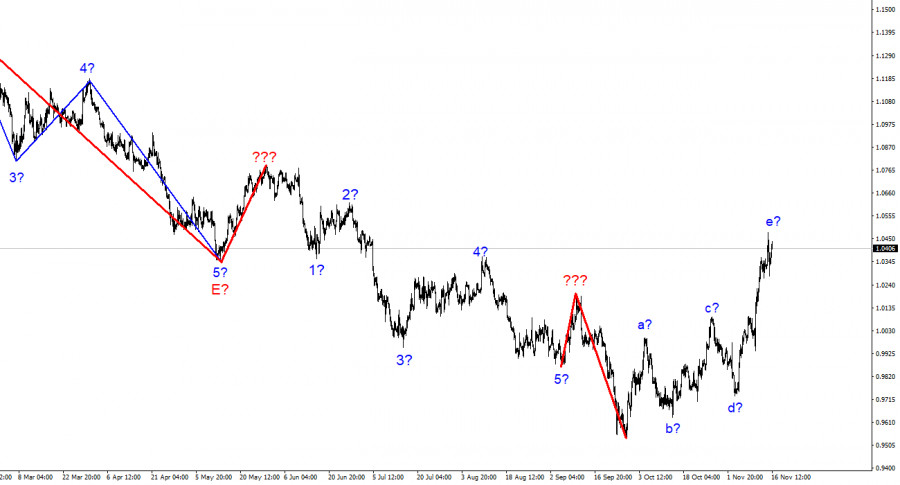

The wave marking of the 4-hour chart for the euro/dollar instrument has undergone certain changes. The upward section of the trend continues its construction, and now it takes a pronounced corrective form. Initially, I thought that three waves would be built up, but it is already clearly visible that there are five waves. Thus, we get a complex correction structure of waves a-b-c-d-e. If this assumption is correct, then the construction of this structure may be nearing its completion since the peak of wave e exceeds the peak of wave C. In this case, we are expected to build at least three waves, but if the last section of the trend is corrective, then the next one will most likely be impulsive. Therefore, I am preparing for a new, strong decline in the instrument. A successful attempt to break through the 1.0359 mark, which corresponds to 261.8% Fibonacci, indicates the incompleteness of the last ascending wave.

The most important thing now is that the wave markings of the pound and the euro coincide. If you remember, I have repeatedly warned about the low probability of a scenario in which the euro and the pound will trade in different directions. Theoretically, this is certainly possible, but it rarely happens in practice. Now both instruments are presumably building corrective trend sections, which may be completed in the near future. Thus, the British dollar can also begin to decline within the framework of a new downward trend segment.

What can Christine Lagarde say?

The euro/dollar instrument increased by 70 basis points on Wednesday. The demand for the euro is increasing again and again without any clear reasons. Nothing was interesting in the European Union in the first half of the day. ECB President Christine Lagarde will speak only in the afternoon. I admit that today the demand for the euro is growing precisely because of this, although it grew in previous days when there was no news background in the European Union and the United States. Nevertheless, I cannot pass by such an important event as Lagarde's speech.

Her speech may well not contain anything interesting. She can talk about the economy, geopolitics, inflation, or high energy prices. All this is only indirectly related to monetary policy, which is now most concerned with the markets. If nothing is said about it, there will most likely be no market reaction. But we are not satisfied with this option, so I am considering an option with Lagarde's important and interesting rhetoric. Today, she can only confirm that rates in the European Union will continue to rise, as they are now slightly below the neutral level. The level still has a very weak effect on inflation. In any case, the interest rate needs to be raised further. Lagarde understands this, so she can only say this about monetary policy. It is difficult to say whether the market will react to a new increase in demand for the euro if it has been growing for a couple of weeks already, and the wave marking assumes the construction of three waves down. But that's another question.

General conclusions

Based on the analysis, the construction of the upward trend section has become more complicated into five waves. It continues due to the inflation report and the impartial statements of FOMC members. However, I cannot advise buying now since the wave marking still needs to imply a further increase. I advise selling in case of a successful attempt to break through the 1.0359 mark with targets located near the estimated 0.9994 mark, which corresponds to 323.6% Fibonacci.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. We saw five upward waves, which are most likely the a-b-c-d-e structure. The construction of a downward trend section may resume after the completion of the construction of this section.