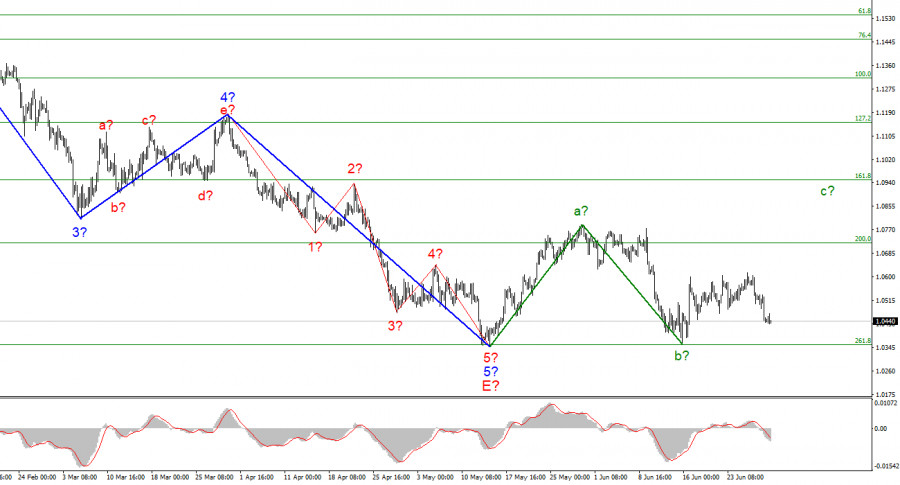

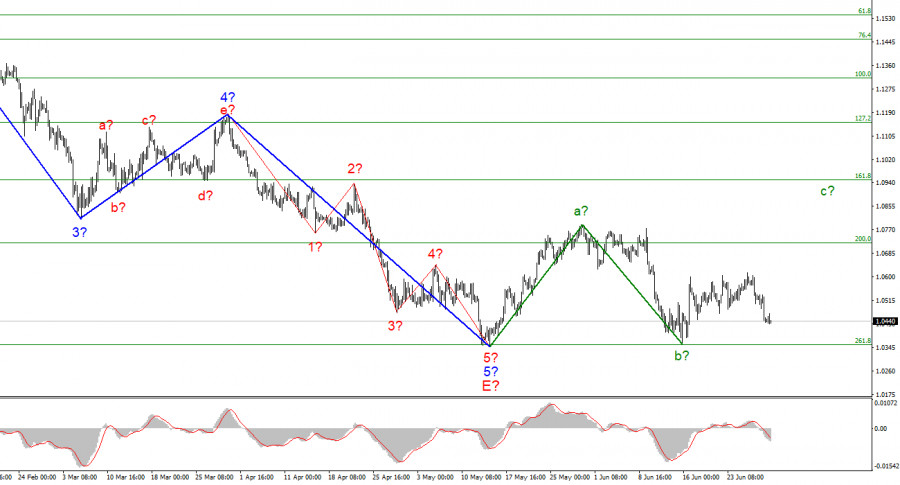

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing and does not require adjustments. The wave pattern has hardly changed in recent weeks, as there has been a small number of movements in the market all this time. I still assume that the instrument has completed the construction of a downward trend segment. If the current wave marking is correct, then the construction of a new upward trend section continues at this time. It can turn out to be three-wave, or it can be pulsed. At the moment, two waves of a new section of the trend are visible. Wave A is completed, and wave b is also presumably completed. If this is indeed the case, then the construction of the ascending wave c is now continuing. The instrument has not decreased under the low of the descending trend section, so the wave marking still retains its integrity. However, I note that the downward section of the trend may complicate its internal wave structure and take a much more extended form. Unfortunately, a very promising wave markup may be broken due to the news background. But at the moment, the chances of building an upward wave c remain. Only the news background can interfere.

Lagarde, who speaks every day, has already bored the market.

The euro/dollar instrument declined by another couple of dozen basis points on Thursday, and each new decline, even the weakest, reduces the chances of building a wave C. The decline of the instrument this week already calls into question the current wave markup. Of course, the wave structure can turn out to be very complex, but still, it does not seem that the market is trying to build an upward wave. I don't want to rush to conclusions before a successful attempt to break through the low waves E and b, but now the wave marking looks as if it will still have to make adjustments.

Christine Lagarde, president of the ECB, has already spoken three times this week and today there will be another of her speeches. Given that demand for the European currency has declined this week, I conclude that Lagarde's speeches and her modest promises to fight inflation did not impress the market. Or the market initially did not attach much importance to Lagarde's speeches at the international economic forum. Anyway, Lagarde made several attempts to convince the market that no one is going to let the inflation situation take its course, but it turned out not particularly convincing.

This week, the market can only wait for the EU inflation report. German inflation fell to 7.6% in June, so there is little hope that European inflation will show at least a minimal slowdown. Germany has always been the locomotive of the European economy, so its statistical indicators are often higher than the pan-European ones. I wouldn't be surprised if Germany becomes an exception to the rule. Meanwhile, the euro is declining even without bad data from the Eurozone. If it turns out tomorrow that inflation has risen again, this may further reduce demand for the euro. And this is unlikely to mean that the ECB will tighten its rhetoric on interest rates.

General conclusions.

Based on the analysis, I conclude that the construction of the downward trend section is completed. If so, then now you can buy a tool with targets located near the estimated mark of 1.0947, which equates to 161.8% Fibonacci, for each MACD signal "up", counting on the construction of wave C. An unsuccessful attempt to break through the level of 261.8% indicates that the market is not ready for stronger sales of the instrument.

On a larger scale, it can be seen that the construction of the proposed wave E has been completed. Thus, the entire downtrend has acquired a complete look. If this is true, then in the future the instrument will rise for several months with targets located near the peak of wave D, that is, to the 15th figure.