On Thursday, the GBP/USD currency pair maintained its upward trend. The verdict of the Supreme Court of the United Kingdom on Scotland's permission to hold a second independence referendum in the last ten years was extremely important for the British pound this week. If you had asked us before the verdict what the chances of a positive outcome were, we would have said, "5% and no more." Nonetheless, this news is positive for the British pound, which most likely boosted the pound this week. Remember that all other macroeconomic events are extremely difficult to interpret as significant. Indicators of business activity that have barely changed since October? Unlikely. The fall in US business activity indices below the "waterline?" They are not significant enough to cause the dollar to fall by 200-300 points. These were not even ISM indices, considered extremely important but only sometimes elicit a response. Purchases for long-term use? Applications for unemployment compensation? The Fed protocol, which, as usual, provided no interesting information? The inquiry is rhetorical.

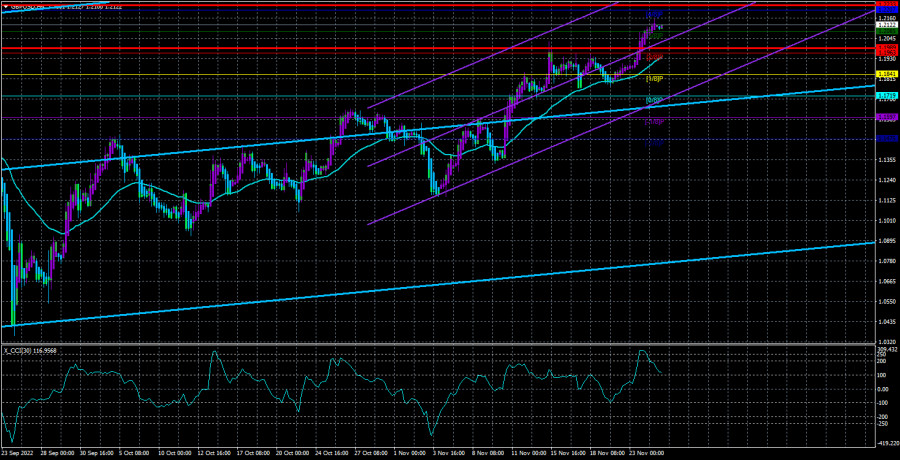

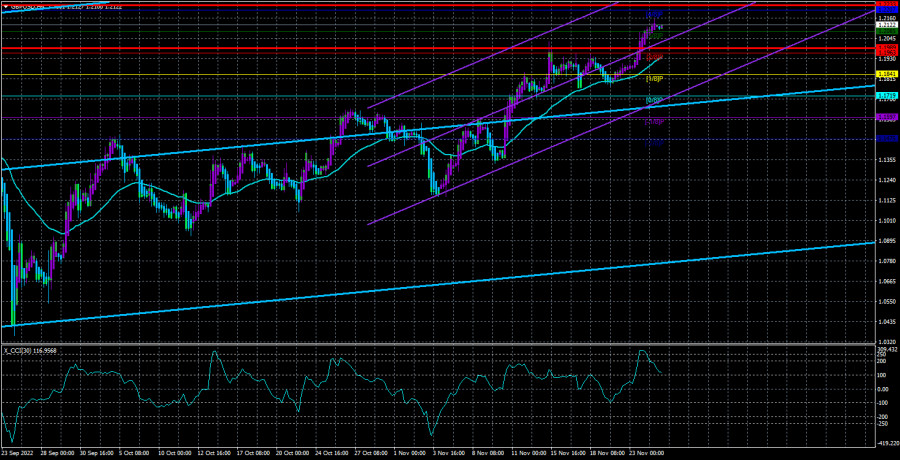

As a result, the British pound now shares the same key advantage as the euro. Technology is this hand's trump card! Almost all technical indicators on all TF are currently indicating an upward trend. Regardless of the fundamental background, the pound sterling has increased by 1,700 points in recent months, which you will agree is quite a bit. However, a few factors have driven the pound higher in recent weeks. We continue to think that a new correction is necessary, but we require at least a few technical sell signals. Discussing the pair's potential fall while they are absent is pointless.

Will Edinburgh and London directly clash?

If Nicola Sturgeon fails to hold the promised independence referendum, she might lose her influence and power in the upcoming years. Recall that she pledged, in exchange for her party winning the most recent parliamentary elections, to hold a referendum by the end of 2023. The SNP has won, and the First Minister of Scotland must take the next step. But it needs to be clarified how she plans to proceed with this. Following British law, which Scotland must also abide by, Edinburgh is not permitted to hold such large-scale referendums without the consent of Westminster. Everyone already understands that neither the British court nor the British government will consent to its holding, as there is no reason for London to require it. The independence referendum was already held in 2014, and events of this size cannot be described as "annual in nature," according to the British. This is why they have a strong defense against Nicola Sturgeon's demands. The Scots advocated for preserving the union with the United Kingdom in 2014. London prefers not to "see" the reality of its Brexit from the European Union, which the majority of Scots voted against in 2016, even though a lot of water has flowed since then.

London is also using its backup plan. Most public opinion surveys indicate that not all Scots favor leaving the UK. There was a 50-50 split in the opinions. As a result, the outcome of the Scottish referendum might be similar to that of the British referendum. In other words, the future of the nation for the ensuing decades can be decided by thousands of people. In our opinion, the decisive vote in a referendum should be cast by an absolute majority rather than a simple majority (70–80 percent of votes). To prevent the nation's fate from being determined by the opinions of thousands of people who may not be knowledgeable about politics and economics but, for instance, disagree with the European Union. According to the results, the final decision is opposed by at least half of the nation's citizens.

There is only one illegitimate way for Nicola Sturgeon to hold a referendum. However, this will start a conflict with Great Britain that might turn into a military one. Since Sturgeon is unlikely to make such a move, Scotland will continue to be a part of the UK.

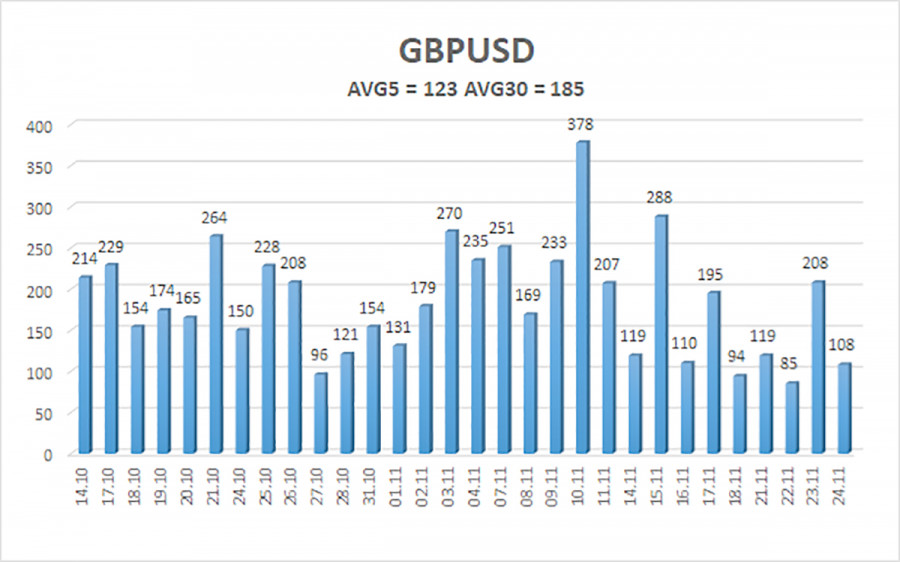

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 123 points. This value is "high" for the dollar/pound exchange rate. Thus, we anticipate movement inside the channel on Friday, November 25, constrained by the levels of 1.1989 and 1.2233. The Heiken Ashi indicator's turning downward indicates a new phase of the corrective movement.

Nearest levels of support

S1 – 1.2085

S2 – 1.1963

S3 – 1.1841

Nearest levels of resistance levels:

R1 – 1.2207

R2 – 1.2329

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair is still moving upward. Therefore, until the Heiken Ashi indicator turns down, you should continue holding buy orders with targets of 1,2207 and 1,2233. Open sell orders should have a target price of 1.1841 and be fixed below the moving average.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal