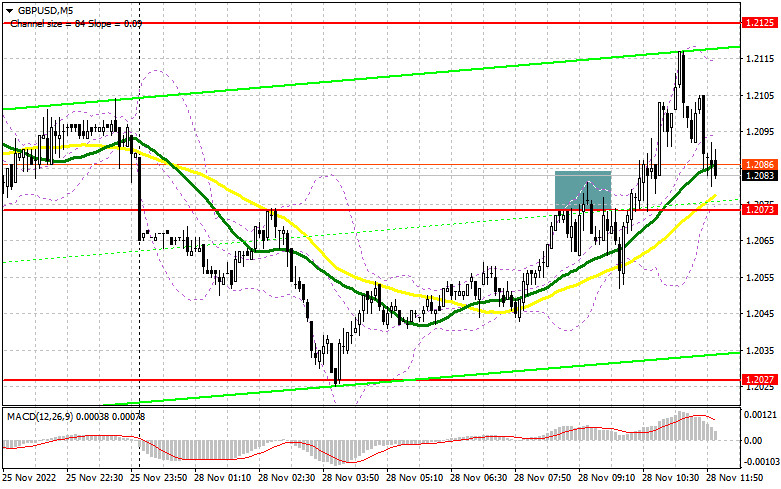

In my morning forecast I pointed out the level of 1.2073 and recommended making market entry decisions with this level in mind. Let us look at the 5-minute chart and see what happened. The pair advanced and performed a false breakout at this level, which created a sell signal in the first half of the day. However, the pound sterling went down by only 20 pips and rebounded afterwards. Bulls broke through the range on the third attempt. I did not review the technical picture for the second half of the day, as I think the pair will stay in the sideways channel. From there, GBP/USD may break above the monthly high.

When to open long positions on GBP/USD:

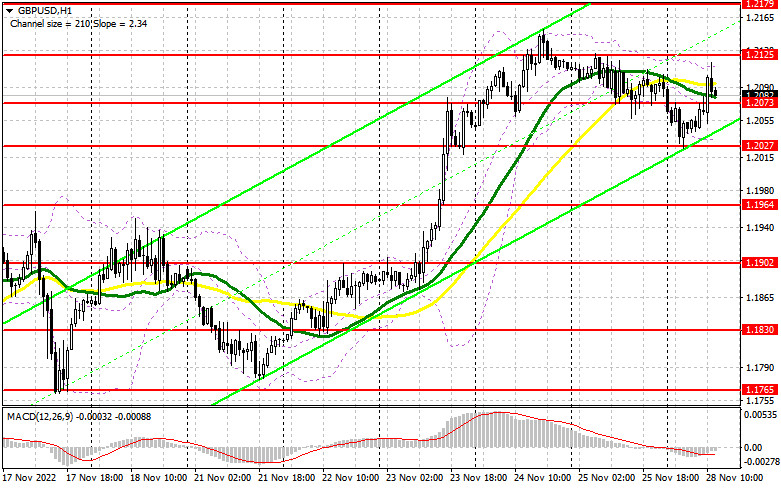

The lack of US statistic data and remarks by Fed officials could all work in favor of GBP bulls, as they will surely talk about the importance of reassessing the pace of aggressive interest rate hikes in December. However it should be noted that not all FOMC policymakers think it would be appropriate to slow down the pace of interest rate hikes at the next meeting. If such a revision is considered, the pound sterling may begin to move upward again. Of course, the best scenario for going long on GBP/USD would be a decline and a false breakout near the support at 1.2073, which served as resistance in the morning. This will create a good entry point for opening long positions, assuming that GBP will reach the high at 1.2125. A breakout and a downward test of this range will create a buy signal for the pound, which might reach 1.2179. The most distant target is the high of 1.2224, where I recommend to take profit. If the bulls fail in the second half of the day and miss 1.2073, there will be more profit taking in the market. In that case I advise to buy only at the support level of 1.2027. You can open long positions on GBP/USD immediately after it bounces from 1.1964 or even 1.1902, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

The efforts of bearish traders at the beginning of the European session fell flat. Bears managed to avoid losses and break even thanks to Stop Loss orders after the pair dropped by more than 20 pips. Nevertheless they failed to make a profit in the first half of the day. The main task of bearish traders during the American session is to hold the nearest resistance at 1.2125, which they did successfully last week. Another false breakout at this level will create a sell signal, which may push the pair back towards 1.2073. A breakout and a downward test of 1.2073 will ruin the bulls' plans, putting pressure on them and creating a sell signal. Afterwards, GBP/USD may decline to 1.2027, where bearish traders might face some difficulties. The most distant target is 1.1964, where I recommend to take profit. If the pair does not slide down from 1.2125, GBP bulls will begin buying the pound sterling again. This may lead to a new surge towards 1.2179. Only a false breakout of this level will create an entry point for opening short positions with a downside target. If bears are idle at this level, you can sell GBP/USD immediately if it bounces off 1.2224, keeping in mind a downward intraday correction of 30-35 pips.

COT report:

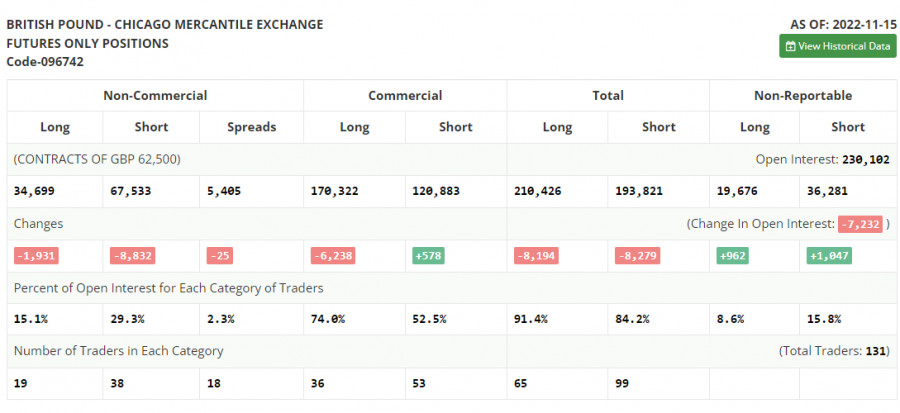

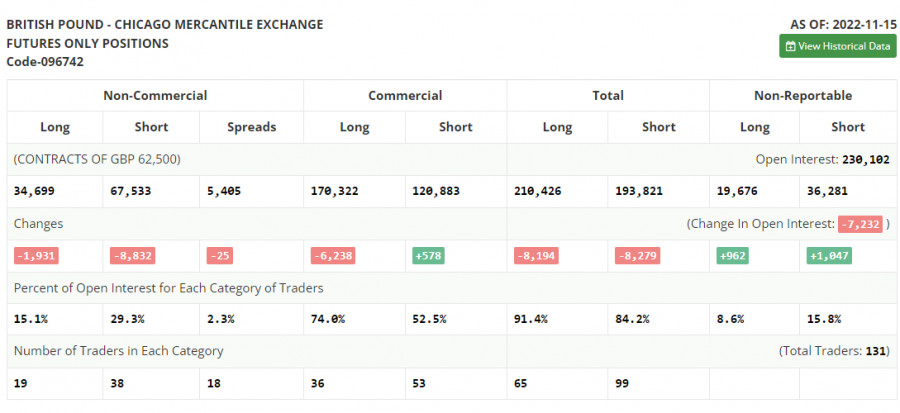

The Commitment of Traders (COT) report for November 15 recorded a decline of both short and long positions. A sharp rise in inflation in the UK was quite unexpected, which definitely affected the Bank of England and its future plans regarding interest rates. Given the situation, the regulator will simply be forced to further pursue an ultra-aggressive policy, which will keep the demand for the pound and allow it to strengthen against the U.S. dollar. But these problems in the UK economy, which were confirmed by the recent GDP data, are unlikely to lure the big market players, who seriously believe that a long-term recovery of the pound sterling is on the way. Furthermore, the Federal Reserve also maintains its monetary tightening policy to fight inflation, which also discourages going long on GBP/USD in the medium term. The latest COT report showed that long non-commercial positions declined by 1,931 to 34,699, while short non-commercials fell by 8,832 to 67,533, further lowering the negative non-commercial net position to -32,834 from -39,735 a week earlier. The weekly closing price rose to 1.1885 from 1.1549.

Indicators' signals:

Moving averages

Trading is carried out near the 30-day and 50-day moving averages, which indicates that the pair is in a sideways trend.

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD moves down, the indicator's lower boundary at 1.2027 will serve as support.

Description of indicators

• Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

• Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

• MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

• Bollinger Bands (Bollinger Bands). Period 20

• Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• Total non-commercial net position is the difference between the short and long positions of non-commercial traders.