Bitcoin is spending the current week within the recovery period after a strong bullish rally. Yesterday, the coin sharply declined below the level of $60,000. The main reasons for this were profit-taking by part of the holders and the correction that came within the framework of the upward movement. Today, the cryptocurrency continues to remain within the corrective structures and is trading in the range of $59,700-$62,500. And despite the absence of obvious signs of growth, the current correction is healthily improving, as proven by the growing on-chain activity and the activation of investors. All this suggests that the stabilization period will be short-term, and the BTC price will continue its upward movement in the near future.

First of all, the beginning of growth is indicated by very high cryptocurrency indicators: the number of unique addresses in the Bitcoin network shows an upward trend since the beginning of the bullish trend on September 30. Over the past four weeks, the number of addresses in the cryptocurrency network has not fallen below 900 thousand, which is an excellent indicator for an asset, the scale of Bitcoin, and indicates the market's readiness for a bullish rally. Similar dynamics can be seen on metrics that display the total transaction volumes, which also remain at a high level since the establishment of a historical record by bitcoin in the region of $ 67,000. The data of on-chain indicate the long-term faith of investors in Bitcoin and the lack of impulsiveness in decision-making. Yesterday's price drop confirmed this and the confident position of the players contributed to the rapid recovery of the asset quotes.

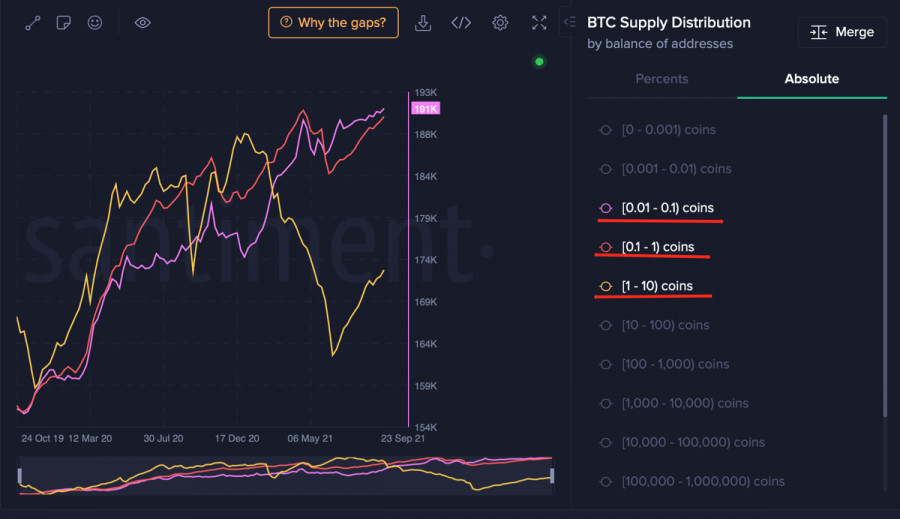

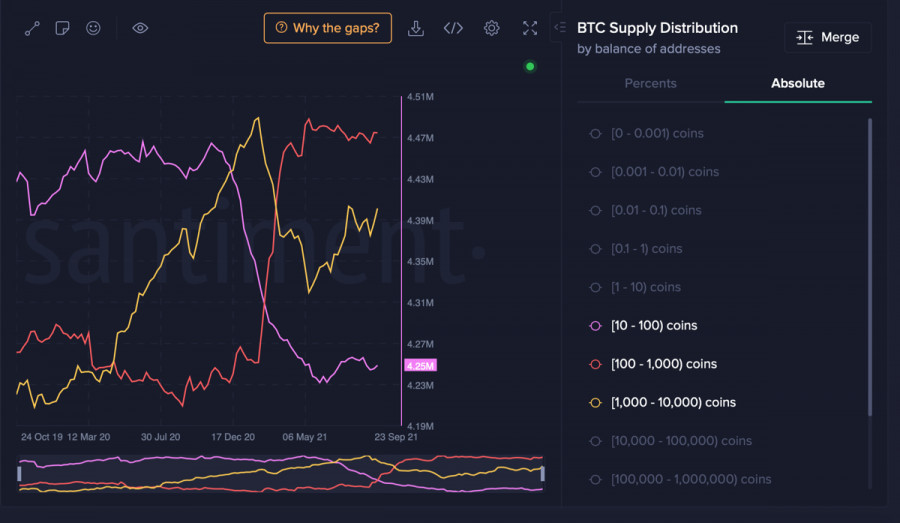

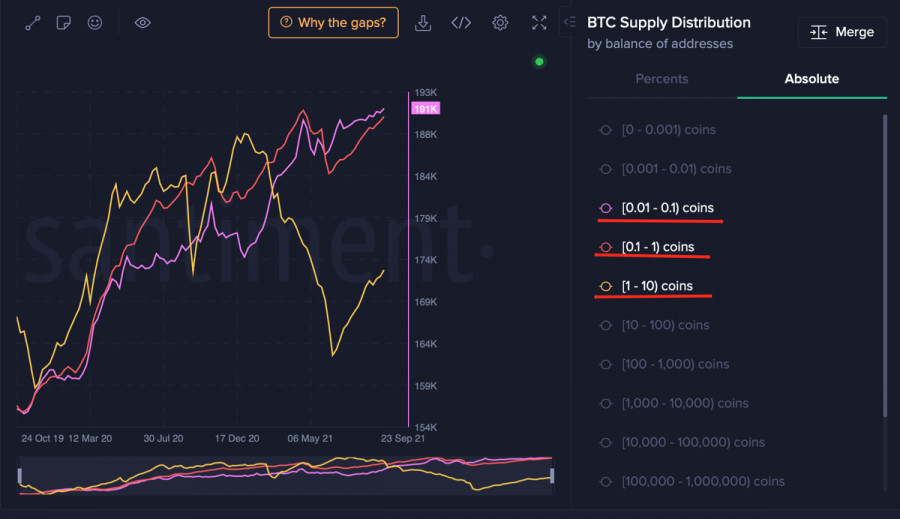

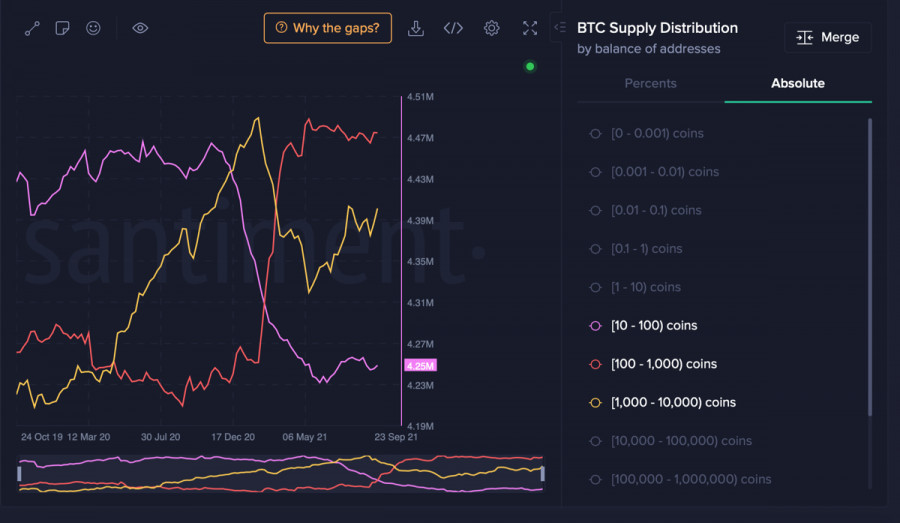

In addition to this, on-chain metrics show the growth of wallet balances of various categories of addresses. For example, during the recent collapse, the start of coin accumulation by users with balances from 0.1 to 10 BTC was recorded. This also confirms the thesis that the retail audience is returning to the bitcoin market and actively buying out yesterday's drop. A similar dynamic can be traced among addresses with a balance of 10 to 10,000 BTC on the balance sheet, which also actively win back yesterday's price drop. This is also evidenced by the movement of BTC capital in the spot market, according to which there is an outflow of BTC from cryptocurrency platforms and a net inflow of USDC, which confirms the presence of a pattern of purchases over the past two weeks.

Summarizing the very activity of Bitcoin, it can be concluded that the asset is cooling after a week in the overbought zone. At the same time, the market correction had not only a recovery effect but also had a positive effect on investment flows, as market participants had the opportunity to purchase BTC at a price below $ 60,000. This allowed us to accelerate the accumulation period and bring the price into positions for growth.

Meanwhile, bitcoin has successfully gained a foothold above $60000 and has grown by 3% over the past day. At the same time, the daily trading volumes of the asset remain at the level of $ 42 billion, which indicates the beginning of a full-fledged payback of yesterday's fall. Despite the local positive, the coin formed a bearish candle on the daily chart in a row, which indicates the strong positions of sellers. At the same time, the quotes made a bearish breakdown of the "bullish triangle" technical analysis figure, which is also a sign of maintaining a short-term downward trend.

At the same time, BTC/USD technical indicators signal recovery and consolidation above the $60,500 area. Stochastic is preparing to form a bullish intersection, and the relative strength index rises to the 60 zone, which indicates an increase in the number of purchases and a full start of the recovery period. Nevertheless, the MACD continues to decline, forming a local divergence with coin quotes. Despite this, on-chain metrics and technical indicators indicate that the market is ready to move to new highs. If the current dynamics of the price movement continue, then the cryptocurrency will be ready to conquer new historical highs by next week.