The yield of 10-year US Treasuries (UST) continues to rise and reach 1.88% overnight, which is the highest level since the end of 2019. Apparently, there is a massive reassessment of the Fed's future actions towards the rate hike. According to CME, the likelihood that the Fed will raise the rate this year four times has already reached 60%. Moreover, the forecast for 2023 has also been raised by a number of banks to four increases. At the same time, it is noted that the risk lies not in a smaller, but in a larger number of rate increases.

Such forecasts suggest an extremely bullish scenario for the US dollar and defensive currencies. The start of the Fed's balance sheet cut is now expected in September, which also supports the bullish mood.

At the same time, the growth of March futures for Brent oil to 89 dollars per barrel contributes to the growth of demand for risk, although its nature is still unclear. Formally, it is associated with an explosion on an oil pipeline from Iraq to Turkey, as well as with a low rate of recovery of production from OPEC+. Even the threat of a reduction in the flow of liquidity does not reduce the excitement.

The US dollar is unlikely to move sharply before the Fed meeting. Trading in the range is more likely.

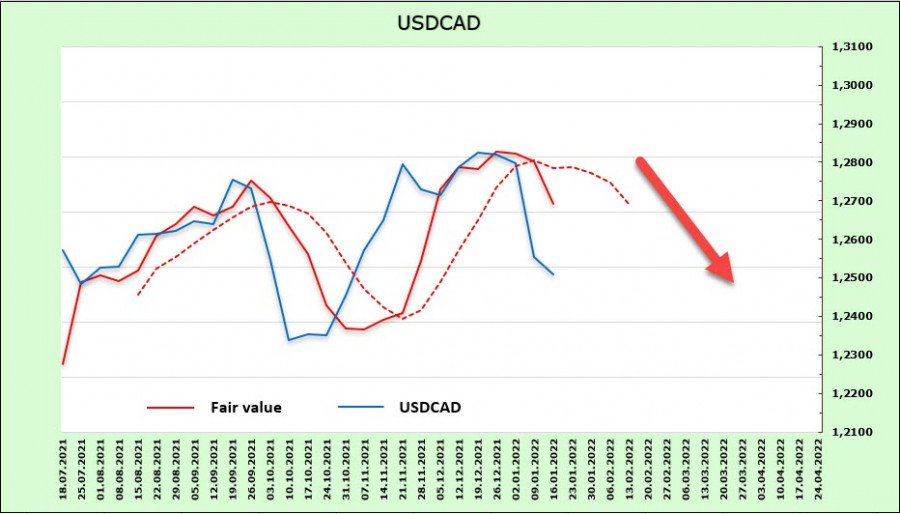

USD/CAD

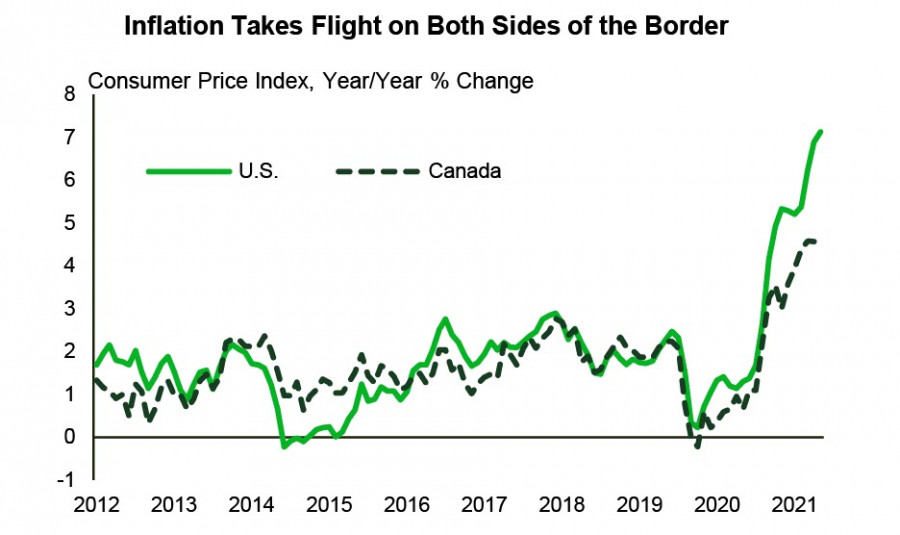

All attention today is focused on the inflation report in December. Until recently, the Canadian inflation index, although growing, still lagged behind the pace of the United States, which gave the Bank of Canada a little extra room for maneuver, which will hold its meeting in 2 weeks.

Nevertheless, the 2% target has already been significantly exceeded, +4.8% is expected in December. Inflation expectations are growing rapidly.

Another reason that may force the Bank of Canada to immediately start raising rates is the strong tension in the housing market. In a recent study, the Bank of Canada found that the era of minimum mortgage rates has led to a sharp increase in housing prices, which reduces its affordability.

As follows from the CFTC report, the short position of the Canadian dollar continues to decline, albeit slowly. It fell by 281 million to -587 million over the week. The accumulated advantage is still in favor of the US dollar, but the dynamics for the Canadian one are clearly positive, not only by high oil prices but also by the dynamics of profitability. Canada's 10-year GKOs reached 1.9%. US Treasury yields are slightly behind even amid tougher rhetoric from Fed members and general market expectations on rate dynamics. The settlement price is confidently directed downwards.

The USD/CAD pair broke through the support level of 1.2550/70 and formed a new local bottom at 1.2454, which exactly corresponds to the lower border of the channel. Technically, an upward pullback is quite likely, but based on the combination of fundamental factors, it can still be assumed that there will be an attempt to break down with the target of 1.2280.

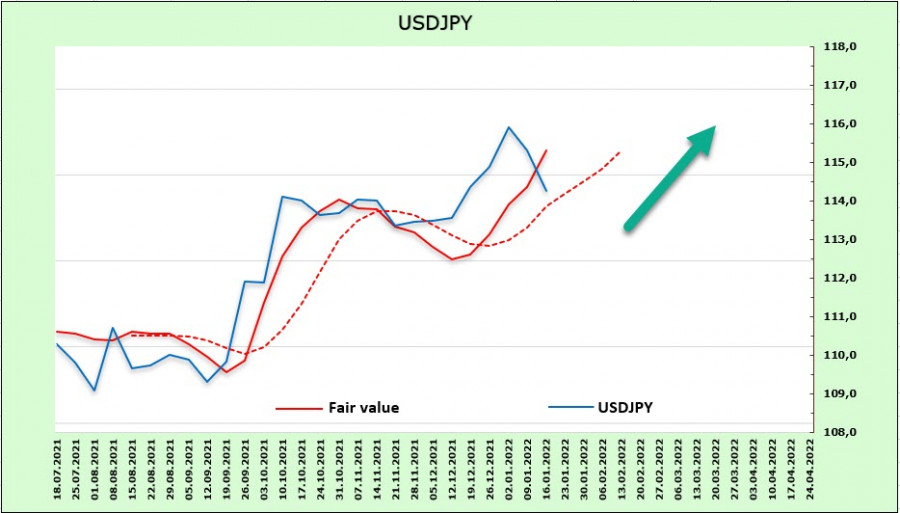

USD/JPY

The Bank of Japan completed a two-day meeting on January 18, at which it expectedly left all parameters of monetary policy unchanged. The median underlying CPI forecast for most policy council members has been slightly revised upwards to +1.1% in both the 2022 and 2023 fiscal years. These figures mean that the price stability goal of 2% remains unattainable, and excludes an exit from QQE.

It seems that the Bank of Japan does not believe in current inflation and considers it a derivative of oil and other energy prices, and even reaching the 2% target is inclined to be considered as a temporary surge. In fact, BoJ will be the last one to continue QE even when the whole world refuses such stimulation. This means continuous and fundamental pressure on the yen, especially if fears about COVID-19 begin to fade.

The net short position on the yen increased by 2.789 billion during the reporting week, which is a very strong redistribution in favor of further weakening of the yen. The bearish advantage reached -9.489 billion. Apparently, expectations of an exit from the COVID-19 pandemic outweigh all other factors. The USD/JPY remains in a steady upward trend.

The Japanese yen has been correcting over the past week, but a downward pullback does not change the general mood. It can be assumed that growth can resume anytime. The target is still 118.60.