To open long positions on GBP/USD, you need:

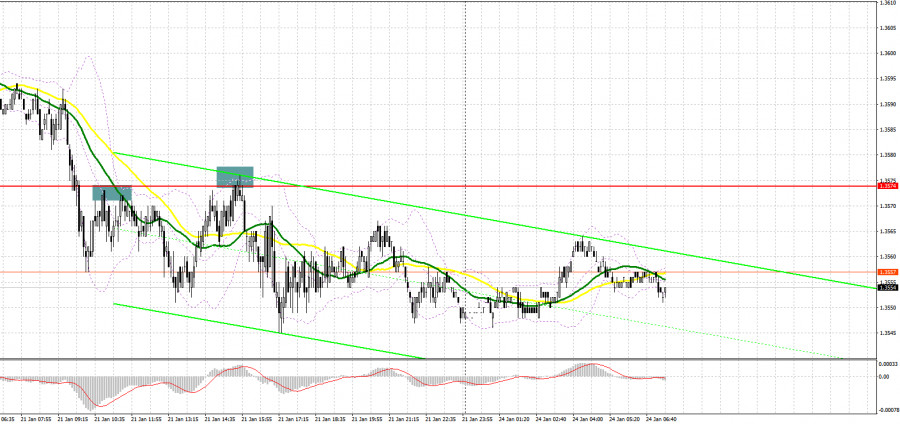

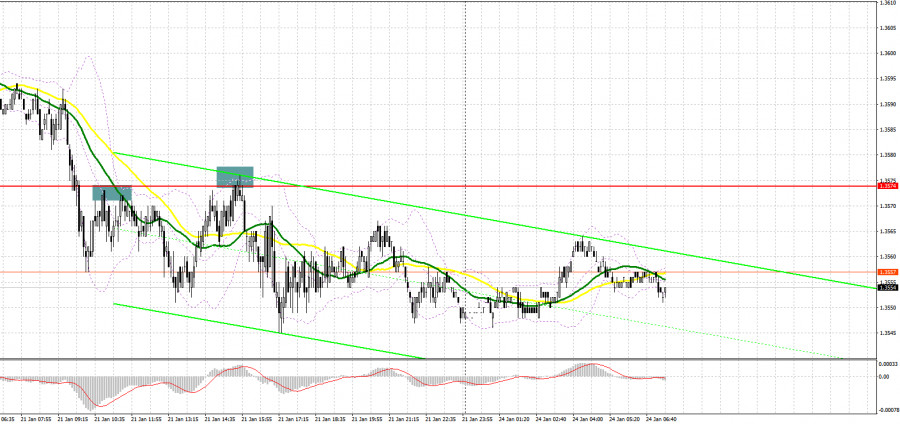

Last Friday, several signals were formed to enter the market. Let's take a look at the 5-minute chart and figure out the entry points. In the first half of the day, I paid attention to the level of 1.3574 and advised you to make decisions on entering the market from it. Crossing this range immediately after disappointing retail sales data in the UK, and then the reverse test of this area from the bottom up had resulted in forming a sell signal for GBP/USD. As a result, the first drop was about 25 points. In the second half of the day, an unsuccessful attempt by bulls to rise above 1.3574 and forming a false breakout had created another entry point into short positions. As a result, the pair dropped 30 points.

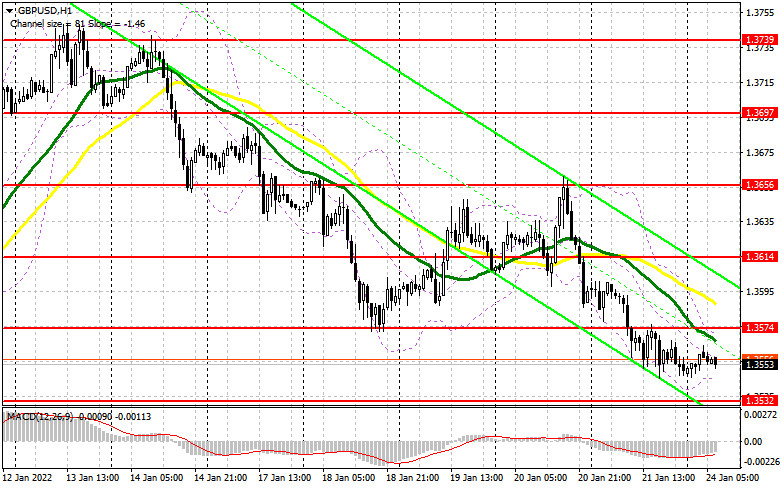

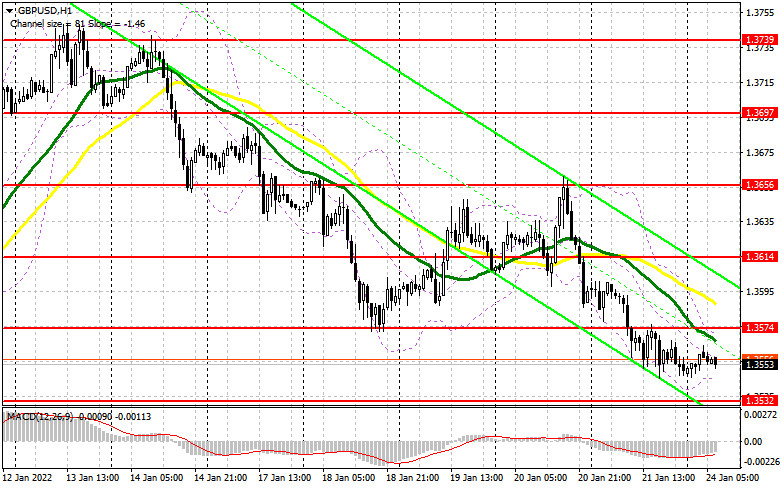

Trading continues to be conducted below the level of 1.3574, which creates a number of difficulties for bulls on the British pound. Quite a lot will depend on today's fundamental statistics, which bulls have a lot of hopes for. An important task for the day is to protect the support of 1.3532 – having missed it, you can say goodbye to the pound's growth in the short term. A false breakout at this level, along with strong data on the index of business activity in the manufacturing sector, the index of business activity in the services sector and the composite index of the UK PMI – all this creates the first buy signal with the prospect of recovery to the area of 1.3574, where the moving averages are playing on the bears' side. Only a breakthrough and a test of this level from top to bottom can provide an additional entry point into long positions in order to return to the high of 1.3614. A more difficult task is the test of the 1.3656 area, where I recommend taking profits. In case GBP/USD falls during the European session against the background of weak data and lack of activity at 1.3532, and judging by what is happening on the market now, it is better not to rush with long positions on risky assets, I advise you to wait for the test of the next major level of 1.3496. Forming a false breakout there will provide an entry point into long positions. You can buy the pound immediately on a rebound from 1.3461, or even lower - from a low like 1.3431, counting on a correction of 20-25 points within the day.

To open short positions on GBP/USD, you need:

Bears kept the market under their control on Friday afternoon, confidently defending the resistance of 1.3574. They need to focus on it again today. The primary task for today is to protect the 1.3574 level. Forming a false breakout there creates the first entry point into short positions, followed by a decline to the area of 1.3532, where bulls are unlikely to give a serious rebuff. Weak data on the UK, namely on activity in the services sector, as well as taking control of this level – all this will provide a new entry point into short positions in hopes of a succeeding decline in GBP/USD by 1.3496 and 1.3461, where I recommend taking profits. If the pair grows during the European session and bears are weak at 1.3574, it is best to postpone short positions to the intermediate resistance of 1.3614. I also advise you to open short positions there only in case of a false breakout. You can sell GBP/USD immediately for a rebound from 1.3656, or even higher - from this month's high in the area of 1.3697, counting on the pair's rebound down by 20-25 points within the day.

I recommend for review:

The Commitment of Traders (COT) reports for January 11 revealed that long positions had increased while short positions decreased - which indicates the pound's appeal after the Bank of England raised interest rates at the end of 2021. If you look at the overall picture, the prospects for the British pound look pretty good, and the observed downward correction makes it more attractive. The BoE's decisions continue to support buyers of risky assets in the expectation that the central bank will continue to raise interest rates this year, which will push the pound even higher. High inflation is still the main reason why the BoE will continue to tighten monetary policy. Last week, Federal Reserve Chairman Jerome Powell said that he would not shape events and rush to raise interest rates, especially in view of the sharp decline in retail sales in December 2021, which should cool down inflationary pressure a little. This led to a decrease in demand for the US dollar, which will allow pound bulls to continue building an upward trend. The COT report for January 11 indicated that long non-commercial positions increased from the level of 25,980 to the level of 30,506, while short non-commercial positions decreased from the level of 65,151 to the level of 59,672. This led to a change in the negative non-commercial net position from -39,171 to -29,166. The weekly closing price rose from 1.3482 to 13579.

Indicator signals:

Trading is conducted below the 30 and 50 moving averages, which indicates the continuation of the bear market.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the upper limit of the indicator around 1.3574 will act as resistance. A breakthrough of the lower limit of the indicator in the area of 1.3540 will lead to a new wave of decline in the pound.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.