To open long positions on EUR/USD you need:

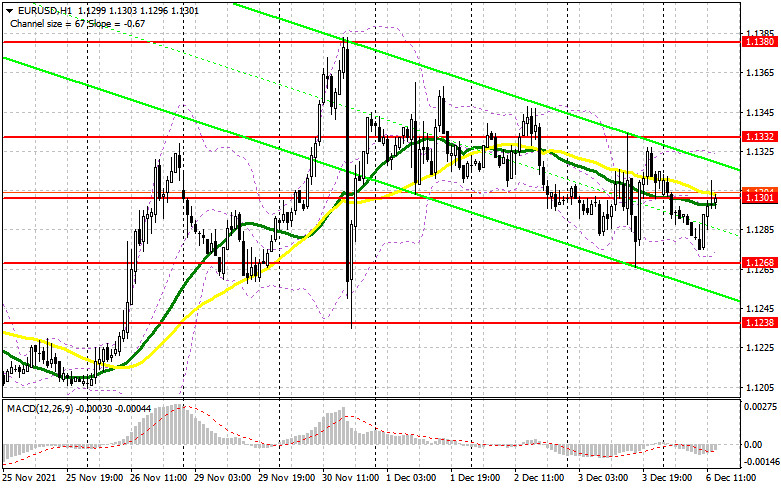

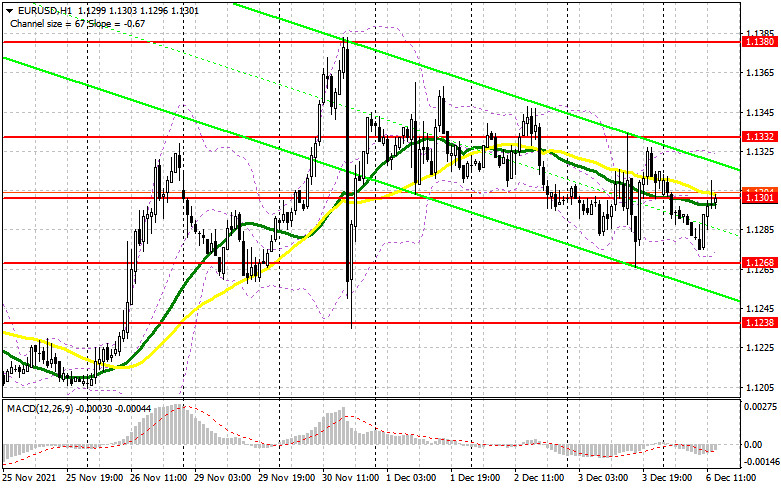

In my morning forecast, I focused on 1.1301 and recommended taking decisions to enter the market, taking this level into account. Let's observe the 5-minute chart and analyze it. Bulls' failed attempt to break above the resistance at 1.1301 together with weak data on the EU economy, triggered the signal to open short positions, which is still active at the moment of writing this article. As long as the trade will be conducted below 1.1301, it is possible to expect the pound to decline. From the technical point of view, nothing has changed, as well as the trading plan.

In the second half of the day, there are no fundamental EU statistics, therefore it is possible to expect further euro's move upwards according to the trend, formed in the first half of the day. However, only break and fixation above 1.1301 with a reversed test from the top down will provide an excellent entry point with the aim to reverse EUR/USD to the upper border of the side channel 1.1332. Besides, the pair failed to get above it last Friday. A break of this range will also lead to a larger upward correction to the weekly high at 1.1380, where I recommend taking profits. The level of 1.1442 will be a further target. However, it should be also mentioned that the EU economic statistics were not positive in the first half of the day. Besides, if the pair does not show further gains, bulls may start taking profits. This aspect will exert pressure on the pair and keep the trade in the sideways channel. If there is further pressure on the euro in the second half of the day, it is better not to rush to buy. I recommend awaiting a false break near 1.1268. Only this scenario will provide a good entry point to long positions. If there is lack of bull activity at this level, it is better to postpone selling to a larger support at 1.1238. I recommend buying the EUR/USD pair at a rebound from the low at 1.1188 or even lower, around 1.1155 with the target of upward correction of 20-25 pips during the day.

To open short positions on EUR/USD you need:

Bears achieved their morning target and managed to defend the resistance at 1.1301, which remains their top priority as the moving averages pass above this level. Another false break there in the second half of the day will provide an excellent entry point into short positions, counting on the resumption of the bearish momentum observed last month. The news that some EU countries have already imposed quarantine restrictions due to the new coronavirus variant will also put pressure on the euro. Besides, increase in new COVID-19 cases might lead to a larger pair's decline. A key task for the EUR/USD sellers is to regain control of the support at 1.1268, acting as the lower boundary of the sideways channel. Its breakout and the test from the bottom upwards will result in forming a signal to open short positions with the prospect of decreasing to the area of 1.1238. Further target will be a support at 1.1188, where I recommend taking profit. In case the euro rises in the second half of the day and bears show no activity at 1.1301, it is better not to sell. Short positions would be the best scenario if a false break at 1.1332 is formed. It is possible to open short positions at a rebound from the highs of 1.1380 and 1.1442, aiming for the downside correction of 15-20 pips.

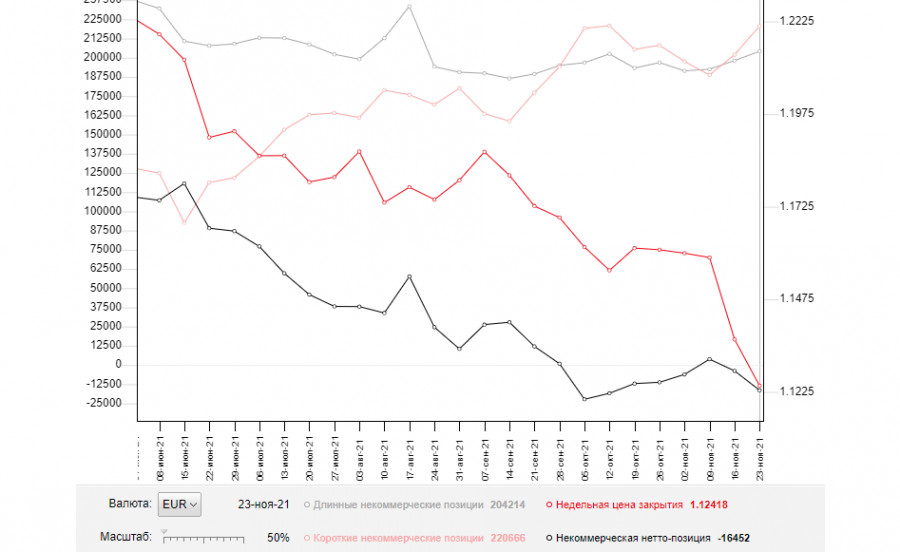

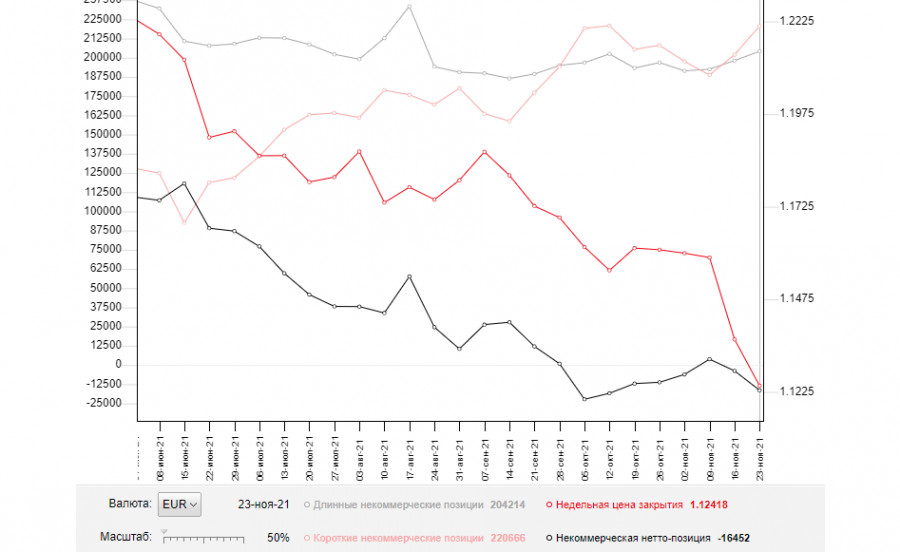

The COT (Commitment of Traders) report for November 23 recorded an increase in both short and long positions. However, the former are numerous, which led to an increase in the negative delta. The euro gained a benefit from the EU manufacturing activity data last week, However, there is further pressure on risky assets. A strong US GDP report and Federal Reserve minutes from its last meeting provided support to the dollar as many traders expect more aggressive monetary policy changes as early as December this year. However, all these prospects may be hindered by the new Omicron COVID-19 variant, widely spreading in the EU and African countries. This variant has not been registered in the US yet, but it is only a matter of time. Euro buyers have to await hawkish pronouncements from EU politicians. They were numerous last week and also provided support to the euro. The latest November COT report showed that long non-commercial positions increased from 198,181 to 204,214, while short non-commercial positions also jumped from 202,007 to 220,666. At the end of the week, the total non-commercial net position increased and totaled -16,452 versus -3,826. The weekly closing price fell to 1.1241 versus 1.1367.

Indicator signals:

Moving averages.

Trading is conducted below the 30 and 50 day moving averages, indicating that the market is sideways.

Note. The period and prices of moving averages are considered by the author on hourly chart H1 and differ from the common definition of classic daily moving averages on daily chart D1.

Bollinger Bands.

A breakout of the indicator's lower boundary at 1.1275 will cause a larger decline in the euro. Breakout of the indicator's upper boundary at 1.1330 will lead to the pair's rise.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. On the chart, it is marked in yellow;

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. On the chart, it is marked in green;

- MACD (Moving Average Convergence/Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20;

- Non-commercial traders are speculators, such as individual traders, hedge funds and large institutions, which use the futures market for speculative purposes and meet certain requirements;

- Long non-commercial positions represent the total long open position of non-commercial traders;

- Short non-commercial positions represent the total short open position of non-commercial traders;

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.