Hysteria continues in the markets due to the appearance of a new strain of COVID-19, which has been named "Omicron". Investors are so intimidated, continuing to be nervous, that this causes a strong increase in volatility in all markets.

What is going on and what can Omicron really threaten for the growth of the global economy and, accordingly, for currency markets?

It is important to understand the reason for the high level of nervousness in the markets is investors' awareness of the fact that the high ability of COVID-19 to various mutations can lead to the fact that the pandemic will really drag on for many years. In these conditions, the normal growth of the world economy should be forgotten. In addition, this whole picture is aggravated by the systemic crisis, primarily in the West, where at one time countries practically destroyed their national production and are completely dependent on imports primarily from the countries of the Asian region.

Another most important negative factor arising from the two above is the growth of inflation in the wake of falling world production, which already signals stagflation, a process characterized by high inflation or even hyperinflation in the wake of stagnation in the economy. And the last of the major reasons that stimulate high volatility and the almost hysterical state of the markets is the expected change in the monetary policy of the world Central banks, starting with the Fed. That's why we see such a picture in the financial markets.

The topic mentioned earlier on the high probability of an earlier increase in interest rates can also be noted, which seems is beginning to acquire a clear picture. Yesterday, Fed Chairman J. Powell said at the Senate Banking Committee that the regulator could speed up the process of winding down stimulus measures and reduce the volume of asset repurchases not by $ 15 billion per month, but a much larger volume. In this case, as we thought, the bank can really start the process of raising interest rates without even waiting for the termination of the QE program already in the first quarter of the new 2022.

What should be expected in the markets in the near future?

We believe that the continued pressure of the topic of the new COVID-19 strain of Omicron will cause demand for protective assets – government bonds of economically developed countries, safe-haven currencies, the yen, and the franc, while the US dollar is likely to remain under pressure for some time, and only the designation of the actual timing of the first rate hike will support its rate. The stock markets will soon be in an extremely excited state, which will be supported, on the one hand, by the "Omicron" topic, and on the other, by the expectation of an earlier start of rate hikes in America, and then in other economically developed countries.

Moreover, we believe that only a softening of the news pressure from the new COVID-19 strain can lead to a local Christmas rally in the stock markets. But as they say, everything is in the hands of God and medicine.

Today, the markets are hoping for the release of strong data in the US on the number of new jobs from ADP. The US economy is expected to have received 525,000 in November. If the values do not disappoint and even go above the consensus forecast, this may lead to growth in the stock markets and to a limited weakening of the US dollar after its market goes up with a simultaneous local sale of protective assets.

Forecast of the day:

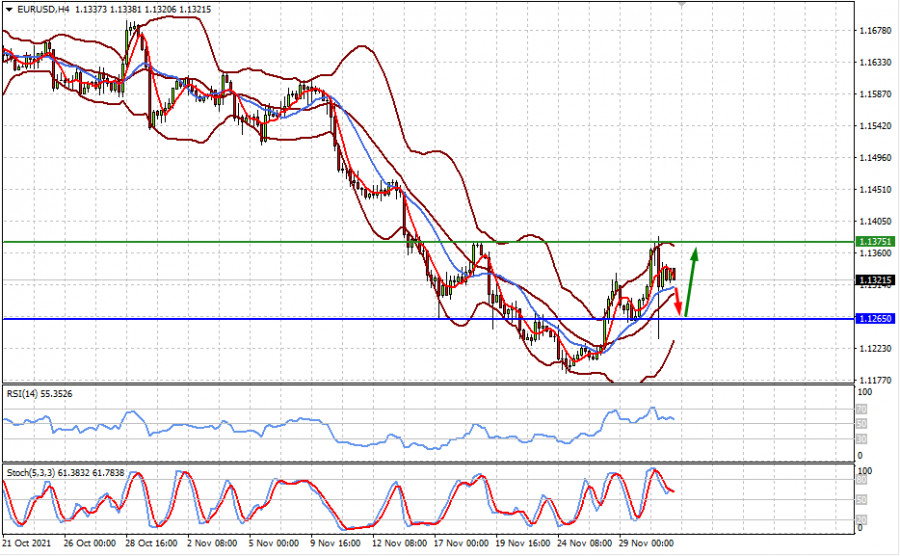

The EUR/USD pair may show significant volatility today if ADP data turns out to be above the consensus forecast. In view of this, the price may first decline to the level of 1.1265, and then try to rise to 1.1375 again.

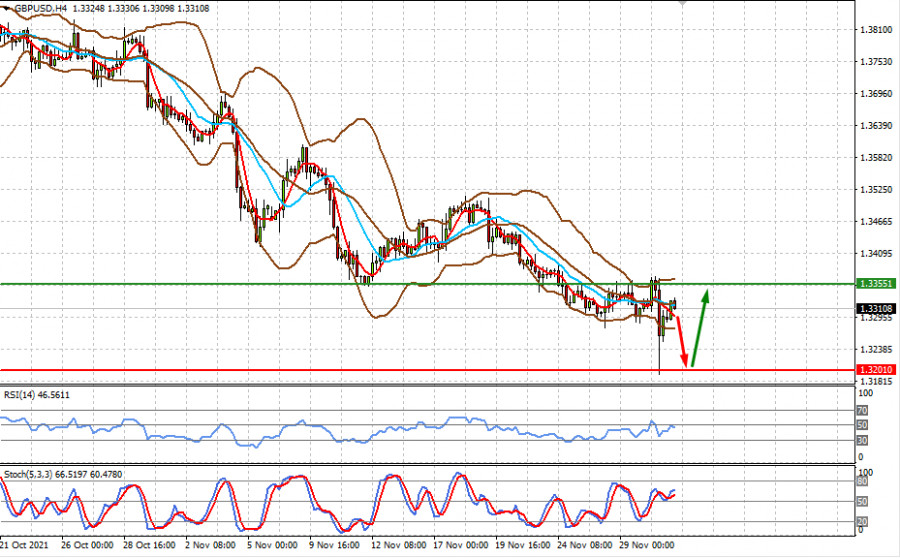

The GBP/USD pair can also react to the US data, as well as the EUR/USD pair. In this case, it may first fall to the level of 1.3200 and then recover to 1.3355.