As a result of the inability of the euro bulls to return the rate above the broken support of 1.1664, a rather strong decline in the main currency pair of the Forex market followed yesterday. Nevertheless, the closing price was 1.1607. The exchange rate has not been growing or falling for quite a long time. Market participants are likely waiting for a strong and iconic driver, which will determine the direction of EUR/USD. In the meantime, as previously expected, trading on the euro/dollar remains in the range of 1.1525-1.1664. As for the fundamental background, it is very poor. Fed officials do not spoil investors with some new information. For example, Friday's speech by the Fed chairman did not impact the price dynamics of the US dollar. It is logical to assume that this happened due to the lack of new information, primarily on the timing and pace of the curtailment of the quantitative easing (QE) program. Markets continue to wait for the Fed's November meeting in the hope of getting concrete information about the curtailment of incentives.

However, it is not yet a fact that such a signal will be given since Jerome Powell complained about the slowdown in economic growth in the 3rd quarter in his last speech. But high inflation, which the Fed considered a temporary factor, is not yet thinking of decreasing, and this may become a determining factor for the beginning of monetary policy tightening. At the same time, opinions differ among FOMC members regarding the completion of the QE program. Given the ambiguous situation with economic growth and inflationary pressure, this is not surprising. In general, it is the tradition of the Fed to refrain from any specifics, at least until the very last moment. The question is, when will this moment come, and will we learn about the next steps of the American Central Bank? If you look at today's economic calendar, it is difficult to call it saturated. There are no reports from the eurozone at all, and from American statistics, we can single out an indicator of consumer confidence, which will be published at 15:00 London time.

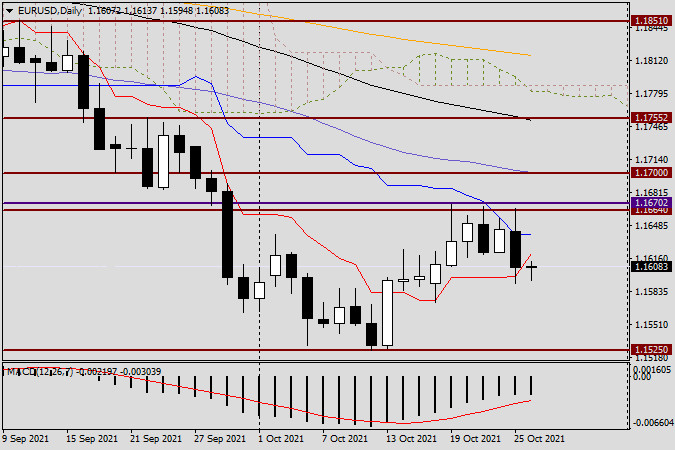

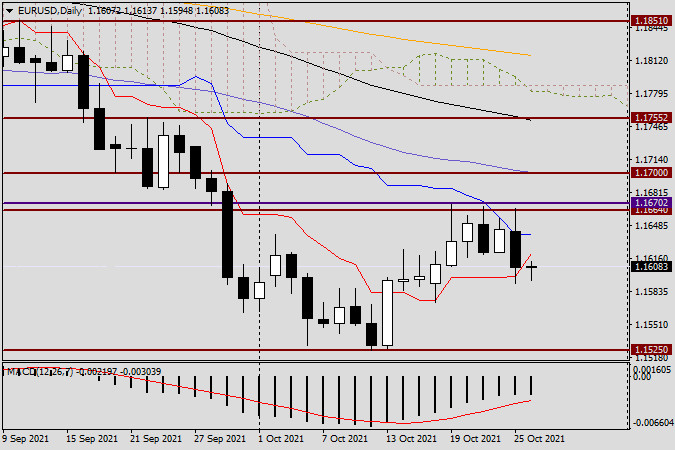

Daily

So, as already noted at the beginning of the article, the EUR/USD pair showed a fairly strong decline at yesterday's trading. I believe that if not for the red line of the Tenkan Ichimoku indicator, which provided strong support to the price, yesterday's session could well have closed below the 1.1600 level. However, today, the pair is trading already under this line, which is located at 1.1621. Considering that the blue Kijun line runs a little higher at 1.1640, euro bulls need to go up both lines for subsequent growth and close the day above 1.1640. In this case, there will be a real opportunity to try again to return trading above the broken support level of 1.1664, after which to storm the resistance of sellers at 1.1670, where the maximum trading values were shown on October 19. If these conditions are met, we can count on a subsequent increase in the price zone 1.1700-1.1750. The primary task of the bears is to reduce the exchange rate below 1.1600, followed by consolidation under this level. In case of successful completion of this mission, most likely, we will see a retest of the 1.1525 support level with a high probability of its breakdown.

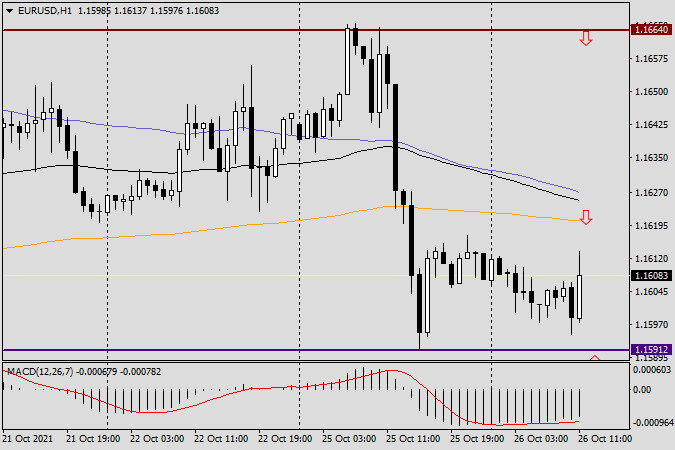

H1

Given the inability to return trading above 1.1664, the reins of EUR/USD have passed to sellers in the current situation. If this assumption is correct, we are waiting for rollbacks to the 1.1620-1.1630 price zone, where the used movings have accumulated, and we are considering opening short positions. And the appearance of reversal bearish candle patterns in the selected zone will convince you of this. In the presence of those signals, sales at more favorable prices can be planned after the rise of the euro/dollar in the resistance area of 1.1660-1.1670. As for purchases, in the current situation, they seem riskier. However, if there are bullish signals near the support levels of 1.1590 and 1.1572, those who wish can try to open positions to buy the euro.