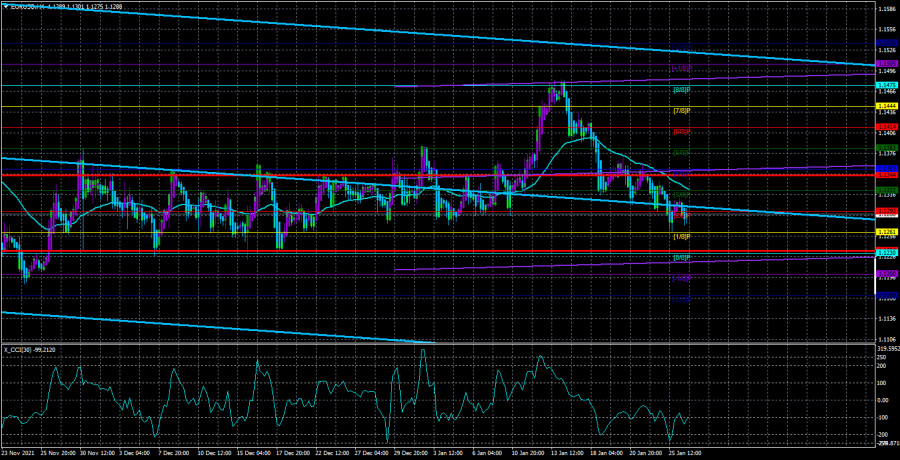

The EUR/USD currency pair was in a flat movement with minimal volatility almost all day on Wednesday. Of course, after the results of the Fed meeting were announced, the pair began to move much more actively. But even now, when several hours have passed since the publication, it is impossible to say with certainty exactly how traders reacted to the results of the FOMC meeting. As we have already said in other articles, the ideal solution would be to wait until tonight and then analyze how the market worked out yesterday's event. After all, a new strong movement may begin with the opening of the European trading session, since only Americans could work out the results of the Fed last night, and the Asian market at night. In general, do not rush to conclusions. At the time of writing, the pair continued to remain below the moving average line, so nothing has changed for the euro/dollar pair. It still retains a good chance of falling to the level of 1.1234, which is so far identified as the lower boundary of the 1.1234-1.1360 side channel, inside which the pair is again located. Therefore, in the near future, we expect that the bears will again try to overcome this level to continue the downward trend of 2021. And any "hawkish" decision of the Fed, of which there may be a lot this year, will potentially support the downward trend. After all, the ECB at the same time does not count on anything like that. If the assumption about the side channel is wrong, then it is all the more likely that the euro quotes will continue to fall, since the bulls failed to develop their success when they were above the moving average line.

The Fed left the key rate unchanged.

Well, the Fed meeting ended with the key rate remaining unchanged at 0.25%. The Fed did not "run ahead of the locomotive" and raise the rate before the complete rejection of monetary stimulus. Thus, now there is an almost one hundred percent probability of raising the key rate at the next Fed meeting, in March. In principle, this was evidenced by the official statement published immediately after the announcement of the decision on the rate. It said that "with inflation well above 2% and a strong labor market, the monetary committee expects that it will be appropriate to raise the key rate in the near future." Immediately after the announcement of this decision, the market practically did not react in any way. In principle, the probability of a rate hike at the January meeting was only 5%. Thus, immediately after the conclusion of the meeting, it could be called a "walk-through". Now all the attention of traders will flow to the European Central Bank, which will summarize the results of its meeting next week. However, everything can be much more boring and prosaic here. The fact is that the ECB has openly stated that it is not going to raise the key rate in 2022 and is not going to chase the Fed, which has a much stronger economy at its disposal than the European one. Thus, there is simply nothing to expect from the ECB now and its meeting may turn out to be "passing" in the literal sense of the word. Accordingly, the advantage of the US currency will not go away, and the US currency can start to get cheaper in the medium term only if traders lose interest in the dollar. This may happen if geopolitical tensions in Eastern Europe subside a little, and traders get tired of buying the dollar only on expectations of multiple increases in the Fed's key rate. However, given the Fed's intention to raise the rate over the next 2-2.5 years, this factor can still support the dollar for a long time.

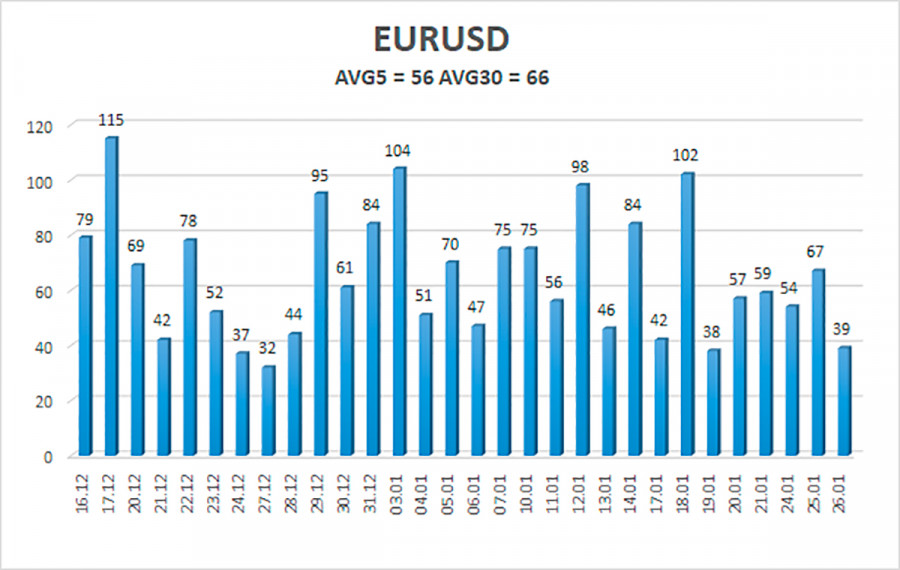

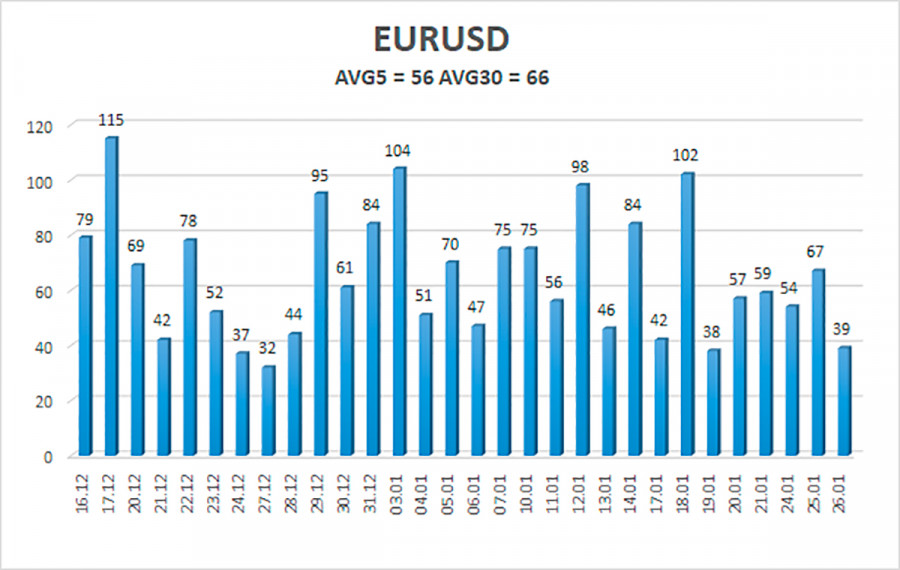

The volatility of the euro/dollar currency pair as of January 27 is 56 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1232 and 1.1344. A reversal of the Heiken Ashi indicator upwards will signal a new round of corrective movement.

Nearest support levels:

S1 – 1.1261

S2 – 1.1230

S3 – 1.1200

Nearest resistance levels:

R1 – 1.1292

R2 – 1.1322

R3 – 1.1353

Trading recommendations:

The EUR/USD pair continues its downward movement. Thus, now you should stay in short positions with targets of 1.1261 and 1.1230 until the Heiken Ashi indicator turns up. Long positions should be opened no earlier than the price-fixing above the moving average line with targets of 1.1383 and 1.1414.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.