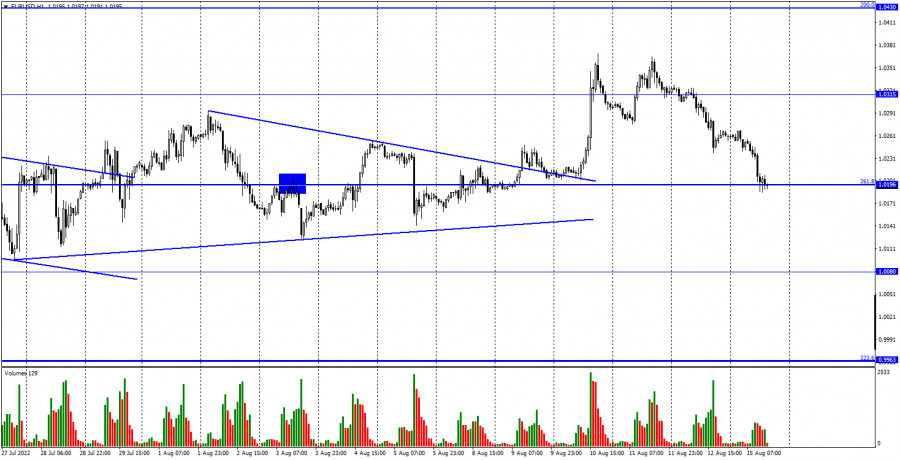

The EUR/USD pair continued falling on Friday, and on Monday, it turned out to be near the corrective level of 261.8% (1.0196), from which the last growth of the euro currency began last week. The rebound of quotes from this level will favor the European currency and the resumption of growth toward the 1.0315 level. Fixing the pair's rate below the level of 261.8% will increase the probability of further decline towards the next level of 1.0080. The background information on Friday was rather weak. The US dollar has been rising all day, so I can't say this movement was related to the news.

Nevertheless, European industrial production grew by 0.7% m/m and 2.4% y/y. Traders did not expect such high values, but, as I said, the euro could not extract any benefits for itself from this report. In America, the most interesting report was the consumer sentiment index from the University of Michigan, which showed a slight increase compared to the previous month. But the US dollar was already showing growth by that time, so this report also cannot be considered to have influenced the mood of traders.

What happens? The US dollar fell significantly after the US inflation report but recovered quickly in the next two days. From my point of view, the information background has nothing to do with it. There is a lot of talk about a recession in the US and the European Union, but no one can say for sure whether there will be a recession. On the one hand, increasing rates will negatively affect economic growth.

On the other hand, no one can say how much this or that economy will decrease due to higher rates. Moreover, it is about the American economy that the greatest number of rumors about the impending recession have been circulating recently. The first two-quarters of US GDP ended with losses. However, FOMC members, on the contrary, say that there is no recession and there will not be, and any economic slowdown cannot be considered a recession. At the same time, the dollar has been at its highest value against the euro over the past two decades. In Europe, everything is bad because of the dry weather and the threat of crop failure, but this factor cannot be considered to affect the mood of traders.

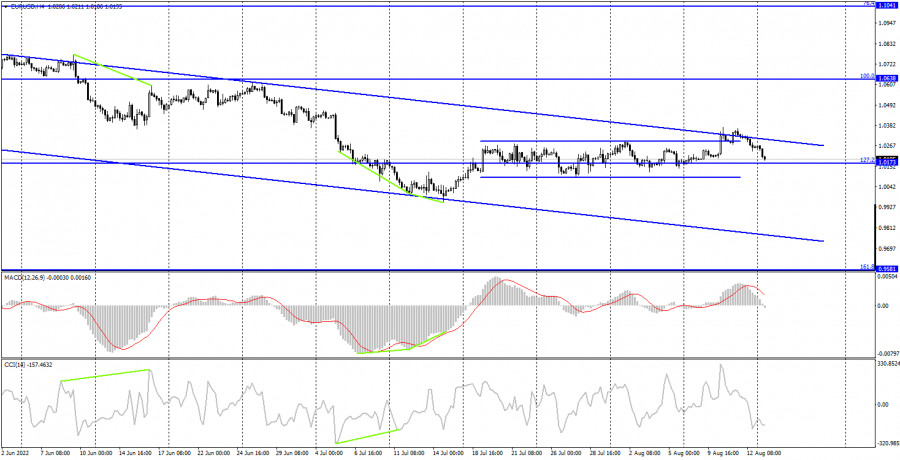

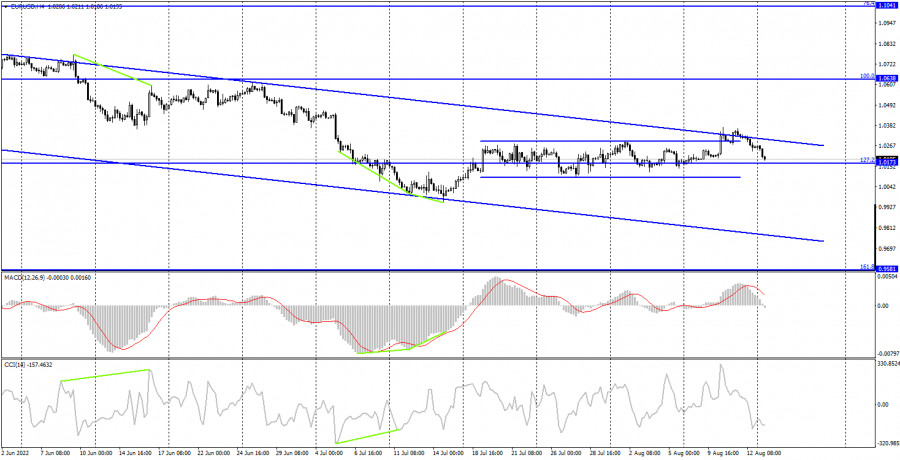

On the 4-hour chart, the pair remained above the level of 127.2% (1.0173) and increased to the upper line of the descending trend corridor but could not consolidate above it. Thus, the quotes got out of the side corridor, but the fall may resume in the direction of the corrective level of 161.8% (0.9581) if bull traders fail to close the pair above the descending corridor, which still characterized the current mood of traders as "bearish." Emerging divergences are not observed in any indicator today.

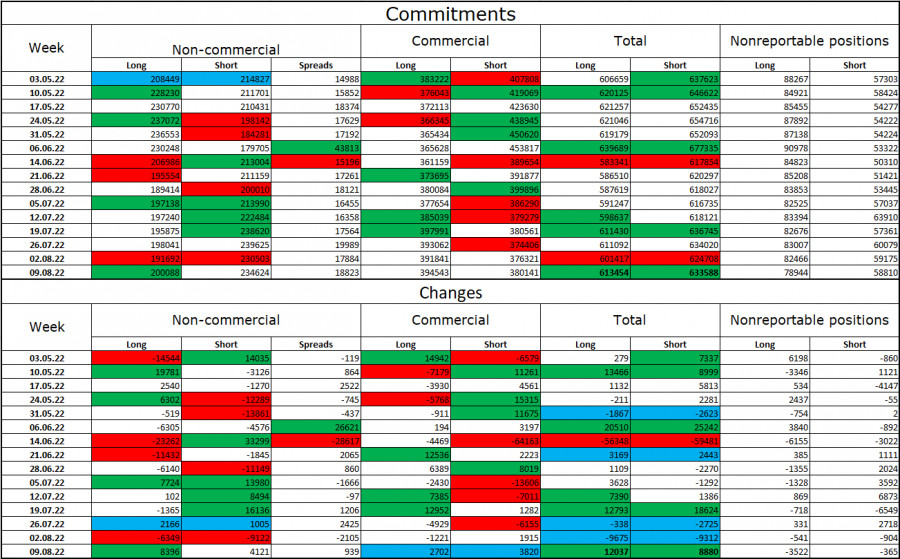

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 8,396 long contracts and 4,121 short contracts. It means that the "bearish" mood of the major players has become a little weaker, but it has remained. The total number of long contracts concentrated in the hands of speculators is now 200 thousand, and the total number of short contracts – 234 thousand. The difference between these figures is still not too big, but it remains not in favor of euro bulls. In the last few weeks, the chances of the euro currency's growth have been gradually increasing, but recent COT reports have shown no strong strengthening of the bulls' positions. The euro currency has not been able to show convincing growth in the last five weeks. Thus, it is still difficult for me to count on the strong growth of the euro currency. So far, I am inclined to resume the fall of the euro-dollar pair.

News calendar for the USA and the European Union:

On August 15, the calendars of economic events of the European Union and the United States do not contain a single interesting entry. The influence of the information background on the mood of traders today will be absent.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair when anchoring below the 1.0196 level on the hourly chart with a target of 1.0080. I recommend buying the euro currency when the quotes rebound from the level of 1.0196 on the hourly chart with a target of 1.0315.