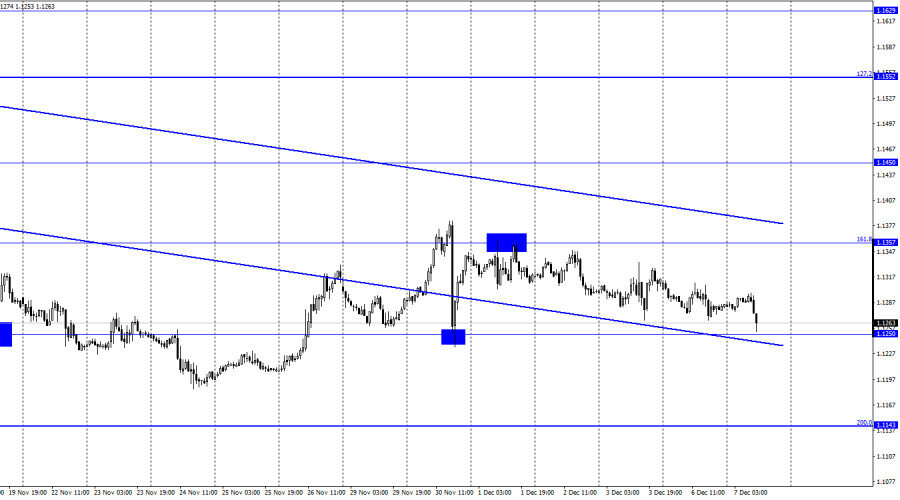

EUR/USD – 1H.

Hello, dear traders! The EUR/USD pair declined slightly on Monday. However, it started after the rebound from the 161.8% correction level at 1.1357. Besides, this morning the quotes already fell to 1.1250, which I mentioned as a target. The pair's rebound from 1.1250 will favour the euro and its rise towards 1.1357. The pair's fixation under 1.1250 will increase the probability of the further decline towards the next Fibo level of 200.0% at 1.1143. At the moment, the pair is still moving within the descending trend corridor, indicating the current traders' bearish sentiment. At the beginning of the new week the information background was and is quite weak. Yesterday, there was no news and reports. Today, the EU GDP report for the third quarter will be released. However, I do not think traders will immediately start analyzing it as two estimates of the same report were already published earlier.

First, the value +2.0% q/q and then +2.2% q/q was released. Therefore, today, the EU economy may be overvalued in the third quarter. However, it is unlikely to be favourable for the euro. Ahead of issuing this report, traders were selling the EU currency again. Thus, traders' sentiment remains bearish. Hardly any report or event can prevent further downfall of the quotes. Only on Friday, the key report on US inflation will be released, but Friday is yet to come. Next week, the Fed will sum up the results of its meeting. Besides, it is quite possible that the decision to cut the QE program by $20 billion or $30 billion will be taken and pronounced as the US inflation rate continues to grow at a very high rate. This Friday, it may become known that the consumer price index surged to almost 7% in November. These figures have not been observed in the US for 30 years. Moreover, amid this data the US dollar may further rise, as the higher inflation, the more likely it is that the Federal Reserve will tighten its monetary policy.

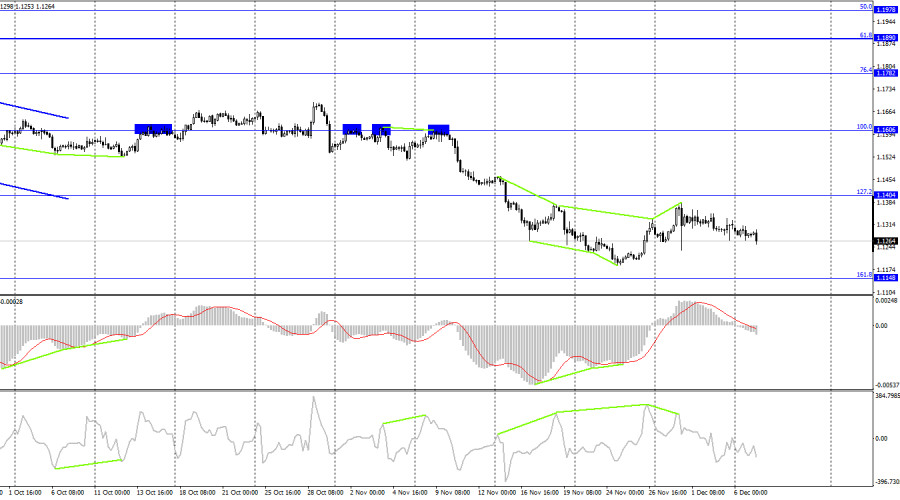

EUR/USD – 4H

On the 4-hour chart, the pair continues to decline towards the 161.8% correctional level at 1.1148 after a bearish divergence in the CCI indicator was formed. At the moment, the fall is weak and there are no new emerging divergences in any indicator. The pair's consolidation above the 127.2% level at 1.1404 will work in favor of the EU currency and it will start rising again towards the 100.0% correction level at 1.1606.

US and EU economic news calendar:

EU - ZEW Institute Business Sentiment Index (10-00 UTC).

EU - GDP volume change (10-00 UTC).

On December 7, the US economic calendar lacks events. In the EU, apart from the GDP report, a business sentiment index will be released at the same time. However, it is also unlikely to cause traders' reaction. Therefore, the influence of the information background will be very weak today.

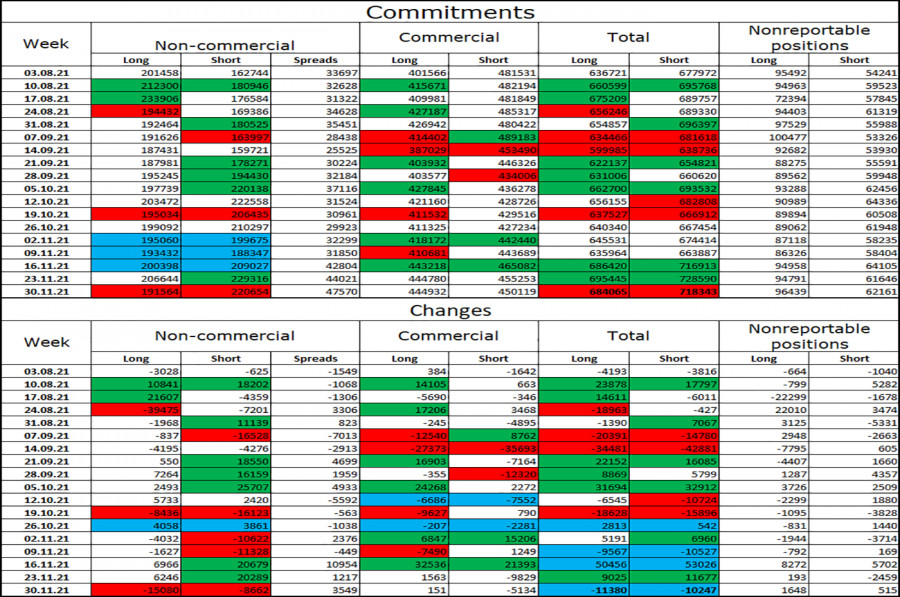

COT (Commitments of traders) report:

The new COT report showed that during the reporting week the sentiment of non-commercial traders was more bearish again. However, this time speculators did not build up short contracts, but closed both categories of contracts. However, long contracts were closed in large volumes. In total, 15,080 ong euro contracts and 8,662 short contracts were closed. Thus, the total number of long contracts has decreased to 191,000, while the total number of short contracts has fallen to 220,000. Therefore, bearish sentiment of the most significant category of traders continues to strengthen. Consequently, the EU currency may resume its decline in the near future. According to the COT reports, there are no signs of possible euro's long-term growth so far.

EUR/USD outlook and recommendations for traders:

Selling of the pair could be opened at the rebound from 1.1357 on the hour chart with the target of 1.1250. This target has now been worked out. New sales are possible at closing under 1.1250 with the target of 1.1143. I recommend buying the euro at the rebound from 1.1250 on the hourly chart with the target of 1.1357.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for ensuring current activities or export-import operations.

"Non-reportable positions" - small traders who have no significant influence on the price.