The EUR/USD technical picture is generally ambiguous

Hello, dear colleagues!

Let's start today's review with the main event of the last trading week, US labor market data. Historically, these reports are very significant for investors and they also influence the trades. Notably, US labor market data has not evoked such a strong reaction over the last few years, taking into account the degree of volatility and the scope of price movements, observed earlier. Nevertheless, US labor market data has always been and still is crucial. For example, in the current situation they show the rate of recovery of the largest world economy after the peak of the COVID-19 pandemic. Let's describe it this way as the coronavirus pandemic continues spreading globally, producing more and more strains. Currently, it is the COVID-19 variant Omicron.

However, that's not the point. Thus, Friday's US labor market reports turned out to be ambiguous and caused investors to think twice. Let's revise the actual numbers for the three most significant indicators. Changes in the number of workers engaged in non-farm economic sectors or nonfarm payrolls reflect the number of new jobs created each previous month. Experts' predictions about creating 550,000 new jobs in the US were not fulfilled. The actual figure turned out to be much less and amounted to 210,000. I believe that the Fed executives, who have repeatedly emphasized the strong labor market recovery, may now become more restrained. Average hourly earnings growth, which was expected to be 0.4%, did not reach the forecast reading and totaled 0.3%.

Amid the current situation with high inflation, which the Fed has recognized to be no longer temporary, this figure has both pros and cons. The only benefit in the rather weak US labor market data for November was the unemployment rate, which fell dramatically to 4.2%. In this case, it should be noted the previous reading of 4.6% as well as the forecasted November reading of 4.5%. Evidently, the actual figure was significantly lower than both indicated values. Therefore, it is recommended to expect the outcome of the last FOMC meeting this year and the press-conference of the re-elected Fed chairman Jerome Powell. Notably, market participants are still focused on the timing and pace of winding down the quantitative easing program (QE).

Since the US economic recovery has been mentioned, the Organization for Economic Cooperation and Development forecasts that the US GDP will grow by about 5.6% this year, while the Eurozone economy will rise by 5.2% in 2021. This hard year is coming to its end, let's see what the real figures will be. In the meantime, it is better to observe the EUR/USD currency pair price charts. Let's start with the outcome of the last trading week.

Weekly

Thus, the expected rise after the previous selected candlestick did not occur. Anyway, the downward trend of the major Forex market currency pair has stopped. At the end of the previous trading week, on the weekly timeframe, a Doji candlestick was formed with the shadows that were equidistant from the opening price. Last week's highs were at 1.1383, while the lows were much higher at 1.1236. At the same time, for the second week in a row, the EUR/USD trades closed above the significant level for the market, 1.1300. According to the technical pattern on the weekly chart, it is still possible to expect a further correctional growth to the area of 1.1440. Evidently, there is the first rebound level of 23.6 fibo from the decline of 1.2266-1.1187, as well as the red Tenkan line of the Ichimoku indicator. If the pair reaches this area, in my view, in this part the further rate direction will be resolved. Bears have to update a record low that they set as the support at 1.1187, and close the week below that level.

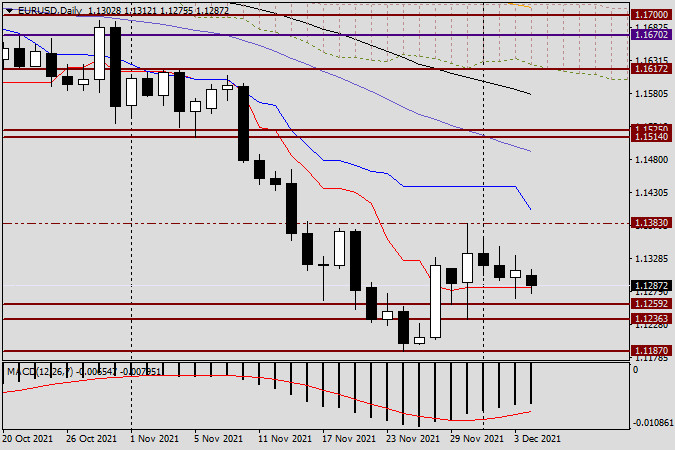

Daily

On the daily chart, the technical picture is ambiguous. The only aspect that can be noted and considered as euro bulls' benefit is the price fixation above the red Tenkan line, currently providing a very strong support to the pair. In my view, only a true breakout of the nearest resistance of sellers at 1.1383 will create the necessary prerequisites for the further growth to the area of 1.1440. Obviously, on the daily chart this level is supported by the blue Kijun line. Consequently, according to the author of this article, the EUR/USD has more chances to rise during the current trading session. If so, the main trading recommendation would be to buy after insignificant and short-term pullbacks down. It is better to discuss the detailed entry points tomorrow, when smaller time frames are analyzed.

Good luck!