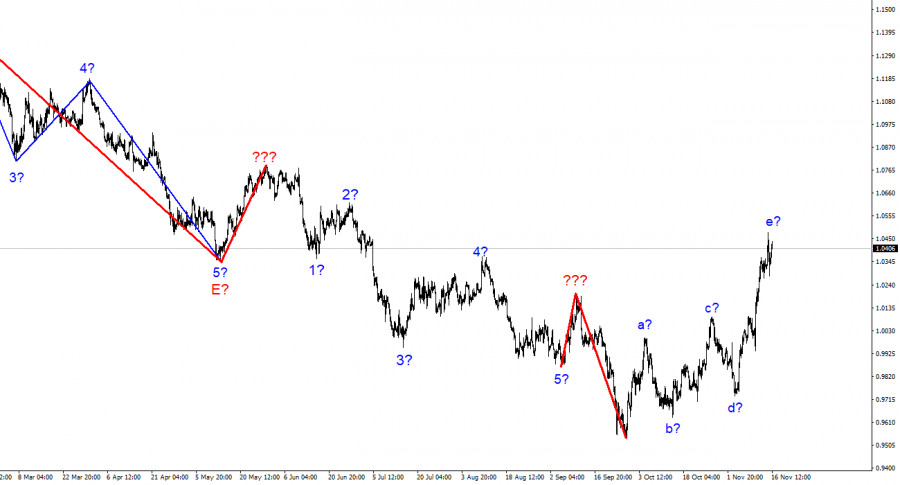

The wave pattern on the 4-hour chart for the instrument euro/dollar has changed. The upward trend section continues to be built and has taken on a more pronounced corrective form. Initially, I assumed there would be three upward waves, but we can now see five. As a result, we obtain a complex corrective structure of waves a-b-c-d-e. If this assumption is correct, the structure's construction could be nearing completion because the peak of wave e exceeds the peak of wave c. In this case, we anticipate at least three waves down, but if the last part of the trend is corrective, the next one will most likely be impulsive. As a result, I am bracing myself for another sharp decline in the instrument. The successful breakthrough of 1.0359, which corresponds to 261.8% Fibonacci, indicates that the previous upward wave is incomplete.

The fact that the wave patterns of the pound and the euro match is crucial. If you recall, I have previously cautioned you about the slim chance that the euro and the pound will trade in opposing directions. Although it is theoretically possible, it happens very infrequently in reality. Both instruments are currently ostensibly developing corrective trend sections, which could soon reach their conclusion. As a result, the GBP may fall within a new downward trend section.

On Friday, the euro/dollar instrument displayed low amplitude movement. There was no news background today, so the instrument is finding it difficult to move away from the peaks reached for the second day in a row. However, at least one corrective wave, ideally three, or an impulsive downward trend section, is in store for us. Given the lack of a news backdrop and the apparent completeness of the five-wave ascending structure, it is difficult to wait for another increase in the European currency.

The dollar's assistance might come from an unexpected source. One of the FOMC members, Mary Daly, suggested that the interest rate could increase by another 100 basis points. We discussed two or three increases totaling 75 to 100 points earlier. Daly did not "discover" America with this message, but her speech contained other intriguing ideas. She stated that the Fed would closely monitor inflation after the rate moves to a range of about 5% and attempt to determine whether the tightening of monetary policy is sufficient for this indicator to continue to decline to 2%.

Additionally, suppose the outcome is unfavorable (inflation may fall slowly or not at all). In that case, the regulator may be forced to postpone one or more rate increases, which the market does not currently expect and does not expect now. And if other FOMC members concur with Mary Daly's statements, the demand for the dollar could rise again. This is the outlook for the dollar over the next few months; we have yet to be interested in this time frame when the Fed might decide to tighten further.

Conclusions in general

The inflation report and the FOMC members' objectivity have caused the construction of the upward trend section to become more complicated, consisting of five waves. However, because the wave marking has yet to suggest a further increase, I cannot recommend purchasing immediately. If there is a successful attempt to break through the 1.0359 level with targets near the estimated level of 0.9994, which corresponds to the 323.6% Fibonacci, I advise selling.

The wave pattern of the downward trend segment noticeably becomes more intricate and lengthens at the higher wave scale. The a-b-c-d-e structure is most likely represented by the five upward waves we observed. After the construction of this section is finished, work on a downward trend section may resume.