The EUR/USD currency pair began to adjust again on Thursday. On Wednesday, it was impossible to overcome the moving average line, but this task can be completed soon. Recall that fixing below the moving line by 20 points cannot be considered a "convincing overcoming." The technical picture of the euro currency is getting worse every day. After the euro currency rose by an "unrealistic" 450 points in a week, it is again inclined to fall. The fundamental and geopolitical backgrounds that brought the pair so low have not changed recently enough to expect a powerful upward trend. Why should the euro currency show strong growth against the dollar in the long run? The Fed rate remains higher than the ECB rate, which will be so for at least another six months or even a year. The EU economy may face serious problems this winter due to a shortage of gas, oil, or high prices for both types of fuel. The American economy, which is already being sent into a recession by everyone who is not lazy, can avoid it, as several large investment banks said on Thursday that they do not expect negative GDP in 2022 and 2023. Thus, in the United States, we can talk about a recession, a slowdown, but not a contraction of the economy.

Geopolitics is even more complicated. The APU continues to counterattack, and the Kremlin's reaction to these events is not yet clear. At the G-20 summit, very important decisions can be made, and to which both Ukrainian President Vladimir Zelensky and Russian President Vladimir Putin are invited. Many military analysts say the Kremlin will not dare use tactical nuclear weapons against a non-nuclear country before this summit. President of Ukraine Zelensky signed a decree stating that negotiations with Moscow would be possible only with another president. Kremlin spokesman Dmitry Peskov said that dialogue with the current president of Ukraine is impossible. Thus, negotiations can resume after the change of president. Therefore, we have an aggravation of the situation at the front; (1) the previously annexed lands recaptured by the Armed Forces of Ukraine; (2) the Kremlin's threats to strike with nuclear weapons; and (3) the G-20 summit. From our point of view, we should not expect an improvement in geopolitics.

The European Union risks being left without oil from the Russian Federation.

Meanwhile, the EU countries have agreed on the eighth package of sanctions against the Russian Federation in response to the annexation and recognition of four regions of Ukraine as part of Russia. In the new package, sanctions will apply to imports from Russia of steel products, wood, paper, various equipment, plastics, and chemicals. But the main thing is that a price restriction on oil from the Russian Federation will be introduced. Earlier, Russian President Vladimir Putin openly stated that in the case of setting a "ceiling" on Russian oil prices, the Kremlin might refuse any energy supplies to the European Union altogether. His position is clear and simple: either market prices go up, and we continue cooperating with you, or you will not receive any oil. Also, in the new package of sanctions, there will be various kinds of bans on the transportation of oil by sea from Russia to third countries. Now, as in the case of the APU counterattack, the answer lies with Moscow. In the near future, the "tap will be turned off," and the European Union will be left without oil sooner than planned.

From our point of view, this will only worsen the economic situation of the European Union itself. Against this background, the European currency may rush down again, as the issue of energy resources and their cost for businesses and households will become even more acute. Of course, this is a blow for Russia as well. But what can we do if modern diplomats cannot agree on anything? For us, the aggravation of the geopolitical conflict in Ukraine and the sanctions war between the West and the Russian Federation is another reason to think about a new fall in risky assets, to which the euro currency belongs. Its consolidation below the moving average can easily send the pair back to 20-year lows.

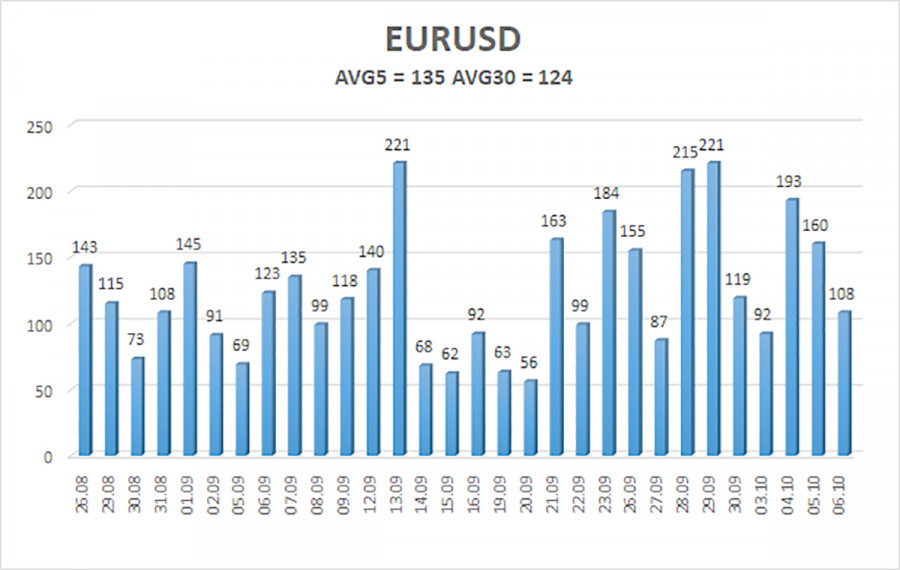

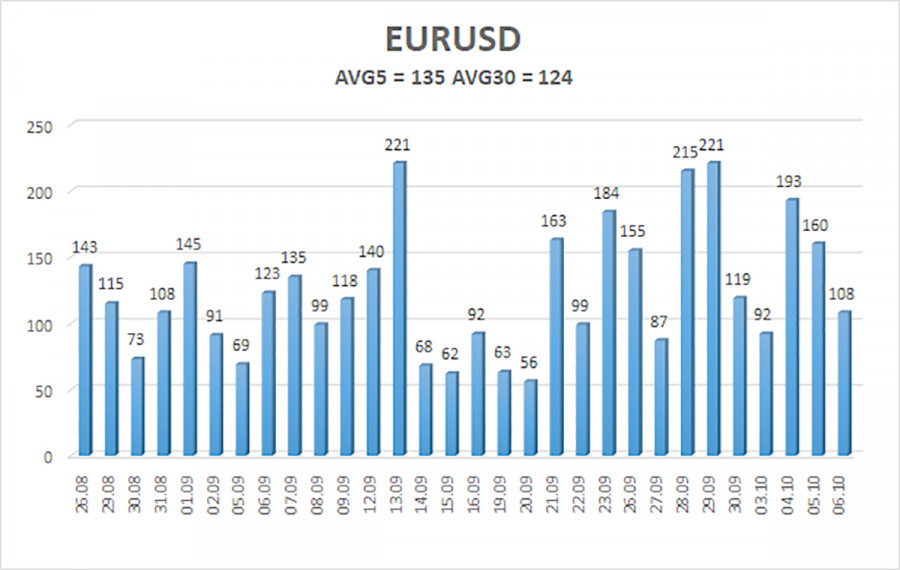

The average volatility of the euro/dollar currency pair over the last five trading days as of October 6 was 135 points, which is characterized as "very high." Thus, on Friday, we expect the pair to move between the 0.9694 and 0.9964 levels. The reversal of the Heiken Ashi indicator back to the top will signal the resumption of the upward movement.

Nearest support levels:

S1 – 0.9766

S2 – 0.9644

S3 – 0.9521

Nearest resistance levels:

R1 – 0.9888

R2 – 1.0010

R3 – 1.0132

Trading Recommendations:

The EUR/USD pair remains above the moving average line but continues to adjust. Thus, now we should consider new long positions with targets of 0.9888 and 0.9964 in case of a rebound from the moving average. Sales will become relevant again no earlier than fixing the price below the moving average with goals of 0.9766 and 0.9694.

Explanations of the illustrations:

Linear regression channels help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which you should trade now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.